Ultimate Stock-Pickers: Top 10 High-Conviction and New-Money Purchases

Several funds take a dive into GE as industrials receive some attention this quarter along with General Motors.

By Eric Compton | Equity Analyst

For the past nine years, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that not only reflect the most recent transactions of our grouping of top investment managers but are also timely enough for investors to get some value from them. In cross-checking the most current valuation work and opinions of Morningstar's own cadre of stock analysts against the actions (or inactions) of some of the best equity managers in the business, we hope to uncover a few good ideas each quarter that investors can dig into a bit deeper to see if they warrant an investment.

With all but two (24 out of 26) of our Ultimate Stock-Pickers having reported their holdings for the second quarter of 2018, we now have a good sense of what stocks piqued their interest during the period.

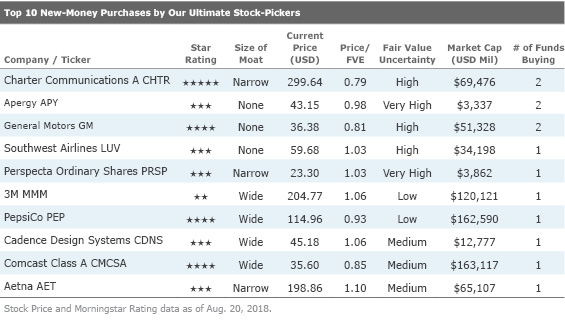

Recall that when we look at the buying activity of our Ultimate Stock-Pickers, we focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the size of the portfolio. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We also recognize that the decision to purchase any of the securities highlighted in this article could have been made as early as the start of April, with the prices paid by our managers being much different from today's trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on myriad factors, including our valuation estimates and our moat, stewardship, and uncertainty ratings.

Looking more closely at the top 10 high-conviction purchases during the second quarter of 2018, the buying activity was similarly diversified compared with last quarter, with most bets seeming to be name specific rather than broad industry bets. No one industry classification captured more than two stocks. The two names that stuck out to us from this list based on valuation were

- source: Morningstar Analysts

Once again, there was a moderate amount of crossover between our top-10 lists this period, with six names on both lists. There were three names with at least two funds initiating new-money purchases this quarter, compared with four last quarter. In addition to the names already mentioned,

- source: Morningstar Analysts

From a valuation perspective, narrow-moat General Electric was one of the most attractive to make our top 10 lists. This stock has been in the news quite a bit over the last several months—and not always for the best reasons. Morningstar analyst Joshua Aguilar believes shares have been beaten down too much and now offer an acceptable margin of safety.

General Electric is a massive industrial conglomerate that has operated in a variety of industrial businesses. GE has historically been a symbol of American ingenuity, but recent management teams under Jack Welch and Jeff Immelt detracted from shareholder wealth by overpaying for business combinations and by engaging in risky financial engineering in GE Capital. Today, the company is paying the penance for the risks incurred, as it was forced to cut its dividend in half in late 2017, reduce guidance all around, and is now in the process of right-sizing itself by selling off noncore assets and refocusing on its aviation, power, and renewable energy segments. Overall, the company has unquestionably been a mess for the last year and a half. However, often where there is the most uncertainty, there is also the most opportunity.

General Electric currently trades at a 22% discount to Morningstar analyst Joshua Aguilar's fair value estimate. While Aguilar agrees that much of the sell-off over the last year and a half has been justified given the very real negative developments for GE, Aguilar argues that the continued sell-off over the last several weeks is starting to appear to go too far. Shares responded quite negatively when reports surfaced that the company was trying to sell a power conversion division known as Converteam at a steep discount to the division's acquisition price, roughly 50% less than what GE paid for the unit in 2011. The news did not surprise Aguilar, as he largely expects GE to have to sell its underperforming units for less than what was historically paid. He estimates that at a minimum, 80% of GE's acquisitions under Immelt were value-destructive, i.e. GE paid too much for them.

While there is no saying when the current pain for GE shareholders will end, Aguilar argues that the company's breakup value provides a margin of safety. He also believes the expected sale of the wide-moat healthcare division will allow GE to overcome its struggles with liquidity and outstanding liabilities. Aguilar contends that the breakup value of the company provides a margin of safety against the company's underfunded debt, accrued expenses, and other liabilities. Aguilar estimated that the wide-moat aviation and healthcare sub-businesses would together be worth around $101 billion ($11.57 per share) net of underfunded liabilities and obligations to an informed private market buyer. When buying a share of GE at the current market price of $12.31, an investor is also purchasing a portion of the subsidiaries. Aguilar calculates the enterprise value of GE's Baker Hughes subsidiary to be $2.87 per share, so investors would essentially get a portion of the remaining power, renewable energy, transportation, and lighting businesses for free at current prices. Although Aguilar sees most of GE's value in the moaty aviation and healthcare services divisions, he also believes that the value of most of the other (non-GE Capital) businesses is greater than zero, so the breakup value alone provides investors with some cushion.

Aguilar argues that the planned sale of one of its wide-moat sub businesses, GE Healthcare, will allow it to increase liquidity and paydown liabilities. General Electric's June 2018 8-K filing explained that the company expects to separate healthcare into a separate company within 12-18 months following the filing. General Electric expects to use the disposition to turn about 20% of its interest in GE Healthcare into cash, and GE shareholders would receive the balance through a tax-free distribution. The sale is part of a plan to subdue the credit rating agencies' solvency concerns. The agencies indicated that they would downgrade GE's credit rating if the company cannot bring its net debt to EBITDA to 2.5 times by 2020. Aguilar expects GE to use funds from the healthcare sale to pay off some of its liabilities, which he sees as progress toward the goal of maintaining the credit rating. Aguilar concludes that GE's remaining business is strong enough to keep paying a smaller dividend, reinvest in its businesses, and pay down the debt enough to meet the 2020 goal.

If investors can look past the mess that GE has been over the last year and a half and get comfortable with the risks at play, GE may be worth a further look.

The second most compelling bargain to make our lists--and also covered by an analyst--was no-moat rated General Motors. We don't often see car manufacturers on our lists, and GM offers a fairly unique story of a compelling turnaround now thwarted by tariffs and politics.

GM has a storied history as one of the largest and most successful U.S. car manufacturers. The company owns brands such as Buick, Cadillac, Chevrolet, and GMC. Times have not always been good for the firm, and GM has certainly come a long way since the financial crisis, when it was what Morningstar analyst Dave Whiston refers to as, "Old GM." Due to the pressure from the financial crisis, old GM (General Motors Corporation) had to file for bankruptcy and ultimately received funding from the United States government via the TARP program as the firm navigated its financial difficulties. After emerging from these woes, new GM has been on the comeback trail, reorganizing and revamping its operations.

The difference between the old and new GMs is the first part of Whiston's bullish thesis on GM. He cites key metrics in support of his views, including the differences between hourly labor costs (now lower), hourly headcount (now lower), the required market share for GM's U.S. operations to break even (now ~17% versus ~25% previously), and the amount of debt and pension obligations outstanding (now much lower). This puts the new GM in a much healthier financial position and stronger operational position, where the firm can remain more resilient during the next downturn, won't have to slash capital expenditures as much, and is at much less of a risk of financial stress. Further, because the firm is so much more efficient, it is more profitable during normal economic times, as well.

While the firm has made admirable strides over the last several years to improve operations, Whiston believes more room for improvement remains. GM is still in the middle of consolidating internal production platforms and making its "vehicle sets" more efficient. These steps will continue to play out through 2025, a long-term story indeed, given how long it takes for such a large firm to make these wide-ranging changes. Even though it will take time, these efforts will allow GM to spread development costs over far more units, enabling even more efficiencies. The better optimized vehicle sets would also give GM more flexibility in shifting production to meet changing consumer tastes between various car and larger vehicle models. Improving supplier relations is yet another piece to the improving margin and efficiency puzzle for GM, which Whiston highlights more extensively in his research. Needless to say, the improvement story is far from over for GM's operations. Whiston also likes the shorter-term production story. GM is timing many of its lineup rollouts very well, as the firm emphasizes more crossovers, pickups, and SUVs, just as these vehicle types are becoming ever more popular among the American public.

While we have laid out the positives for GM, the negatives have been piling up recently, largely due to factors beyond management's control. These include tariffs from trade wars and currency devaluations in Argentina and Brazil compared with the dollar. Tariffs have simply increased the cost of key production inputs, namely steel and aluminum, and currency devaluations hurt relative revenue even as certain input expenses remain steady. These items hit second-quarter 2018 earnings hard, causing a reduction in guidance and in Whiston's fair value estimate. Whiston also notes that NAFTA negotiations may turn into another headwind for GM, and he thinks that U.S. auto sales have already peaked, which is likely to give investors hesitation to buy GM stock now. With more vehicles coming off leases, this draws some consumers to a used vehicle over a new one. Finally, there is risk of anti-U.S. sentiment in China impacting GM's Chinese business, as well. While Whiston still likes the long-term outlook for GM operationally, these risks and headwinds are certainly worth considering, and Whiston has factored them in by raising his estimated weighted average cost of capital for the firm. Whiston is also factoring in a legal settlement reserve of $5 billion to cover future settlements from the ignition switch recall.

Even with these risks in mind, the stock still looks attractive to Whiston, as it trades at nearly a 20% discount to his fair value estimate of $45. In summary, GM now makes products that consumers are willing to pay more for than in the past, and no longer has to overproduce in an attempt to cover high labor costs and then dump cars into rental fleets (which hurts residual values). GM now operates in a demand-pull model where it can produce only to meet demand, is structured to do no worse than break even at the bottom of an economic cycle. The result has been higher profits despite lower U.S. market share. GM has also embraced the opportunity of ride-sharing and ride-hailing. Whiston thinks actions such as a 9% investment in Lyft for $500 million, buying Cruise Automation, and unifying GM’s legacy car-sharing activities under the Maven brand, along with GM’s connectivity and data-gathering via OnStar, position GM well for this new era. The company expects to start autonomous ride hailing at scale in 2019. Given all these factors, GM may warrant further due diligence from investors.

No discussion would be complete without looking at what

Finally, we'll also give a brief update on Comcast. Comcast is currently trading at a 15% discount to Morningstar analyst Neil Macker's $42 fair value estimate. Comcast was profiled extensively in our last article, when it was trading at a 19% discount and before the drama over certain

If you're interested in receiving email alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: As of the publication of this article, Burkett Huey has an ownership interest in GE. Eric Compton has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)