Liquid Alternatives Have Yet to Prove They Belong in Portfolios

A framework for evaluating the diversification benefits an alternative mutual fund might confer to a traditional portfolio.

To determine whether an alternative mutual fund will add value to a portfolio, one must look beyond absolute returns. In this article, we present a more-robust approach to evaluating an alternative fund that considers any potential diversification benefits it might confer to a traditional portfolio. Using this framework, we find that most liquid alternative funds have failed to add value to traditional portfolios.

Key Takeaways Though still relatively new, few alternative mutual funds have conferred meaningful diversification benefits in recent years.

The past five years has been one of the worst periods for alternative strategies since 1983.

Alternative strategies' recent struggles appear to owe to rising correlations to stocks and bonds; in addition, the traditional 60% stocks/40% bonds allocation has been tough to beat.

Introduction In this article we present a framework for evaluating a liquid alternative mutual fund beyond risk and return, to consider the diversification benefits it confers. This framework builds on the Morningstar Style Box for Alternatives, which visually depicts alternative strategies based on their correlation to broad market returns and relative volatility. This article takes the concept one step further by incorporating a given fund's correlation and risk-adjusted returns into a construct that can be used to determine whether it would enhance a traditional portfolio of stocks and bonds, if added.

A Better Way to Judge an Alternative Fund's Performance Modern portfolio theory holds that an investor should seek to maximize return for a given level of risk, defined as volatility, or minimize risk for the same unit of return. Building on that concept, we can evaluate a given liquid alternative fund's potential utility by assessing whether it will improve a portfolio's future risk-adjusted return. Specifically, if a liquid alternative fund's expected Sharpe ratio exceeds the portfolio's expected Sharpe ratio multiplied by the forecast correlation between the two, then adding the alternative to the allocation would be expected to improve its future risk-adjusted returns.

This equation shows that the lower an alternative fund's expected correlation to the existing baseline portfolio, the lower its future expected risk-adjusted returns could be while still improving the overall portfolio's risk-adjusted performance, and vice versa.

Putting Alternatives to the Test While we don't presume to forecast expected returns and covariances, we can apply this formula retrospectively to test whether alternative strategies would have enhanced a hypothetical portfolio.

For the test, we used a hypothetical portfolio with the following allocations:

60% equity

45% U.S. Equity (S&P 500)

15% International Equity (MSCI EAFE Index)

40% fixed-income

35% U.S. Investment-Grade (Bloomberg Barclays US Aggregate Bond Index)

5% U.S. Non-Investment-Grade (Bloomberg US High Yield 2% Issuer Cap Index)

We assumed the portfolio allocations were rebalanced back to the target monthly.

For purposes of the test, we focused on the three- and five-year periods ending December 2017. (Too few alternatives funds existed prior to 2012 to form a reasonable sample size.) To facilitate comparison, we also included some other fund categories (nontraditional bond, tactical allocation, and commodities) that are also sometimes touted for their diversification potential.

One limitation of the formula is that it is binary. An alternative fund would have either improved the starting portfolio's efficiency or not. To estimate the best-case scenario, we used an optimizer to infer the portfolio mix that would have conferred the highest Sharpe ratio portfolio.

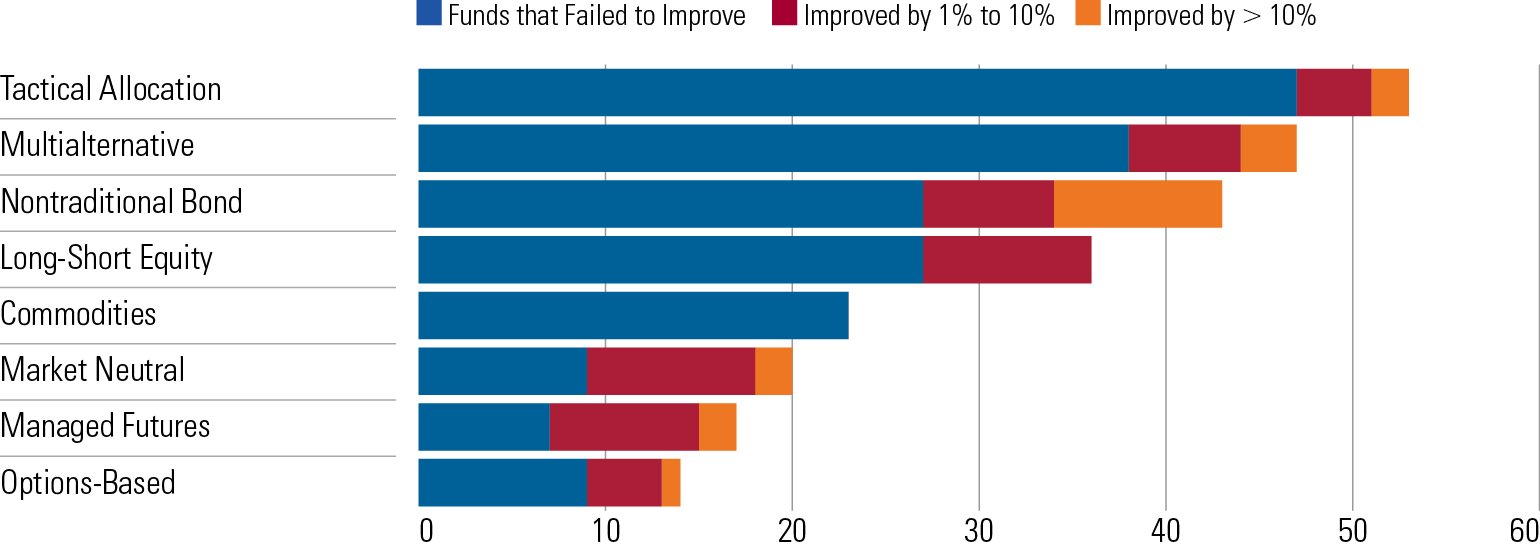

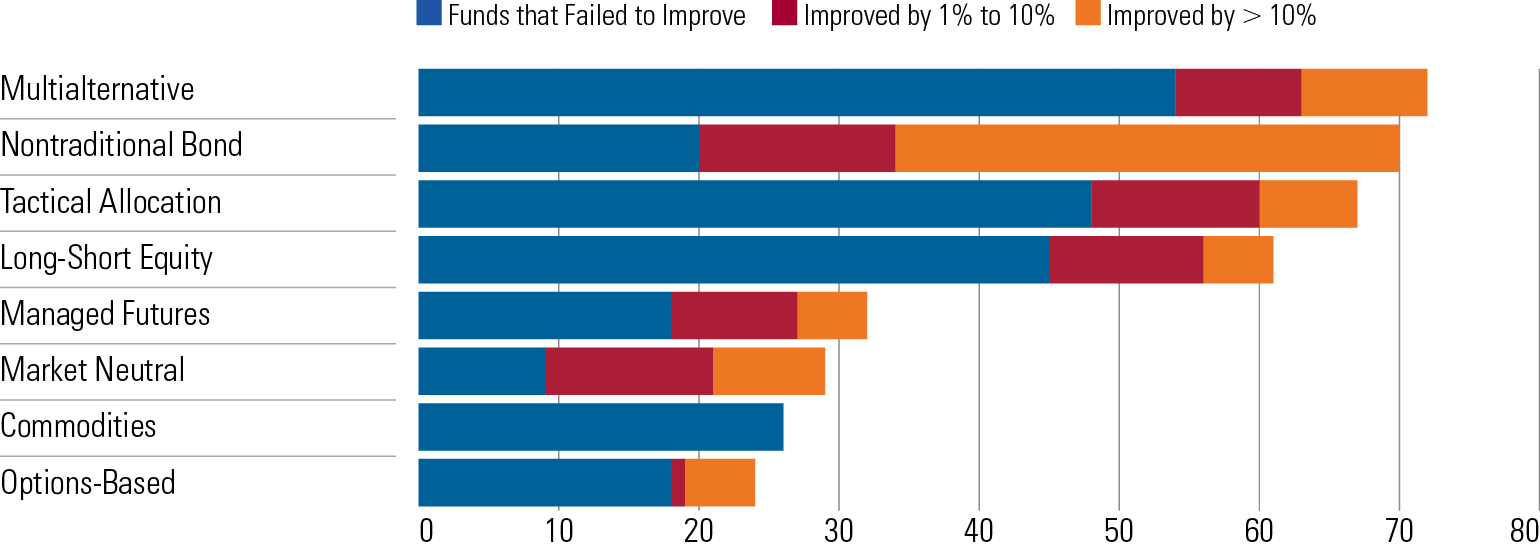

Exhibits 1 and 2 break down alternative funds by the degree to which they would have improved the Sharpe ratio of the model portfolio. Even under the best-case scenario, most liquid alternatives would have failed to improve the starting portfolio over the three and five years ended Dec. 31, 2017. (These results exclude funds that began but didn't finish the period because they were merged or liquidated away in the interim. As such, the findings below are potentially survivorship-biased. If we included the dead funds, the results would look even worse.)

Exhibit 1: Five-Year Results of Adding Liquid Alternatives and Other Diversifying Strategies to a Portfolio

Source: Morningstar Direct, author's calculations. Data as of 12/31/17.

Exhibit 2: Three-Year Results of Adding Liquid Alternatives and Other Diversifying Strategies to a Portfolio

Source: Morningstar Direct, author's calculations. Data as of 12/31/17.

For most categories, the results were disappointing across both time periods. Over the trailing five years, for example, not a single long-short equity fund would have improved our portfolio's efficiency by at least 10%. Market-neutral funds fared a bit better given their very low correlations to traditional equity and fixed-income returns, as did managed futures funds.

Bad Funds or Bad Timing? The short track records of most liquid alternatives can make it hard to draw conclusions about what is to blame for poor performance—the funds, the market environment, or both. To gauge alternatives' diversification potential over a longer time frame encompassing multiple market cycles, we conducted the same test but using the HFRI Fund Equally Weighted Composite Index, an equal-weighted index of global single-manager hedge fund net returns (the baseline portfolio remained the same). The index dates to 1992.

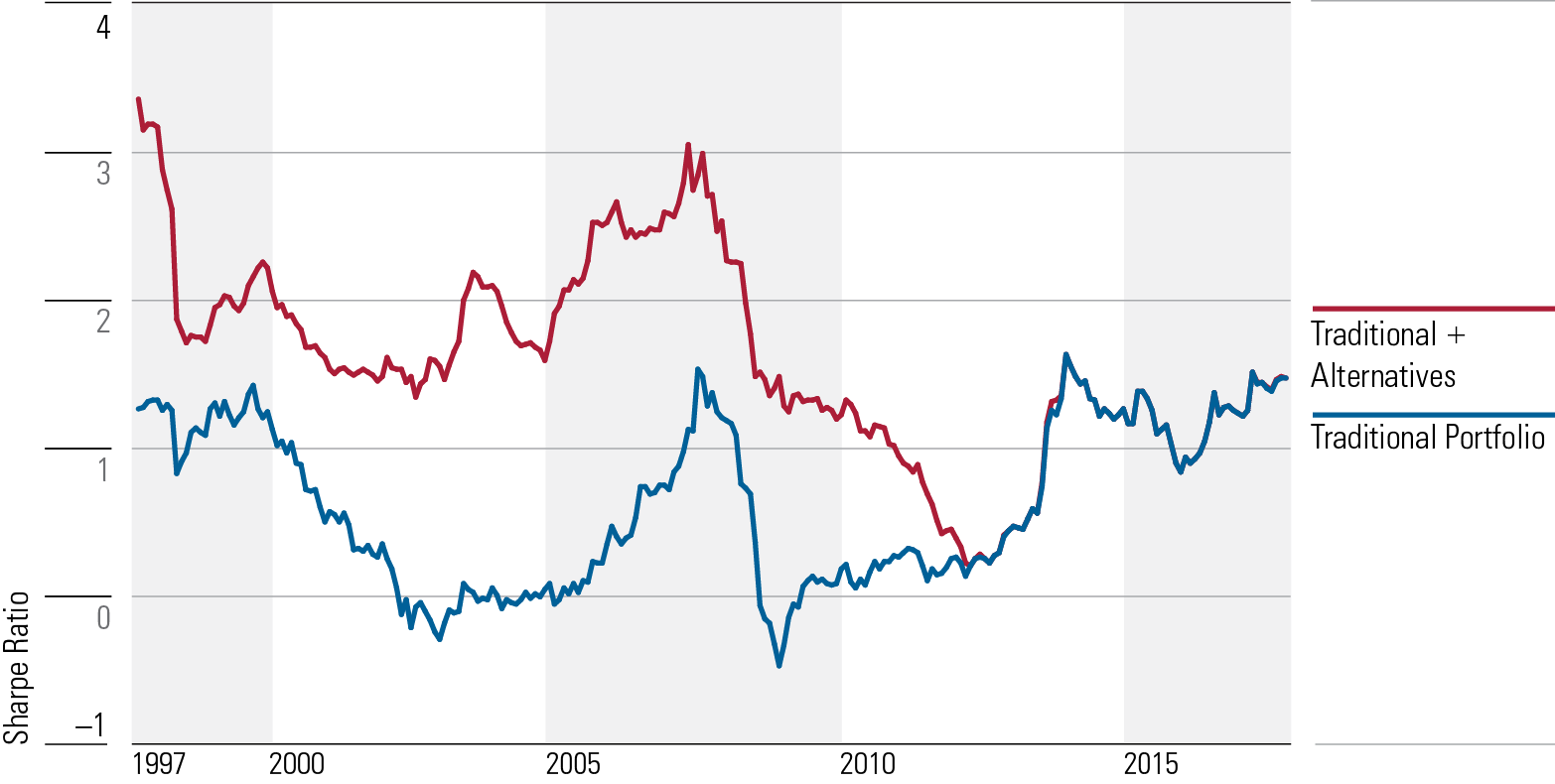

Exhibit 3 shows the rolling five-year Sharpe ratios of the baseline portfolio as well as the baseline portfolio plus an assumed optimal allocation to the hedge fund index.

Exhibit 3: Rolling Five-Year Sharpe Ratios

Source: Morningstar Direct, Hedge Fund Research Inc., author's calculations. Data as of 12/31/17.

Until relatively recently it has been beneficial to add at least some hedge-fund exposure to the traditional allocation, as evidenced by the fact that the traditional portfolio's Sharpe ratio rose after adding an allocation to the HFRI Index. It's only in the past 10 years that the benefits of using hedge fund strategies have basically vanished.

There are two factors that have gone against hedge fund strategies in recent years. First, the traditional 60/40 portfolio mix has been hard to beat: In the rolling five-year periods from January 2013 through December 2017, the traditional portfolio generated a 1.14 average Sharpe ratio, which was nearly double its average Sharpe ratio for the rolling five-year periods between December 1997 and December 2017. This creates a higher bar for hedge funds to add value.

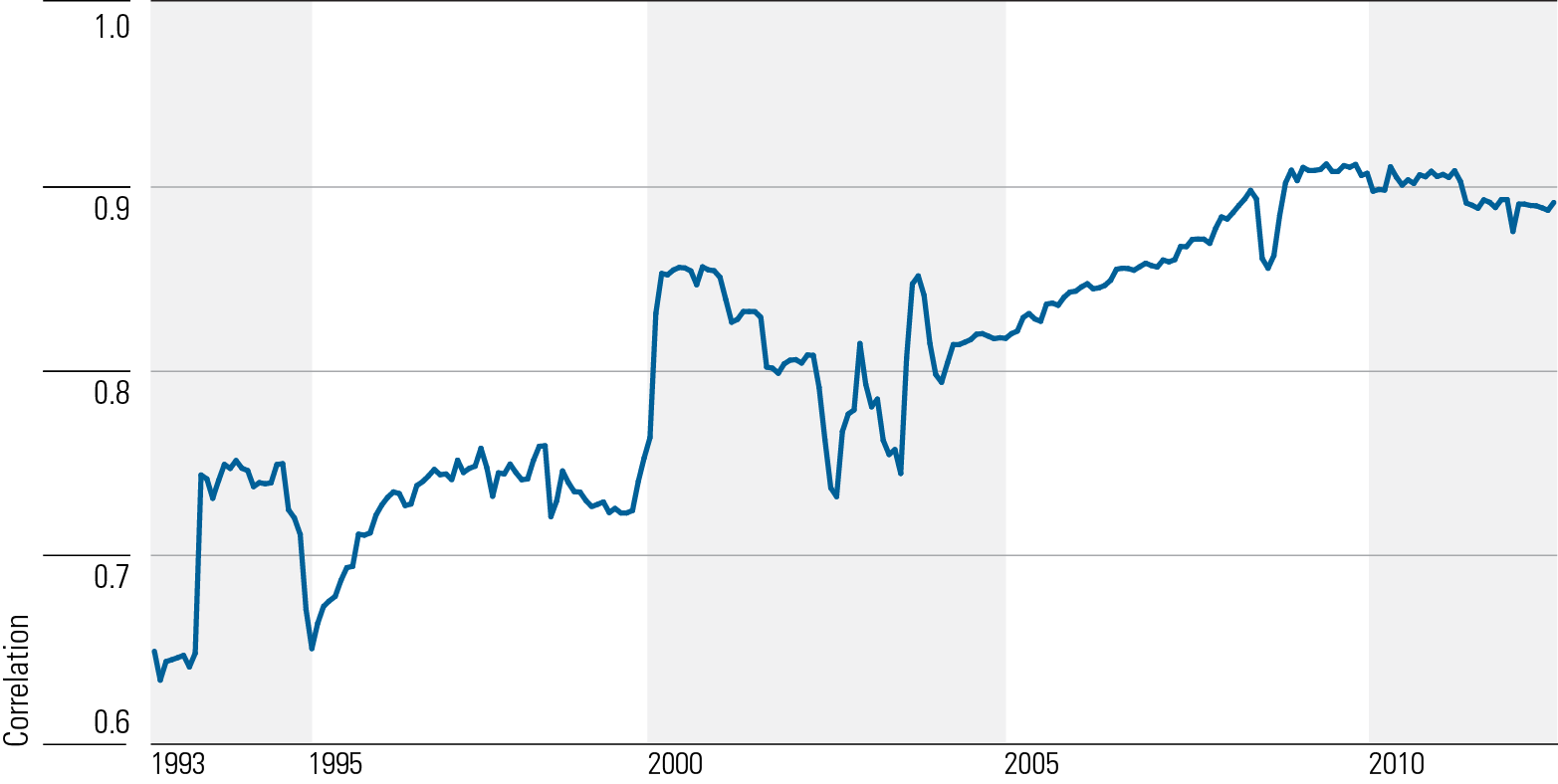

In addition, hedge fund returns have gotten increasingly correlated with the broader market's returns over time. Exhibit 4 shows the rolling five-year correlation of the HFRI Index and the traditional portfolio.

Exhibit 4: Rolling Five-Year Correlation of Hedge Funds to a Hypothetical Moderate Portfolio

Source: Morningstar Direct, Hedge Fund Research Inc., author's calculations. Data as of 12/31/17.

This indicates that the hedge fund returns are being driven primarily by stock and bond market returns. This creates another high hurdle for alternative strategies. The low levels of equity market volatility between 2012 and 2017 likely drew more hedge fund managers to increase their net exposure to the asset class, which would cause correlations to move higher.

Conclusion Liquid alternatives have struggled to add value in recent years owing primarily to two factors—standout stock and bond market returns, and rising correlations. The former is likely to prove temporary but higher correlations probably reflect structural changes, raising questions about whether nontraditional strategies can confer the same diversification benefits in the future as they did in the past.

Investors considering an alternative fund to diversify a traditional portfolio should assess the strategy's potential future risk-adjusted returns and correlation to stocks and bonds, as these factors will continue to dictate its diversification potential.

Financial professionals are accessing this research in our investment analysis platform, Morningstar Cloud. Try it today.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/s3.amazonaws.com/arc-authors/morningstar/fadee740-dfeb-494d-95b1-c462d0ac1f59.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fadee740-dfeb-494d-95b1-c462d0ac1f59.jpg)