Which Fund Companies Punch Above Their Weight?

A cleaner comparison of fund pricing among the largest sponsors of index mutual funds and ETFs.

Earlier this year, my colleagues published Morningstar's annual U.S. Fund Fee Study which offers insights into fee trends across the U.S. fund landscape. This article aims to build on that comprehensive report. Here, I will examine fees among the largest providers of index mutual funds and exchange-traded funds. The largest firms in this universe continue to hoover up assets. These fund flows have tended to land in low-cost funds tracking broadly diversified, market-cap-weighted indexes. As outlined in our annual fee study, the decline of asset-weighted fees over recent years is largely attributable to investors moving toward cheaper funds—index mutual funds and ETFs in particular—rather than fee cuts.

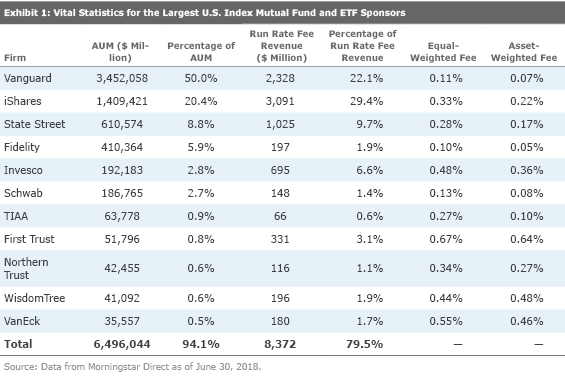

The Big Get Bigger Exhibit 1 shows assets under management and run-rate fee revenue for the largest sponsors of index mutual funds and ETFs. I calculated run-rate fee revenue as the product of funds' AUM and prospectus net expense ratio. All data is as of June 30, 2018 (this data does not reflect fee reductions after June 30, 2018).

Asset-weighted fees are lower than equal-weighted fees for nearly all these fund sponsors. That’s consistent with the trend of investment dollars moving toward low-cost funds. It’s also evidenced by the fact that the firms represented in Exhibit 1 control about 94% of U.S. index mutual fund and ETF AUM, but account for a relatively smaller share (80%) of run-rate fee revenue. This also means that there is still room for small players to extract relatively larger fees in niche market segments.

One example of this can be found among the funds in the alternative Morningstar Category grouping. Fund sponsors like ProShares and Direxion have carved out a profitable niche in this arena by offering leveraged and inverse index mutual funds and ETFs. The pair are the only fund sponsors with exemptive relief from the SEC to offer these types of index mutual funds and ETFs. At the end of June 2018, these firms combined to control around 70% of the AUM and run-rate fee revenue of all passive funds in the alternative category grouping. This translates to run-rate fee revenue of $225.4 million and $135.4 million for ProShares and Direxion, respectively, in this category group. ProShares and Direxion won’t make headlines for their huge asset flows, but they’ve found their corner of the market and are doing just fine.

Of the fund sponsors in Exhibit 1, only WisdomTree’s equal-weighted fee is lower than its asset-weighted fee. This owes to the firm’s product mix and pricing strategy. WisdomTree doesn’t intend to compete with the behemoths on vanilla, market-cap-weighted funds where asset scale begets success. Instead, it opts to offer funds that pursue differentiated investment strategies such as currency-hedging or strategic beta. Differences in product strategy like these muddy the waters when trying to compare fee levels across U.S. index mutual fund and ETF sponsors.

Lower expense ratios are great for investors, but equal- and asset-weighted fee measures don’t account for differences in product mix among index mutual fund and ETF sponsors. For example, U.S. large-blend funds are generally cheaper to manage than emerging-markets stock funds, and their fees tend to be lower as a result. Also, funds tied to traditional, broad-based market-cap-weighted benchmarks tend to command lower fees relative to more-niche funds.

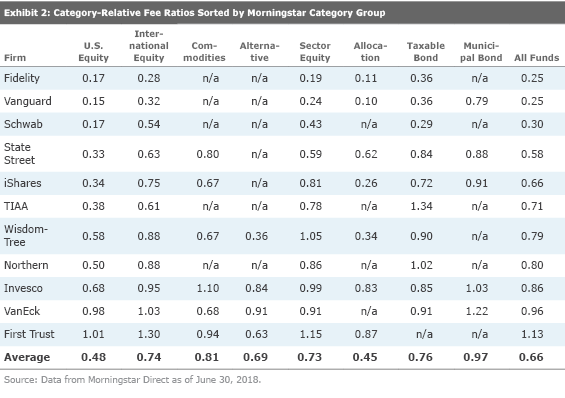

Apples to Apples To produce a fairer comparison of fund sponsor fees, I calculated the ratio of each fund's fee compared with the average fee of its U.S. index mutual fund and ETF peers in its Morningstar Category. For example, if the average expense ratio among all index mutual funds and ETFs offered in the large-blend category is 0.50%, and a firm's average fund in the large-blend category charges 0.40%, then the resulting ratio of that firm's fee level in the large-blend category is 0.8 (0.8 = 0.40%/0.50%).

Next, I aggregated these Morningstar Category-relative fee ratios into the Morningstar Category groups. For example, Morningstar’s large-blend and large-value categories roll up into its U.S. equity category group. These category-relative ratios remove some product-mix-related biases from the average fee measures. Lower ratios in Exhibit 2 indicate a cheaper average category-relative fund expense ratio. I sort Exhibit 2 by average category-relative fund ratio in ascending order.

On average, most of these fund sponsors charge fees that land below their respective category average. First Trust is the exception. Its average category-relative fee ratio across its index mutual fund and ETF offerings measures 1.13. This indicates that, on average, First Trust prices its index mutual funds and ETFs above their respective Morningstar Category average fees.

Conversely, the average category-relative fee ratios of the index mutual funds and ETFs offered by Fidelity, Vanguard, and Schwab are less than one third of their respective category index prices. In fact, these firms post low category-relative fees across all category groupings. The exception is Vanguard’s category-relative fee of 0.79 in the municipal-bond category grouping. But category-relative fee ratios don’t account for index mutual fund and ETF pricing dynamics within the Morningstar category. The average fee of index mutual funds and ETFs in the municipal-bond category group is 0.26%, so ratios below 1.0 in the municipal category grouping are still low.

Fees Keep Marching Lower The trend is clear with respect to fees. On one hand, investors are voting with their feet and moving to low-cost fees. On the other hand, because the least-expensive index mutual funds and ETFs attract the lion's share of investors' dollars, comparing fee-level differences as they approach zero becomes an ever less-meaningful endeavor. Don't get me wrong: Fees are important, but investors should keep their focus on funds with strong investment processes (as defined by the makeup of their underlying indexes and how well portfolio managers can track them). As fees reach the zero bound, the investment process will likely have a greater impact on investment outcomes going forward.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)