13 Gold-Rated Mid-Cap Funds

Mid-caps offer good risk/reward potential, but check your existing exposure before buying a dedicated fund.

A press release recently piqued my interest. It described a podcast collaboration between actress Elizabeth Banks and State Street Global Advisors as a way to "raise awareness of the strong performance of several mid-cap companies that make up the

I'm sorry, "raise awareness"? This advertisement disguised as a public service announcement made me laugh a little to be honest, though I do find Elizabeth Banks charming. I also wondered, why MDY and not SPY? If a novice investor buys a mid-cap fund and nothing else, their portfolio is more risky than it would be if they owned only the

Which brings me to today's question: Do people even need a mid-cap fund?

The 'Sweet Spot'? Morningstar methodology currently classifies mid-caps as companies with market caps above $4 billion but below $17 billion. Mid-cap companies are usually not as dependent on a single product as their smaller-cap peers can be, meaning that mid-caps' revenue and cash flow are often more consistent and the stock price is less volatile. But mid-caps are also not yet hampered by their size, either (meaning that once a company reaches the mature large- or giant-cap stage, its growth potential slows down).

Despite their potential to outperform, though, risk-adjusted return metrics for MDY and SPY show that mid-caps and large caps have had similar performance over the trailing and five- and 10-year periods, but mid-caps have been on a bumpier ride, as SPY has a considerably higher Sharpe ratio over both periods.

How Much Exposure to Mid-Caps Do You Need? The total stock market can be a good starting benchmark for figuring out if you need dedicated mid-cap exposure. Morningstar data shows mid-caps accounting for 20% of the U.S. equity universe. Total market index funds typically devote about 18% to mid-caps--6% to each of the mid-cap style box squares.

The mid-cap weightings of many target-date funds land in a similar ballpark. All three Gold-rated target-date fund series (Vanguard VFIFX, JPMorgan SmartRetirement JTSIX, and BlackRock LifePath LIPKX) have around a 20% weighting in mid-cap stocks.

What Do You Already Own?

If you have a portfolio saved in Morningstar.com's

tool, it's easy to see how much exposure to small- and mid-caps you already have. It's possible that you don't need to own a pure mid-cap fund if you already have plenty of exposure to smaller-cap companies in your portfolio. (

can show you the percentage of your equity exposure that falls into each square of the style box, which helps you get a handle on how much of your portfolio's equity exposure is in mid-caps versus small caps and large caps.)

For instance, as I mentioned earlier, 18% to 20% of total market indexes are currently in mid-caps. So, if you have a total market index fund, you may have all you need unless you wanted to explicitly overweight this pocket of the market.

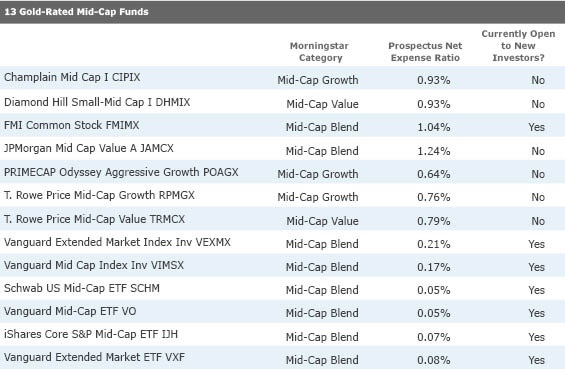

Choosing the Best Fund for Your Portfolio If, after examining your holdings, you decide that your portfolio would benefit from adding a mid-cap fund, here are the 13 mid-cap stock funds that our manager research analysts have the most conviction in.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)