Investors Have Failed to Time Currencies With Hedged ETFs

Attempting to time changes in foreign-exchange rates hurts long-term performance.

A version of this article was published in the April 2018 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

Edwin Lefevre's classic tome, Reminiscences of a Stock Operator, chronicles the career of Jesse Livermore, an infamous trader from the early 20th century. The book is often cited by traders and investors alike for the many lessons gleaned from Livermore's stock market trials--a mixed series of successes and failures. While his exploits may impart some teachable moments, they often overwhelm the larger message, which can best be summarized through the following quote from the book: "There is nothing like losing all you have in the world for teaching you what not to do."

Livermore apparently never took his own advice. His speculations made and lost several fortunes over the course of a career that spanned several decades. If there's one lesson that investors should take away from his story, it is that trading and speculation are risky to one's wealth. Really risky. But Livermore's experience, and others like it, haven't stopped us from trying.

Cash flows for mutual funds and exchange-traded funds appear to confirm that investors are still engaged in bad-for-their-wealth behavior--moving in and out of funds at the wrong time. While there is a smorgasbord of strategies available to examine, the detrimental impact of timing one's exposure to a given asset is particularly noticeable among funds that hedge their currency risk.

The primary objective of currency-hedged strategies is to eliminate currency risk from their foreign stock or bond exposures--the additional volatility that comes from changes in foreign-exchange rates. For long-term investors this is a reasonable strategy, as currency risk typically isn't compensated. But a closer look at currency-hedged funds shows that these strategies hang an enticing carrot in front of those willing to speculate. And investors, collectively, haven't been able to time currency fluctuations using these funds.

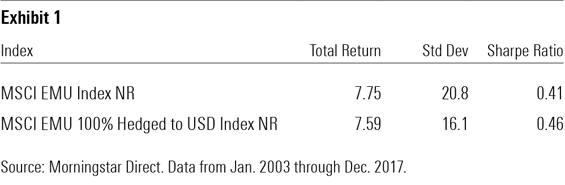

The Nature of Foreign-Exchange Risk The volatility of foreign stocks (as measured by standard deviation) has two sources: the first being the volatility of stocks denominated in their local currency, and the second a consequence of changes in the foreign-exchange rate between a stock's home currency and an investor's local currency. Strategies that hedge currency risk attempt to eliminate this second source of volatility. Theoretically, currency movements tend to be cyclical. Therefore, they can add to the long-term volatility of foreign investments without providing any compensation to investors for assuming this risk. A hedged strategy can all but eliminate this additional risk without affecting long-term returns. Exhibit 1 captures the performance of the MSCI European Monetary Union Index, denominated in U.S. dollars, and its currency-hedged counterpart from January 2003 through December 2017. As you'll see in Exhibit 1, the long-term returns of these two benchmarks were nearly identical over this 15-year stretch. But the hedged strategy delivered those returns with considerably less volatility.

Currency hedging looks like a pretty good deal through this long-term lens, as it effectively eliminates currency risk while preserving long-term returns. But it requires investors stay put for a long time in order to reap the benefit. Potential concerns arise over shorter stretches, as the intentional elimination of foreign-exchange risk can drive differences in performance between hedged and unhedged strategies.

Hedging is accomplished by locking in a predetermined exchange rate through a forward contract, with hedged strategies benefiting from this activity when the U.S. dollar appreciates relative to a foreign currency. As an example, the U.S. dollar appreciated against the euro in 2016, causing the returns of the MSCI EMU 100% Hedged to USD Index to exceed those of the unhedged index by 4.66% that year. However, hedging causes performance to lag an unhedged portfolio when exchange rates go the other way. In 2017, the U.S. dollar depreciated relative to the euro. Consequently, the MSCI EMU 100% Hedged to USD Index underperformed its unhedged counterpart by 13.38% over those 12 months. To summarize: Hedging currency risk can cause returns to deviate from a comparable unhedged portfolio over shorter time frames, but over the long run the impact tends to wash out.

Bad Timing Leads to Poor Returns Thus, timing one's exposure to a hedged index (when the U.S. dollar appreciates) and exiting when exchange rates reverse looks like a tempting proposition. Well-timed exposure can potentially earn speculators several percentage points of additional return.

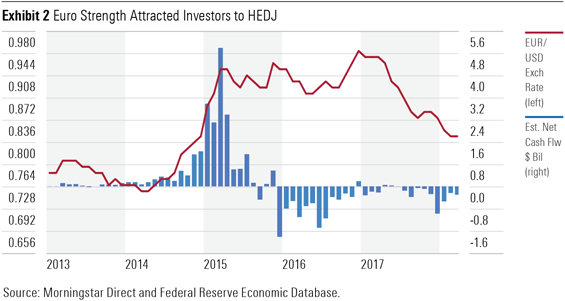

There are signs that investors attempt to do this, but little evidence that they can pull it off successfully. In Exhibit 2, I show monthly net cash flow data for

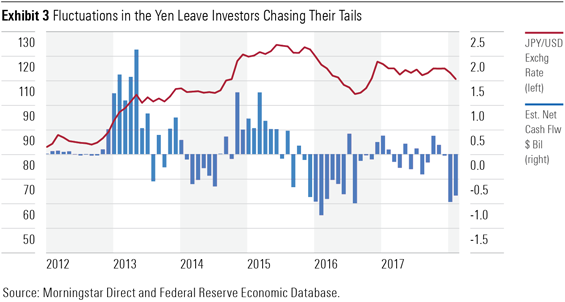

Another currency-hedged fund, WisdomTree Japan Hedged Equity ETF DXJ, has also experienced cash flows that appear to have been driven by investors trying to time movements in foreign-exchange rates. The pattern in Exhibit 3 shows net inflows occurring as the U.S. dollar appreciates relative to the yen, and outflows appearing as the dollar declines.

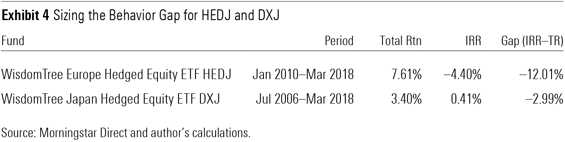

Consequently, the returns for DXJ are also symptomatic of the behavior gap, but the disparity isn't as large as with HEDJ. As you can see in Exhibit 4, DXJ's internal rate of return lagged its total return by 3% annually from July 2006 through March 2018. Other currency-hedged funds exist, such as iShares' suite of currency-hedged ETFs. But these funds are relatively new, while HEDJ and DXJ have substantially longer track records. Therefore, they provide the best opportunity to assess just how well investors have fared with these funds.

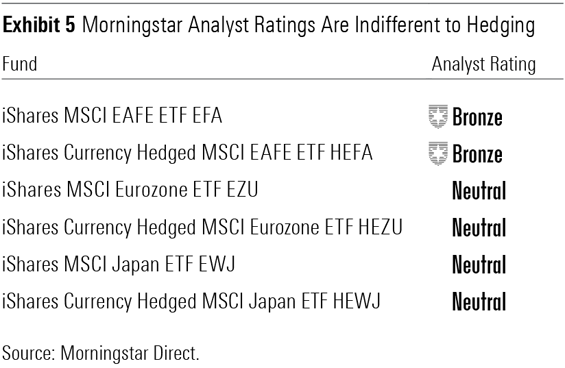

It's important to emphasize that currency-hedged funds aren't bad funds, as they can be an effective means to reduce uncompensated volatility. But evidence suggests that they aren't being used appropriately. In evaluating these funds, we remain indifferent to currency hedging, assigning the same rating to comparable hedged and unhedged portfolios. Exhibit 5 summarizes the Morningstar Analyst Ratings for six iShares foreign-stock funds and demonstrates our even-handed perspective of currency hedging.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)