8 of the Best Short-Term Bond Funds

Short-term bonds currently offer attractive yields with modest interest-rate risk.

If you are retiring or you have a big expense in the next few years, you have an interest in conserving the money in your portfolio. You don't have as much time to weather equity market downturns before you have to spend the money. It makes sense to park this money in very low-risk investments.

Thanks to recent interest-rate hikes, yields on money markets have risen to a range of 1.5% to 1.9%. If you don't need the money to be in liquid assets, CDs will bring you even higher, to around 2.4% for a one-year and 2.6% for a two-year.

Short-term bonds, though not immune from capital losses, have become an increasingly interesting proposition this year.

"If you absolutely want to avoid losses, cash is a good place to be. But if you have a bit of a longer time horizon, you're getting paid more to take some price risk," said Miriam Sjoblom, a director in Morningstar's manager research group.

Also adding to short-term bonds' current appeal is that you're not giving up too much yield in return for protecting your money from interest-rate risk. In fact,

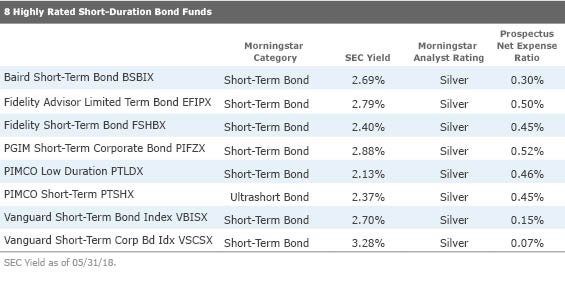

These funds are highly rated by our Morningstar manager research analysts. We evaluate funds based on five key pillars--Process, Performance, People, Parent, and Price--and assign ratings of Gold, Silver, and Bronze to funds we believe are more likely to outperform over the long term on a risk-adjusted basis.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)