Diversification, Asset Allocation, and Rebalancing

Would the three-fund idea have worked 20 years ago?

Speaking Hypothetically Among the questions asked of my July 4 column about Taylor Larimore's three-fund portfolio was its historic performance. How would investors have fared had they implemented that idea 20 years ago?

Easy to answer, particularly with Morningstar Direct's handy-dandy hypotheticals tool. (If you need to ask Direct's price, the product is not for you.) But, without context, not very instructive. Comparisons make the statistics relevant. Which investment decisions were favorable, and which were not? Can we draw lessons from the experience?

More Than One

The starting point is diversification. Larimore's recommended portfolio holds three Vanguard index funds:

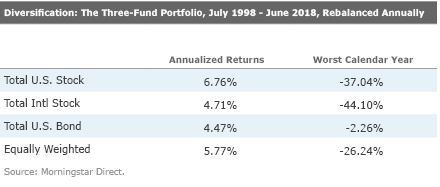

For this initial exercise, I assume that the collective portfolio is equally weighted, such that each fund receives one third of the investor’s assets. It is rebalanced annually. (Both of those assumptions will later be altered.) The table below shows the annualized total returns and single worst calendar year for each of the three funds and for the equally weighted portfolio, from July 1998 though June 2018.

Diversification delivered on its promise. Of the four investment possibilities, the blended portfolio scored second on both measures: annualized returns and worst calendar year. Beating two out of three single-fund options, for risk as well as return, is a worthy feat. Another way of viewing the matter: The diversified portfolio’s returns landed midway between the two stock funds’, while its risk was distinctly lower.

To be sure, those who cared exclusively about returns should have bought only Vanguard Total Stock Market Index, while those concerned solely about risk should have restricted themselves to Vanguard Total Bond Market Index. One of Monty’s doors concealed a prize. The difficulty for the investor is knowing which. In this example, predicting the funds’ risks would have been straightforward and would have led cautious investors to avoid the stock funds. Predicting their gains, not so much. Diversification was needed.

Allocating Assets Of course, investing by 1/N (N=number of assets) is but one road to asset allocation, and an unlikely path, at that. Most U.S. investors who form a three-fund portfolio will hold more domestic stocks than overseas issues. They won't necessarily opt for 67% in stocks, either.

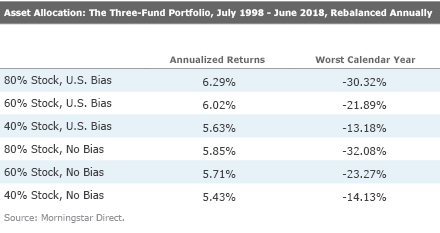

The next table shows how various asset allocations would have performed. The first three portfolios carry stock positions of 80%, 60%, and 40%. They have a home-country bias, with U.S. stocks comprising 80% of their equity portfolios. (For example, the growth portfolio would have 64% invested in Vanguard Total Stock Market Index, 16% in Vanguard Total International Stock Index, and 20% in Vanguard Total Bond Market Index.) The next three portfolios have the same overall equity weighting, but their equities are evenly divided between domestic and abroad.

The first thing to notice is that the returns are clustered. No portfolio made as much as 1 percentage point per year more than another. This compression is time-period dependent. As we saw with the initial chart, domestic stock and bond returns were separated by an annualized 2 percentage points for the 20-year stretch, as opposed to roughly 6 percentage points over a full century. International equities were even more depressed, barely beating U.S. bonds.

Thus, over the long haul, asset allocation wasn’t terribly important. The three-fund investor reaped greater profits by holding more stocks (albeit at the cost of enduring significantly more losses during 2008) and was better off staying home than moving heavily into international stocks, but neither effect was large. Nor were they reliable. This time around, stocks modestly beat bonds, and U.S. companies outgained their overseas rivals. Next time, they might not.

This leads to a general point: Diversification is more important than asset allocation. To be sure, allocating assets is a skill. Those who do it well can tilt the odds in their favor. But ultimately, success is determined by the fates--how the assets perform at a given time. Diversification is the surer of the two bets. It possible that the blended portfolio will disappoint, such that the investor will regret not having made a single choice, but that will happen less often than not.

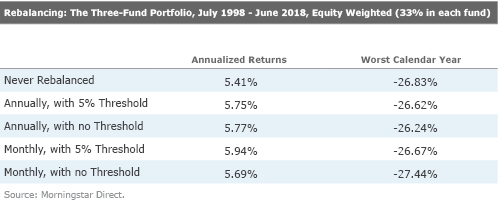

Balancing Acts Let's now look at rebalancing. For this test, I will revert to the original, equally weighted portfolio: 33.3% in each fund. We'll see how the hypothetical investment would have acted if 1) Never rebalanced; 2) Rebalanced annually, if the fund's allocation is more than 5 percentage points away from its target; 3) Rebalanced annually, without a rebalancing threshold; 4) Rebalanced monthly, with the 5-percentage-point trigger; and 5) Rebalanced monthly, with no rebalancing threshold.

Hmmm. Rebalancing has less effect than does asset allocation, which in turn has less effect than does the basic act of diversifying. That was my intuition when I began this column, and it was supported by this example of the three-fund portfolio. After that, I am not quite sure what to say about rebalancing.

In this instance, the never rebalanced portfolio lags the other four choices, but that lesson cannot be generalized. Were one of the three assets to outperform the other two assets, consistently and without a major reversal (as occurred with U.S. stocks versus U.S. bonds in this example), then the never rebalanced strategy would post the best return. Its high-flying asset would become an ever-larger chunk of the portfolio.

Similarly, I will not draw a conclusion from the fact that setting a 5% threshold for monthly rebalancing led to better gains, given that establishing that same 5% threshold for annual rebalancing did not. These results are accidents of history. We know that rebalancing less often is better if transaction and trading costs apply. The matter is less clear for mutual funds that are traded within a taxable account, as modeled by today’s exercise.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)