A Look at the Menu of Chinese Equity ETFs

No two dishes on this expansive menu are alike.

A version of this article was published in the June 2018 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

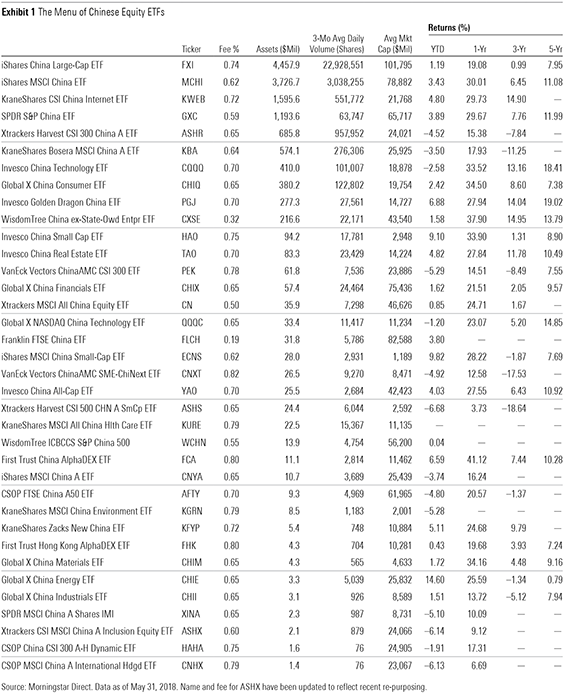

The menu of exchange-traded options available to investors looking for Chinese equity exposure is expansive. As of the end of May 2018, there were three dozen China-focused stock exchange-traded funds, no two alike. The full spread is featured in Exhibit 1. Here, I'll call out some of the more interesting options.

Plain-Vanilla We tend to favor funds tracking broadly diversified market-cap-weighted indexes. These funds often have a sizable fee advantage over peers, and their portfolios typically capture the opportunity set available to their competition. IShares MSCI China ETF MCHI, SPDR S&P China ETF GXC, Franklin FTSE China ETF FLCH, and WisdomTree ICBCCS S&P China 500 WCHN best fit this mold. Of these four, WCHN casts the widest net: It has the largest number of holdings, the lowest average market cap, and about a third of its portfolio invested in its top 10 holdings (versus roughly one half for the other three funds). That said, the fund is relatively new and has a small asset base, so liquidity is thin and closure is a risk. FLCH is by far the least expensive of the bunch, but the fund faces similar issues as MCHI, given its low level of assets under management and sparse trading volumes. Of the four, I think that GXC is currently the best option. Its portfolio is a bit more expansive than MCHI's, and it has a lower fee to boot.

'A-ppetizers' The duo of Xtrackers Harvest CSI 300 China A-Shares ETF ASHR and KraneShares Bosera MSCI China A ETF KBA dominates the list of ETFs focused on China A-shares, collectively holding more than 95% of assets invested in that cohort as of the end of May. The funds take different paths to crafting portfolios that, at present, look awfully similar. ASHR tracks the CSI 300 Index, a market-cap-weighted benchmark made up of the largest and most-liquid stocks in this universe. KBA tracks the MSCI China A Inclusion Index, which is meant to track those China A-shares that are being included in MSCI's mainline benchmarks over time. Given that the first group of China A-shares being folded in are among the largest and most liquid, it is little surprise that the two funds have substantial overlap. That said, given that just 227 China A-shares have been added to MSCI's suite thus far, ASHR's portfolio is incrementally broader than KBA's. Also worth noting is ASHR's new sibling, Xtrackers MSCI China A Inclusion Equity ETF ASHX. The fund was recently created by way of repurposing Xtrackers CSI 300 China A Hedged Equity ETF. At 0.60%, its fee edges out KBA (which tracks the same bogy), but at just over $2 million, its asset base is still tiny. This bodes poorly for trading volumes and raises the specter of closure risk. All told, it's tough to pick a favorite from this lot. If forced to play favorites, I'd go with ASHR, mostly because it already owns the next slug of China A-shares that KBA and ASHX will eventually add to their own portfolios.

Hot Sauce

The technology sector has been red-hot in China. Thus, it should come as little surprise that some of the larger offerings on the menu are trying to harness the momentum being enjoyed by some of the country's emerging technology powerhouses. The largest fund on this roster is KraneShares CSI China Internet ETF KWEB. From its inception in July 2013 through the end of May, KWEB outperformed GXC by nearly 7 percentage points on an annualized basis. It even edged out

Small Fries

Invesco China Small Cap ETF HAO, iShares MSCI China Small-Cap ETF ECNS, and Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF ASHS offer access to the small fries. All three are tiny as measured by assets under management, likely because they are incredibly volatile. Over the five years through May 31, ECNS had a standard deviation of monthly returns of 22.4%. This compares with 19.2% for GXC, 15.2% for

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)