Self-Employed? How to Budget for Taxes

Without payroll deductions, you have to anticipate how much you'll owe and incorporate it into your budget.

A self-employed friend recently asked me how much she should budget for taxes.

"Payroll taxes or income taxes?" I asked.

"All of it. Everything I will be on the hook for in April."

We came up with a rough estimate of what her 2018 tax liability will be. We didn't bother getting too precise with it by accounting for deductions and credits; her yearly salary is hard to pin down precisely as it depends on how much she works over the next five months. But the process of figuring this out was educational for both of us, so I wanted to share it.

Amy is a self-employed creative director. Advertising agencies hire her to write ad campaigns. She estimates that for calendar year 2018, her earned income will be around $160,000.

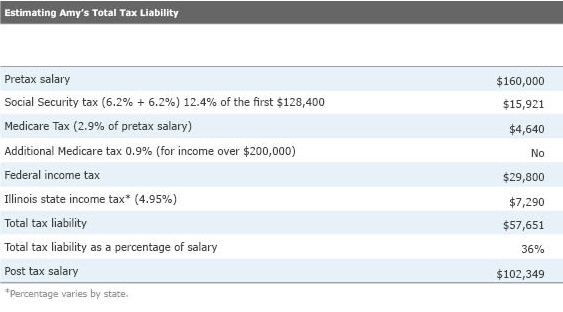

Her total tax liability is below. I'll explain more about the individual components and how they are calculated.

The first tax is FICA, which is Social Security and Medicare withholding up to the Social Security wage cap of $128,400. (Note that there is no wage cap for Medicare tax.) When you work for a corporation, half is paid by your employer, and you owe the other 7.65% (6.2%, up to $128,400 + 1.45% on your whole salary). When you're self-employed you pay both halves.

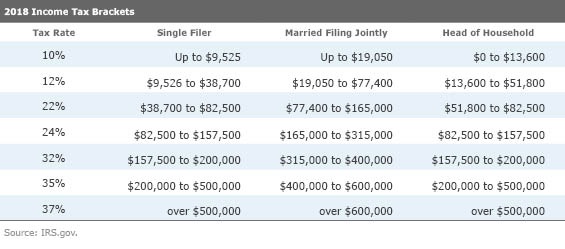

Next, we estimated her federal income tax amount. Use the tax table below to calculate it, but don't simply take pretax salary and multiply it by marginal tax rate. For instance, Amy won't be on the hook for 32% of $160,000, even though she falls into the 32% tax bracket.

Taxes are paid in tiers. The first $9,525 of income is taxed at 10%. The next $29,174 of income--the amount from $9,526 to $37,950--is taxed at 15%. The next bracket, 22%, goes from $38,700 to $82,500. The next strata of Amy's income, from $82,500 to $157,500, is taxed at 24%. But Amy earned just a smidge more than that--the final $2,500 of her salary is subject to the 32% tax rate, which is her "marginal" tax rate. In actuality, though, her taxable income will be in the 24% tax bracket after we apply the $12,000 standard deduction. Our estimate of Amy's income tax liability is $29,800.

This example is calculated for a single filer. If Amy were married filing jointly, we would need to know about her spouse's income before we calculate their joint tax liability. For instance, if her spouse were employed by a corporation, we would need to be careful to exclude the portion of the couple's income that had already been subject to FICA tax when calculating their tax liability.

I also added her state tax; Illinois has a flat 4.95% income tax rate.

Those who have been self-employed for a while can probably do these calculations in their head. They are used to practicing discipline in their budgeting to ensure they're not overspending. For instance, though Amy is taking home the equivalent of $13,000 a month, her aftertax salary is more like $8,333, so she needs to be careful her monthly expenses don't exceed this.

Of course my friend is very prudent with her spending--evidenced by her attempts to budget for taxes nine months before they are due. For the rest of us, payroll deductions are the necessary evil that keep us on the right track.

My advice for any self-employed person who thinks budgeting for taxes might be a challenge is to go through the steps above and determine total tax liability as a percentage of salary. Then open a second checking or savings account and divert a certain percentage of every paycheck (about 35% or so) into it. Don't touch this account--forget it's even there.

Easier said than done? Maybe. In an upcoming article I plan to discuss how to run the calculation backward; if you are self-employed and want a certain post-tax monthly salary, we'll walk through the steps to figure out the weekly, daily, and hourly rate you would need to charge.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)