Morningstar's Take on the 2nd Quarter

Morningstar's analysts have provided in-depth reviews and outlooks across equity sector, fund categories, and private markets. Plus, fund category and index return data.

Morningstar's analysts have provided in-depth reviews and outlooks across equity sector, fund categories, and private markets. Their takes are below along with quarter-end fund category and index data.

Morningstar's Quarter-End Coverage

Stock Market Outlook: Some Values to Be Found in Defensive Sectors

Energy: Despite Geopolitical Wildcards, the Reckoning Is Still Coming for U.S. Shale Producers

Real Estate: Strong Fundamentals Persist--As Do Opportunities

Utilities: Back to Fair Value With Some Emerging Opportunities

Healthcare: Drug Pricing Concerns Weigh on Valuations, Creating Opportunities

Consumer Defensive: Attractive Opportunities in Competitively Advantaged Stocks

Consumer Cyclical: The Themes Driving Retail's Rebound

Industrials: Despite Bullish CEO Talk, Few Values

Technology: Data Security and Privacy Remain on the Forefront

Basic Materials: Overpriced, With Significant Downside Ahead for Commodities

Financial Services: A Positive Outlook for U.S. Banks, More Consolidation to Come for Asset Managers

Communication Services: Undervalued With a Case of Merger Fever

Venture Capital: With Ample Available Capital, Growing Venture Market Is Subject to Inflationary Pressures

Private Equity: Firms Revamp the Traditional PE Playbook

Credit Markets: Investment Grade Struggles While High Yield Strengthens

Manager Research Insights Kinnel: Fund Winners and Losers From the First Half

Target-Date Changes at Fidelity

ETF Inflows Trailing at the Half

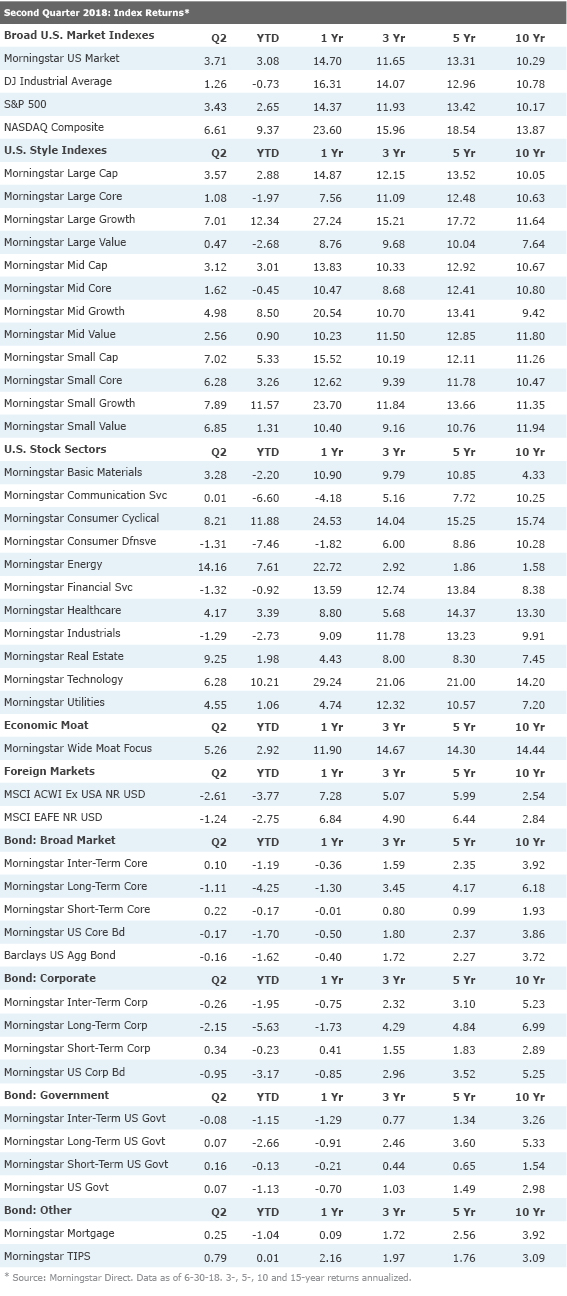

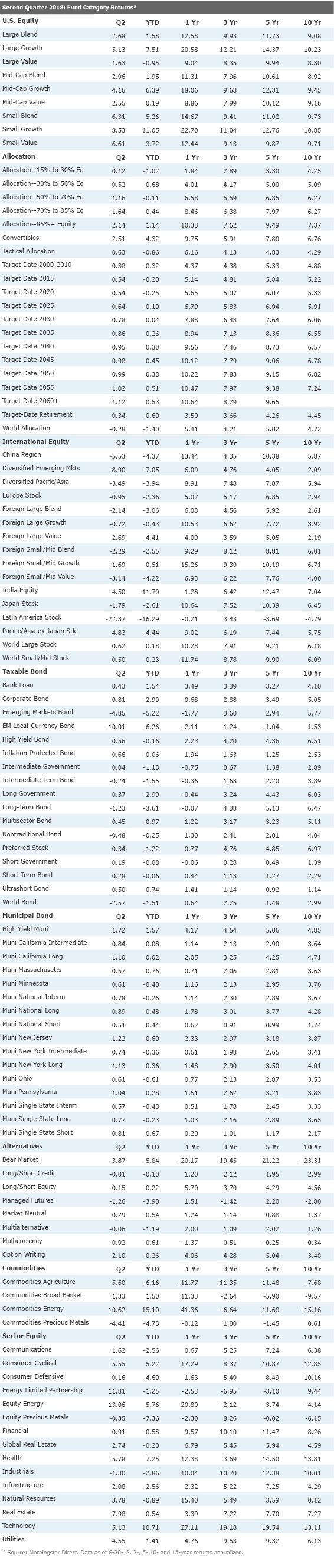

Data Report

Open-End Fund Category Returns Index Returns Download Data (Excel)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)