31 Undervalued Stocks

As we wrap up the second quarter, our equity analysts name their best ideas in every sector.

The Morningstar Global Markets Index is hovering just below zero for the first half of 2018 through June 28. The market-cap-weighted price/fair value estimate ratio for our equity analysts' global coverage universe was 1.0 through the same period, indicating that the median stock we cover is about fairly valued.

Drilling down to the sector level, we see proportionately more opportunities in less-cyclically sensitive sectors like consumer defensive and healthcare.

"Generally speaking, we're more positive on sectors that are less sensitive to the economic cycle, which might not be too surprising given the global economy is now in its ninth consecutive year of expansion," said director of North American equity research Dan Rohr in his second-quarter wrap-up. "Consumer defensive ranks among the more undervalued sectors, trading at a price/fair value of 0.94 on a cap-weighted basis."

Our equity analysts provide their takes on the biggest themes and the best remaining investment opportunities in each sector.

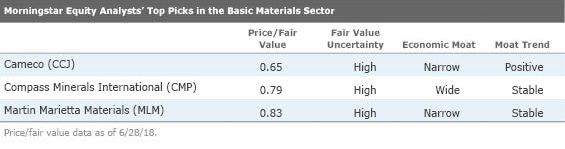

Basic Materials On a market-capitalization-weighted basis, our basic materials coverage trades at a 25% premium to our estimate of intrinsic value--the most overvalued sector in our global coverage. Our bearish perspectives on most mining and metals companies are the primary drivers of this. That said, there are still some pockets of opportunity to be found.

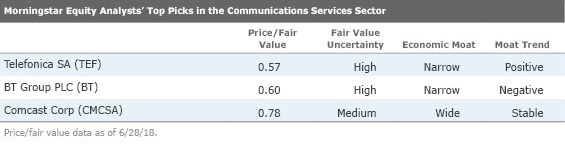

Communication Services We believe the communications services sector is undervalued, trading at a market-cap-weighted price/fair value of 0.82.

Consolidation is the trend among U.S. telecom companies. The T-Mobile-Sprint merger will likely face hefty regulatory scrutiny, as it shrinks the number of nationwide wireless telecom providers from four to three. Yet both T-Mobile and Sprint are behind the industry leaders,

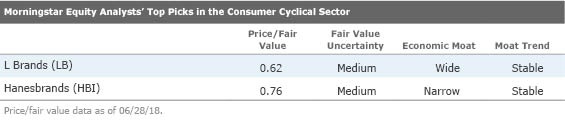

Consumer Cyclical The consumer cyclical sector is about 5% overvalued at present. Consumer sentiment in the U.S. and many other developed nations remains healthy. Low unemployment rates and wage rate increases have helped to drive middle class consumption globally, as have rising equity and housing market valuations.

When it comes to competing in an Amazon world, our equity analysts believe that physical retailers that offer a combination of specialization, convenience, and experience are best positioned. While concerns about potential disruption from Amazon linger, we've seen a rebound among several traditional retailers that have embraced these qualities in 2018.

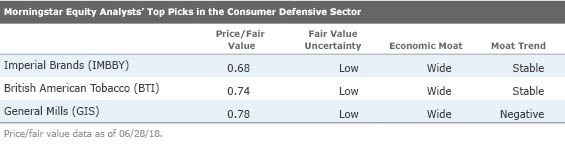

Consumer Defensive Valuations throughout the consumer defensive sector have retreated; stocks in the sector now trading 5% below our fair value estimates. We believe the combination of lagging fundamentals and rising interest rates (and subsequently slightly less attractive dividend yields) have weighed on shares, but we don't believe this should prevent investors from building a position in competitively advantaged names, says director of consumer sector equity research Erin Lash.

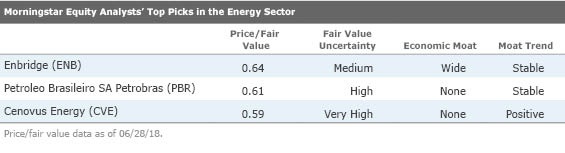

Energy Voluntary curtailments from OPEC and its partners combined with geopolitical supply disruptions in Venezuela and possibly Iran (after President Donald Trump's decision to abandon the Iran nuclear accord) have lowered the global oil supply, said equity analyst Joe Gemino. As a result, current oil prices provide economics are very attractive to the major U.S. shale producers. Energy sector valuations look fairly valued at current levels with an average price/fair value estimate of 1.00. Despite our bearish outlook for long-term oil prices, we see pockets of opportunity in the oil and gas space.

Financial Services The global financial services sector appears approximately fairly valued. It recently traded at a market-cap-weighted price/fair value estimate ratio of 0.94--a 6% discount to what our analysts believe the sector is worth.

While the economy remains relatively strong, increased competition among banks shown in rising funding costs are slowing net interest margin growth, and uncertainty regarding credit costs is increasing. Though our near-term outlook for banks is positive, we also believe bargains are few and far between.

Our analysts are also seeing a general easing of financial regulation in the United States, but some tightening in China and Europe. Read our analysts' regional and industry outlooks here.

Healthcare In aggregate, valuations in the healthcare sector have slightly decreased to a price/fair value of 1.01, down from 1.04 at the start of the year. Drilling deeper, however, the differences in industry valuations suggest drug, biotech, and drug supply chain industries are the most undervalued areas, says Damien Conover, director of healthcare equity research. You can read more on his take on what drug pricing reform means for the industry, as well as his top picks in the sector.

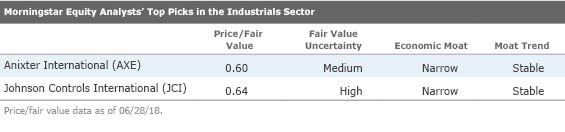

Industrials We consider the industrials sector to be priced fairly reasonably at a market-capitalization-weighted price/fair value estimate ratio of 1.03. At a recent industrials conference in Florida, CEOs consistently preached macroeconomic bullishness, and nearly all expressed a near-uniform commitment to share buybacks. Implicit in these endorsements is that the underlying stocks of their companies are cheap. But, in aggregate, we find few bargains in the sector, says equity analyst Josh Aguilar. That said, as many industrials CEOs pointed out, many companies (particularly the wide-moat firms we cover) are poised to benefit from U.S. corporate tax law changes.

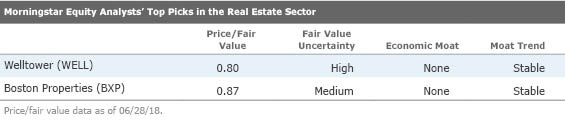

Real Estate Morningstar's real estate coverage appears fairly valued at current levels. Equity analyst Kevin Brown views themes in commercial real estate as generally defensive in nature, with lingering concerns about increasing bond yields associated with future rate hikes. Despite these concerns, though, Brown says underlying performance has remained healthy overall, as REITs have been focused on repositioning and strengthening their portfolios, deleveraging, and capital recycling.

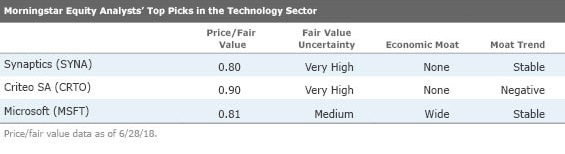

Technology We view technology stocks as fairly valued to modestly overvalued, at a market-cap-weighted price/fair value of 1.02, writes director of technology, media, and telecom equity research Brian Colello in his second-quarter technology sector wrap-up. The shift toward enterprise cloud computing remains the single most important trend in technology, which has ramifications for dozens of stocks across our coverage, he said. Another ongoing trend in technology remains mergers and acquisitions, particularly among semiconductor and software firms.

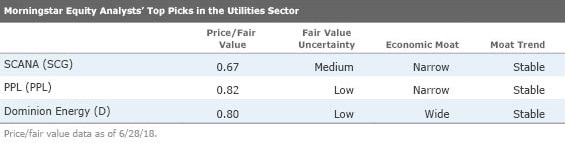

Utilities Earnings and dividend growth will be the story for utilities investors in 2018 and 2019, says energy and utilities strategist Travis Miller. Utilities across our domestic coverage universe--which now trade at a price/fair value of 1.0--have aggressive investment plans with mostly constructive public policy support. As long as energy prices remain stable, we expect 5%-7% annual earnings and dividend growth across the sector during the next few years, Miller said.

For income investors, U.S. utilities' dividend yield premium relative to interest rates has evaporated as interest rates have continued to climb, says Miller. But with little yield premium left, we expect utilities will become more sensitive to interest rate changes.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)