Who's Behaving Better: Passive-Stock-Fund Investors or Active-Bond-Fund Investors?

The direction of investor flows and market returns--not behavior--appears largely to account for differences in dollar-weighted returns.

Key Takeaways

- Several recent studies of investors' dollar-weighted returns have found that equity funds have recently experienced positive return gaps (that is, equity fund investors have outperformed their fund investments) while bond funds have suffered negative return gaps (that is, bond-fund investors have lagged their fund investments).

- Similarly, passive funds have exhibited small or even positive return gaps while active funds have seen negative gaps.

- This invites the question of whether equity- and passive-fund investors are "behaving better" than bond- and active-fund investors.

- We find that these differences appear to stem mainly from the direction of investor flows (that is, inflows versus outflows) and market returns (that is, improving or deteriorating), rather than investor behavior.

Introduction We recently published several studies that assess the extent to which investors participate in their funds' performance. Specifically, these studies try to estimate the difference between investors' dollar-weighted average returns and the returns of their fund investments. You can find Russ Kinnel's annual "Mind the Gap" study here and an "active/passive" version that Ben Johnson conducts here.

Overall, investors appear to have done a pretty good job investing in funds recently. Russ found that the gaps between investors' dollar-weighted returns--which reflect the magnitude and timing of their cash flows to funds--and the stated (that is, time-weighted) returns of their fund investments had shrunk. For his part, Ben found that passive-fund investors had suffered only modest timing gaps. All told, investors appear not to be badly mistiming their investments by, for example, buying high and selling low.

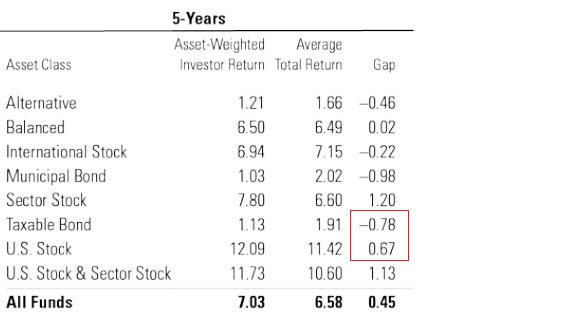

Nevertheless, a few findings from their studies stand out. For one, equity-fund investors recently experienced smaller timing gaps than taxable-bond-fund investors. In fact, as shown in the excerpted chart from of Russ' study, U.S. equity-fund investors managed to outearn their fund investments while bond-fund investors fell short.

Source: Morningstar

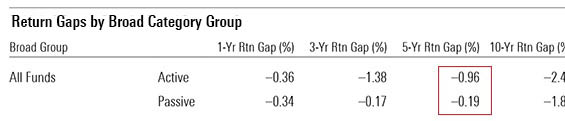

Ben found that active-fund investors appeared to have suffered larger timing gaps than passive-fund investors.

Source: Morningstar

These findings immediately raise several questions: Why have stock- and passive-fund investors done a better job of capturing their funds' performance in recent years? Did these investors behave better than bond- and active-fund investors?

Unpacking the Findings These very questions arose in the blogosphere and on Twitter, where some took issue with the suggestion that bond- or active-fund investors had behaved poorly. For instance, the pseudonymous "Jake" of the blog Econompic argued that the findings owed more to broad market currents than investor behavior. In Jake's telling, the behavior of stock- and bond-fund investors was broadly similar: They pumped money into each asset class, favoring lower-cost passive funds. What differed was the outcome: improving stock returns, decelerating bond performance.

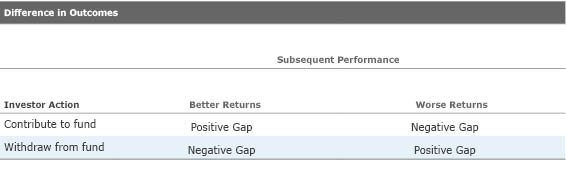

Here we should back up: In general, investors' dollar-weighted returns should surpass their funds' stated returns (we call this a positive gap) if those investors add assets to their funds before the funds' absolute returns improve or withdraw money from the funds before the funds' returns deteriorate. Conversely, their dollar-weighted returns will lag the funds' total returns (negative gap) if they add monies before the funds' absolute returns turn down or they withdraw assets before the funds' returns improve. We illustrate this relationship in the table below.

To bring this full circle, equity-fund investors benefited in recent periods by contributing to stock-funds as equity-market performance improved (the top-left box of the table); bond-fund investors also contributed to bond funds in recent years but, because bond market performance eroded, their dollar-weighted returns suffered (top-right box).

Extending that reasoning, it's also possible that passive equity funds experienced smaller gaps than active equity funds because investors were pumping money into the former (top-left box) while pulling money from the latter (bottom-left) amid improving stock-market returns. On the flip side, strong inflows to active bond funds, which still loom large in that asset class, would have yielded worse dollar-weighted returns given the performance falloff in fixed income (top-right box).

Testing, Testing… Reasoning is one thing, but it's another matter to test suppositions with data. With that in mind, we collected three-year investor-returns (dollar-weighted returns) and total returns (time-weighted returns) for all U.S. equity and taxable-bond funds as of May 31, 2018. For each asset class, we grouped funds into one of eight cohorts:

- Outflows >50% of beginning assets, active

- Outflows >50% of beginning assets, passive

- Outflows 0-50% of beginning assets, active

- Outflows 0-50% of beginning assets, passive

- Inflows 0-50% of beginning assets, active

- Inflows 0-50% of beginning assets, passive

- Inflows >50% of beginning assets, active

- Inflows >50% of beginning assets, passive

By grouping funds this way, we can control for differences in market returns (equity versus fixed income), investor action (inflows versus outflows), and strategy type (active versus passive). (Hat tip to Jake of Econompic, who devised this approach.)

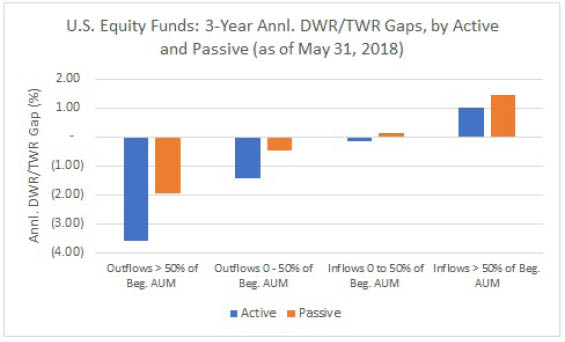

When we follow this process for equity funds and aggregate[1] the return gap data, this is the picture that's revealed:

Source: Morningstar

There are a few takeaways. First, we do indeed find negative gaps among stock funds that suffered outflows of assets and, in general, positive gaps for those that got inflows. Second, active versus passive didn't really matter: Funds in outflow had a negative gap as a group while funds in inflow tended to have positive gaps or, at worst, no gap.

That said, it is interesting to note that, among the groups of funds in outflow, the gaps for passive funds were smaller (that is, less negative) than those for active funds. And for the funds that saw the strongest growth because of inflows, passive funds enjoyed a larger positive gap than active funds. Taken together, this suggests that while investor demand (direction of flows) and market (up or down) were the strongest determinants of whether equity funds experienced a positive or negative gap, strategy type (active versus passive) appeared to influence the gap's size.

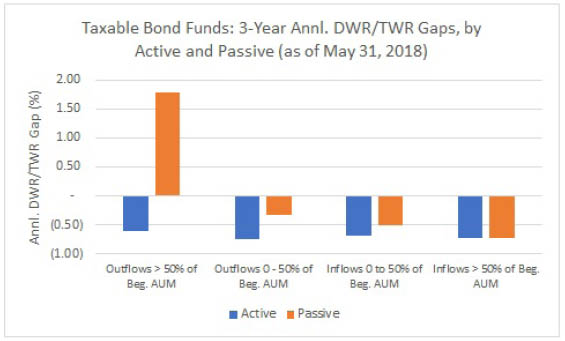

Below is the same chart as above but for taxable-bond funds.

Source: Morningstar

Here we observe a similar pattern but in reverse: Bond funds that received heavier inflows tended to suffer larger negative return gaps (whereas previously we saw equity funds that received heavy inflows experience larger positive return gaps). Though the effect was less pronounced in this instance, it's still apparent that investor demand and market path affected the direction of investor-return gaps.

Conclusion It appears that the direction of investor flows and market returns at least partly explains why stock- and passive-fund investors have captured more of their funds' performance recently than bond- and active-fund investors. While investors have contributed to stock and bond funds alike in recent years, the equity market has improved while the bond market has decelerated. That's led to positive gaps in stock funds that have received inflows and negative gaps to bond funds that have also garnered new assets. That is, the same investor behavior produced different outcomes.

We do observe differences in the magnitude, if not direction, of investor-return gaps for active and passive funds, even after controlling for asset-class and asset growth. This likely points to factors that have made passive funds easier to use in certain circumstances and contexts. For instance, defined-contribution-plan investors might gain access to passive funds via a default investment in target-date funds--which, in turn, allocate their assets to passive funds. Target-date funds are widely diversified, making it less likely that investors will be rattled by fluctuations in the performance of an individual holding, like an equity index fund. That makes it less likely that those investors will buy and sell their passive-fund holdings at inopportune times.

It would be a mistake to conclude that behavior doesn't play a role in explaining why investors sometimes fail to fully capture their funds' performance. Experience and data have shown us that investors' propensity to chase performance can badly dent their returns. But by the same token, it's important to be mindful of these other, enveloping factors--the direction of investor flows and market returns--as they can heavily affect investors' dollar-weighed returns and, with that, the gaps they experience.

[1] We aggregate the gaps for each asset class as follows:

- Calculate the three-year annualized gap for a fund as the difference between its dollar-weighted annual return and its stated annual return.

- Determine the fund's group assignment based on whether it is active or passive and how much it grew or shrank during the 36-month period (measured as the fund's cumulative three-year net inflows divided by its net assets on June 1, 2015, when the period began).

- Weight each fund in its group based on the ratio of its average monthly net assets during the 36-month period to the aggregate average monthly net assets of the group as a whole.

- Multiply each fund in a group by its weighting and sum the products to arrive at the asset-weighted average gap for the group.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)