13 Companies With Attractive, Low-Risk Dividends

We take a look at the new entrants to the Morningstar Dividend Yield Focus Index, and we explore how to use Morningstar metrics to find high-quality companies with safe dividends.

New Morningstar research shows that our metrics can improve investors' success when it comes to finding high-quality companies with safe dividends.

I recently spoke with Dan Lefkovitz, a strategist in Morningstar's indexes group, about which metrics can help predict dividend sustainability.

"A company with a [economic] moat around its business is able to sustain its profits and fend off competition. Distance to default is a measure of balance sheet strength. It gauges the likelihood of bankruptcy. It looks at leverage and volatility and gauges whether the sum of a firm's assets are at risk of falling below its liabilities," Lefkovitz said. "We found that the wider the economic moat and the better the distance to default score, the less likely for a firm to cut its dividend."

The Morningstar Dividend Yield Focus Index combines these metrics to home in on the highest-yielding stocks of companies that are financially healthy enough to sustain and even grow their dividend. Therefore, in contrast to most other dividend indexes that use only backward-looking criteria, the Dividend Yield Focus also uses both qualitative and quantitative forward-looking measures.

To find the constituents in the Dividend Yield Focus, we first screen the Morningstar US Market Index--a broad market index targeting 97% of the overall market capitalization--for the highest-yielding companies. (The dividend must come from qualified income, so real estate investment trusts are not included.) We then search the high-yielders for companies that have a Morningstar Economic Moat Rating of wide or narrow, meaning we think they have competitive advantages that will allow them to continue to earn above-average profits and sustain their dividends for 20 or 10 years, respectively. We also consider a company's distance to default score to determine how likely a firm is to default on its liabilities.

The 75 highest-yielding stocks that make it through the quality screen are then included in the index. The index is dividend dollar-weighted (constituents are weighted according to the total dividends paid by the company to investors). You can see the current holdings here.

New Dividend-Payers in the Index In the table below, we show the 13 newest entrants to the Dividend Yield Focus Index, which pass our strict requirements for high yields, sustainable competitive advantages, and financial health. (Note that the dividend yields listed below are backward-looking and could change.)

On a price/fair value basis, Franklin Resources, Colgate-Palmolive, and Bristol-Myers Squibb currently look undervalued relative to our analysts' fair value estimates.

Franklin has lagged of late: Its U.S. equity offerings have struggled to consistently outperform benchmarks, making it difficult to generate organic growth in an environment where index funds and ETFs are capturing a majority of fund flows.

But we believe the wide-moat asset manager has many of the attributes necessary to right the ship over the long run. Franklin not only has well-known brands--like Franklin, Templeton, and Mutual Shares--but it also had $737.5 billion in total assets under management at the end of March 2018, providing it with the size and scale necessary to be competitive. Franklin's product mix is also diverse, with 41% of managed assets dedicated to equity strategies, 19% in hybrid funds, and 38% in fixed income. While product distribution is weighted toward retail investors (73% of AUM), who tend not to be as sticky as institutional (24%) and high-net-worth (3%) clients, the firm has historically maintained strong relationships with financial advisors, not only allowing it to capture investor inflows in periods when products and/or asset classes are in favor, but also tending to limit outflows when the opposite is true. --Greggory Warren, CFA

Colgate's stock is down more than 13% so far in 2018, reflecting the intense competitive and inflationary pressures weighing on consumer product manufacturers. But we don't think its wide moat shows signs of decay.

Colgate's competitive advantage owes to its solid brand intangible assets and its cost edge. Colgate's focus on the high-loyalty oral-care category has helped the firm build a sustainable advantage around the Colgate brand. In our view, Colgate's commitment to bring locally relevant new products to market, even those at a premium price, supports its competitive prowess, as evidenced by its leading share position: The firm maintains more than 40% worldwide market share in toothpaste (greater than 3 times its next-largest competitor)--including more than 55% share in India, 73% in Brazil, and 30% in China.

The firm's dominant share extends beyond oral care to include other personal care and home care categories in select markets around the world, further showcasing the brand strength the firm has built up over its 200-year history. But we also think that by maintaining a leading position across a number of categories Colgate is a valued partner for retailers, and surmise these entrenched relationships with retailers support another aspect of the firm's intangible asset moat source. --Erin Lash, CFA

Based on a wide lineup of patent-protected drugs, an entrenched salesforce, and economies of scale, Bristol-Myers Squibb holds a wide economic moat. The patent protection allows the company to price its drugs at levels that translate into superior returns on invested capital compared with its cost (particularly in cancer drugs, an area of focus for Bristol). The patents also provide Bristol with ample time to bring forward the next generation of new drugs.

While the company faces significant continued generic pressures on virology drugs through 2018, we expect its next generation of drugs to fill the patent holes over the near term, supporting its wide moat and steady growth potential. Further, by selling off business lines unrelated to its core pharmaceutical strategy, the company has been streamlined to focus primarily on specialty pharmaceuticals. --Damien Conover, CFA

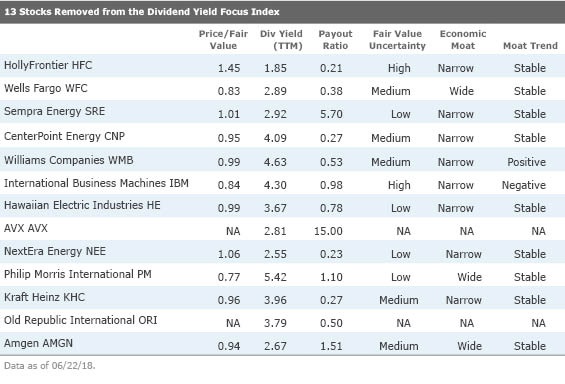

13 Stocks Removed from the Index

One stock--

The other 12 companies on the list were removed because their distance to default scores crept into a range that we weren't comfortable with.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TQKIUI6SDRCQFMUBSWCMD7OKPI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)