Private Equity: Firms Revamp the Traditional PE Playbook

As capital continues to build up from strong fundraising and competition for deals across the spectrum heats up, PE firms are adapting to a more challenging environment.

- Private equity funds have seen strong inflows in 2018 as institutional investors continue increasing their private equity allocation.

- Though fundraising and dry powder have proliferated in recent years, private equity deal-makers have accelerated their investment pace to put that capital to work.

- Private equity firms are utilizing new value creation levers, including add-on acquisitions and longer hold periods, to adapt the traditional LBO model for a climate of higher prices and increasing competition.

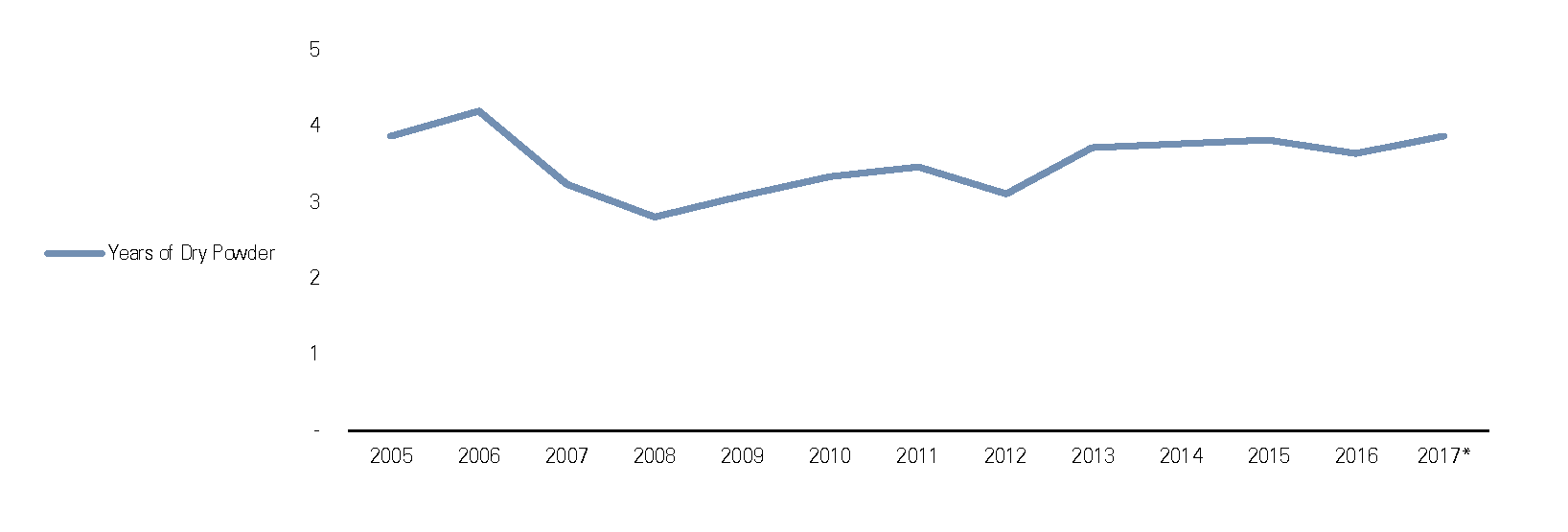

Fundraising in 2018, and the years prior, has been strong as large institutions continue to increase their allocation to private markets, especially private equity. Fueled by this strong fundraising, private equity firms deployed more capital from 2015-2017 than any other three-year stretch in history. Even though investment activity has been strong, uncalled capital has continued building up, leading to record dry powder figures. Rather than focusing on the absolute number, we prefer to put it in perspective by normalizing dry powder for current levels of investment activity. Looking at the average amount of capital allocated over the trailing three-year period, we find that private equity firms have 3.9 years of dry powder on hand. In other words, if private equity firms were to cease fundraising immediately, it would take 3.9 years to invest all available capital. While still below the 2006 peak of 4.1 years, this figure has been steadily trending up since the global financial crisis.

- source: PitchBook

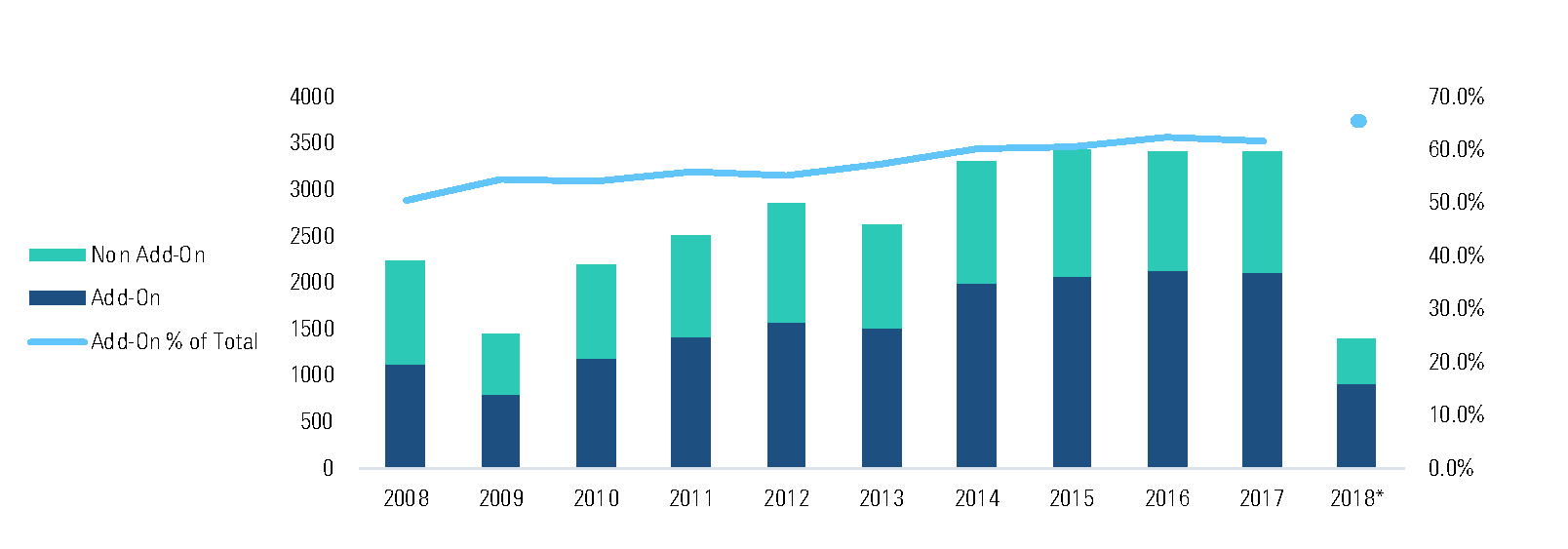

Heightened competition in the buyout market has led to elevated EV/EBITDA purchase-price multiples. The recent corporate tax rate reduction outlined in the Tax Cuts and Jobs Act ought to further inflate EV/EBITDA multiples, with lower corporate tax bills translating to increased free cash flow. Given current multiples, many private equity firms are modeling deals without factoring in any multiple expansion at exit, and some are even expecting multiple contraction. Without counting on what has traditionally been one of the largest drivers of return, private equity firms are increasingly using the "buy-and-build" strategy, whereby one--or many--add-on acquisitions are used to generate value from portfolio companies. The strong trend is visible in the data, which shows that add-ons are increasing in frequency and proportion, now representing nearly two-thirds (65%) of all buyouts. The goal of these add-on acquisitions is to build scale, drive revenue growth and increase returns. Additionally, add-ons are often acquired at lower multiples than the original platform, thereby "blending down" the aggregate multiple for the combined company.

KRG Capital Partners, Mountaingate Capital and PennantPark partnered together and executed this strategy to drive strong returns for their investment in Convergint Technologies, undertaking 20 add-ons between September 2013 and February 2018. During this time, Convergint's value grew from $345 million to $1.62 billion, while the GPs were able to realize additional value by completing a dividend recap two years in to their hold period. Add-ons can be an effective means of value creation, but the strategy takes more time and resources. Despite the effort required, we believe the number of add-ons will continue to rise as private equity firms feel an increased pressure to put dry powder to work.

- source: PitchBook

Growing reserves of dry powder have also prompted many GPs to pursue larger deals. And as the number of multibillion-dollar transactions has increased, PE firms have lost many bidding competitions to corporate acquirers. In response, some PE firms are changing the structure of their funds to make longer-term transactions viable, and hopefully better position themselves to compete with corporate acquirers by enabling a decade-plus value creation plan. These long-dated and evergreen (that is, permanent capital) funds give companies more time to digest additional add-on acquisitions and pursue longer-term growth opportunities unavailable with the standard 4-6 year holding period.

While these long-dated funds open new opportunities to private equity firms, they also benefit LPs. Longer hold times create fewer taxable events, allowing capital to compound longer before paying capital gains. The longer funds also save LPs time and money by reducing the frequency of new fund commitments and the requisite manager due diligence. Fees tend to be lower than the traditional 2/20 as well, with Carlyle Global Partners reportedly charging a 1% management fee and 15% carry, with no fees charged on uncalled capital. We believe these longer dated funds will gain in stature as the private equity industry continues to mature and offer LPs additional investment strategies.

Private equity continues to adapt to rising valuations and elevated dry powder levels, finding new ways to put capital to work. We expect to see private equity firms continue to undertake value-creation methods beyond those available to the plain-vanilla LBO. We believe the remainder of 2018 will see unique fund offerings--such as long-dated funds--become a more common, and add-ons to proliferate further.

Quarter-End Insights

Venture Capital Outlook: With Ample Available Capital, Growing Venture Market Is Subject to Inflationary Pressures We expect startups will continue securing outsize financing as private capital remains abundantly available, giving rise to inflationary market effects.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)