Venture Capital Outlook: With Ample Available Capital, Growing Venture Market Is Subject to Inflationary Pressures

We expect startups will continue securing outsize financing as private capital remains abundantly available, giving rise to inflationary market effects.

- Although the number of deals has leveled out in the past few quarters, startups continue to secure massive financing rounds compared with historical levels.

- Despite a slight uptick in tech IPOs, exits remain subdued as startups stay private for longer periods, spurring investors to pursue innovative exit routes and secondary activity.

- As startups command greater sums in initial and follow-on financing, we believe venture fund sizes will continue to grow as managers seek to maintain equity positions and avoid dilution.

As institutional investors continue to search for outperforming asset classes to fulfill future funding obligations, capital has continued to flow into the private markets at an extraordinary rate. Both startups and venture funds have secured unprecedented amounts of capital, with General Catalyst, New Enterprise Associates, and 10 other venture capital firms raising funds of $1 billion or more since 2016. Ample dry powder in venture capital funds has facilitated 129 venture capital rounds larger than $50 million closed in the first quarter alone, a 115% increase year over year. We believe inflated venture funds and financing are a product of a maturing U.S. venture market, with high competition for deals spurred by both domestic and international investors like SoftBank. We also believe this dynamic has led investors to become more selective in their deployments, shifting the entire venture market toward funding fewer but more mature companies at each stage of development.

U.S. startups collectively raised over $70 billion in funding each year since 2014 and have already secured over $51 billion so far in 2018. Deal count has steadily declined, however, as more mature companies have secured larger sums to supplement their development. This is evidenced by a swift decline in angel and seed activity, while late-stage deal-making has seen sustained strength.

We believe the effects of this trend have manifested in an upward shift in the entire venture ecosystem, especially affecting companies at the earliest stages of venture-backing. A few years ago, venture investors and startup founders were remarking that "seed is the new Series A"; as that shift has occurred, competition among startups and investors at the earliest stages has led to the emergence of a stage referred to as "pre-seed." Because startups that in the recent past would have received early-stage financing are now seeking out seed capital, less developed companies must look to "pre-seed" investors for capital. Our research indicates that investors at this very early stage are acting more selectively while taking larger equity stakes to compensate for the higher risk. We see this creating greater barriers for startups looking to raise initial funding rounds, as seed-stage companies will need to reach more milestones if they hope to get funded.

With more-developed companies raising capital at each stage, round sizes and valuations have increased correspondingly. Angel & seed and early-stage valuations have both increased at a steady clip in recent years. At the same time, late-stage valuations have spiked in 2018, reaching $75 million in the first quarter, a 19% increase year over year.

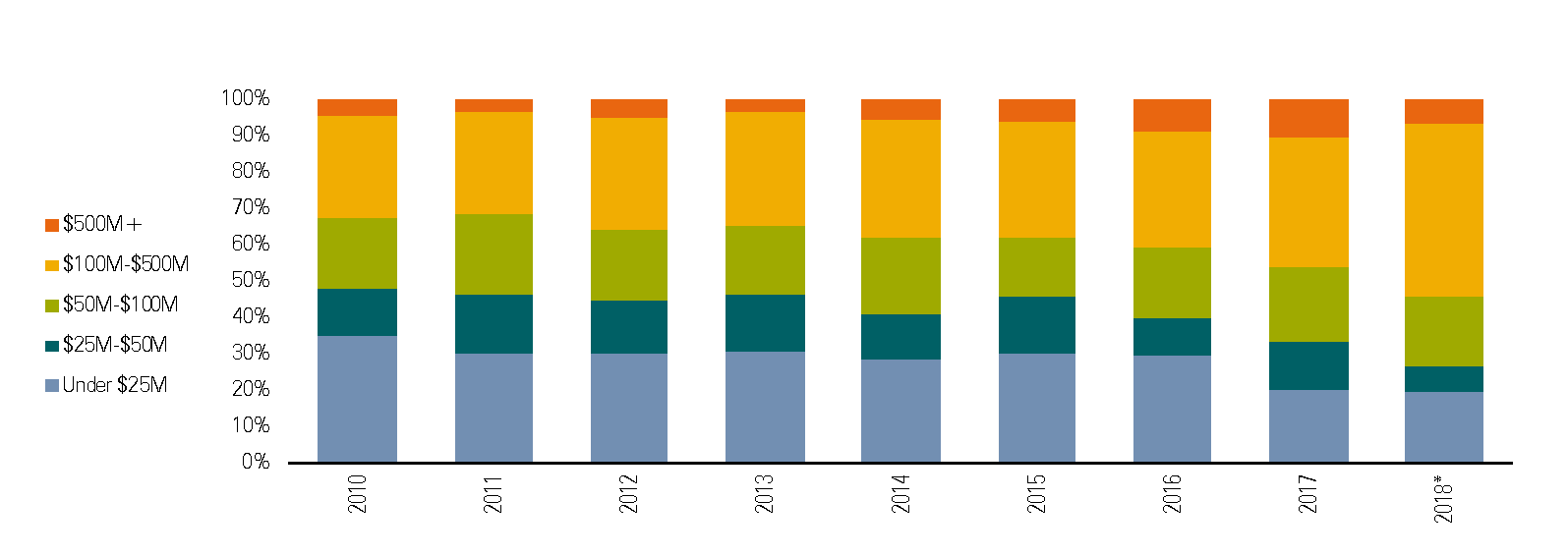

In terms of exits, capital availability has provided both drawbacks and benefits for investors. With ample supply, some startups have opted to stay private longer because the capital they traditionally would need to access via public markets is now readily available in private markets, with fewer strings attached. This has subsequently extended the time it takes to exit venture-backed companies, leaving investors with extended hold periods and return horizons. On the other hand, outsize exits have also become increasingly common in the presence of well-developed late-stage companies commanding higher valuations at time of exit. Exits of $100 million or more made up 16% of all disclosed exits, and 92% of all exited capital in the first half of 2018. With a strong pipeline of late-stage unicorns preparing for exits, we expect 2018 will outpace the previous year in terms of unicorn exits; however, we also expect to see continued secondary activity as venture capitalists search for additional means of achieving liquidity.

Exits (#) by Size

Source: PitchBook

Quarter-End Insights

Private Equity: Firms Revamp the Traditional PE Playbook As capital continues to build up from strong fundraising and competition for deals across the spectrum heats up, PE firms are adapting to a more challenging environment.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)