What to Do With Your 529 During a Volatile Market

Self-directed investors should keep their risk tolerance in mind when choosing a 529 plan.

Q: With all the volatility in the market right now, I'm getting nervous having all the money I saved for my kids' college education at risk. My 529 plan has a money market option; should I move my balance there until things improve?

A: It's always tempting to take shelter in safer assets when markets whipsaw, but timing moves into and out of stocks will probably just prove costly. In the short term, there is no way to accurately predict how the market will behave.

I can't tell from this reader's question how close he or she is to paying college tuition, but the good news is that many 529 plans are designed to expose investors only to as much equity risk as they can reasonably handle as their goal date draws near.

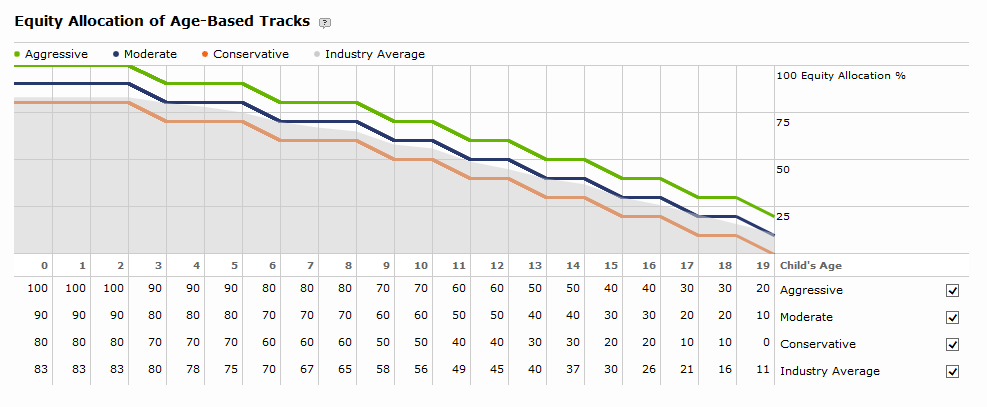

The lion's share of 529 assets are invested in age-based 529 plans. These plans follow glide paths that are similar to those used by target-date funds. Age-based 529 tracks start out with a high percentage of assets invested in equities--sometimes as much as 100%, but the average is around 80%--and they gradually sell stocks and increase the allocation to bonds and cash as the child gets closer to age 18.

I personally use age-based 529 accounts to save for my own children’s future college expenses, and I wouldn't shift my money into cash even in an extreme equity market downturn like 2008's.

If your beneficiary is early in an age-based track, up to age 6, you have time on your side. Day-to-day market volatility may be unsettling, but it likely won't hurt returns too much over the long haul; you have more than a decade to recover from stock market shocks. For instance, the stock market lost nearly 40% in 2008. Equity investors felt that pain acutely. But in the ensuing 10 years, the S&P 500 has gained more than 260%, about 15% per year. Hindsight is 20/20, but history keeps teaching us that when it's most painful to be an equity investor it's the best time to buy more stocks.

If you're closing in on the 529 beneficiary's matriculation day, you have less time to recover from a sell-off, but the age-based track has taken care of ratcheting down your exposure to equities. The typical 529 investor has about 15% in equities at college enrollment, according to Morningstar data. Even if we experience another year where the market loses 40% of its value, as it did during 2008, most of your savings won't be affected.

Dial Down the Risk (a Bit) One lever you have at your disposal is to fine-tune the aggressiveness of your 529's allocation. All the age-based tracks follow a glide path that is based on an investor's risk capacity by investing time horizon, but you can choose a more or less aggressive age-based track that best suits your risk tolerance.

Risk capacity and risk tolerance are different concepts, and they can be out of sync with each other, as explained here by my colleague Christine Benz. If you are saving for a newborn's future college needs, you have a large capacity for risk--you have 18 years to ride out the market volatility that comes along with equities' higher long-term returns. An equity allocation close to 100% could make sense for the first six years you invest. But if you cringe every time the market drops a few percentage points, your risk tolerance may not be in line with that risk capacity.

On the other side of the coin, if the 529 beneficiary is in high school, you have an interest in conserving the money in the account. You don't have as much time to weather equity market downturns before you will need that money. It makes sense, then, that your risk capacity is lower, and your overall exposure to safer assets like bonds is higher. This will help protect your savings from getting wiped out in an equity market sell-off when you need that money to pay college tuition bills.

Age-based plans model their tracks primarily based on risk capacity, but some offer marginally less or more aggressive portfolios along the same overall glide path. For instance, take a look at the tracks offered by Illinois' Bright Start Direct-Sold College Savings Plan, one of the four plans that Morningstar analysts rate Gold.

The aggressive age-based option starts with a 100% allocation to equities, and winds down to about 30% to 20% at ages 18-19. That means that for the first six years, you're fully exposed to the market's gyrations--for better or for worse.

Let's say your child is 15, and stocks take a huge hit. You would have 40% of assets in equities if you had chosen the aggressive track, 30% in equities if you had gone with the moderate track, and 20% in equities if you had invested in the conservative track.

On the whole, whether your equity allocation is 10 percentage points higher throughout your holding period probably won't amount to a huge difference in returns over the long haul. But if you are the kind of investor who checks your account balance often and tend to feel anxious when it falls, having a higher allocation to less volatile assets could help dampen losses and therefore help you stay the course during rough times.

Finding the Best Fit If you are a self-directed investor shopping for a 529 plan, you may encounter a questionnaire on a 529 plan's website that asks you to describe your attitudes toward gains and losses. These types of surveys focus on gauging how loss-averse you are and attempt to pair you with the most suitable asset allocation among that plan's different 529 products. A common question is "What would you do if your college-savings portfolio declined XX% in a year?" The answer choices include options like "Stay the course," or "Move into a less risky portfolio."

I would recommend that you use these tools if they are available to you. Really try to imagine the scenario described and answer honestly. If you can't find a risk-assessment tool, ask yourself the same sorts of questions: If we were to see a repeat of 2008's market, could you bite the bullet and stick with your 529 plan? If your answer is no, consider going with an option that isn't 100% equity at inception, but isn't as low as 50% either. Find a balance: You want an allocation aggressive enough to give you the best chance of meeting your investing goals, but conservative enough that you're comfortable sticking with it.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)