Foreign Index Funds and Dunn's Law

The case for indexing foreign stocks is still valid.

With many foreign stock index funds turning in mediocre performance over the past decade, investors may be wondering: Is the case for indexing foreign stocks dead?

The primary thesis for investing with index funds is well-known and accepted. Investors get a diversified portfolio of stocks at a low expense ratio, and low fees should translate into superior performance relative to the more expensive, actively managed alternatives in a given asset class. But that has not been the case with index trackers in the foreign large-blend Morningstar Category for the trailing 10 years through May 2018. A deeper dive indicates that the lackluster performance of the aggregate foreign stock market is at least part of the reason, but the case for these funds is just as strong as it has ever been.

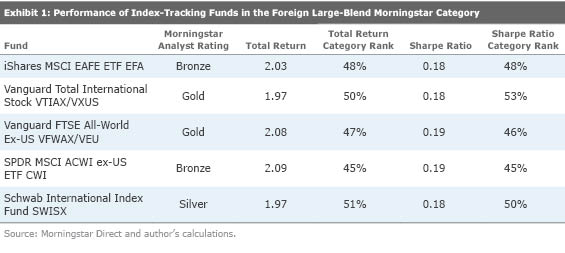

Foreign large-blend index funds have experienced lackluster returns over the past 10 years. As Exhibit 1 shows, a variety of index trackers had total and risk-adjusted returns that landed near the category midpoint. In other words, roughly half of actively managed funds in the category were able to overcome the low-fee advantage that index funds offer, contrary to expectations.

What’s going on here? A few things stand out. First, index composition didn’t appear to have much of an impact. Some of these funds include small-cap stocks, while others focus exclusively on large-caps. A few hold stocks from emerging markets; some do not. What’s more interesting is that all of these funds, and the indexes they track, returned only 2% annually--a low rate of return by historical standards (the MSCI EAFE Index grew 10.7% annually from January 1970 through May 2008).

Poor overall market performance lends some insight as to why index funds have come up short against many of their active competitors. Active funds can deviate from the market in some ways that cause them to be defensive, which can be advantageous when markets don’t deliver. They tend to hold cash balances to meet redemptions and take advantage of opportunities as they arise, so their drawdowns likely won’t be as deep as an index fund that is fully invested. In other instances, managers can also choose to hedge currency risk, which can help tame volatility. In addition to making returns more stable, currency hedging also improved returns over the past decade since the U.S. dollar appreciated against many foreign currencies.

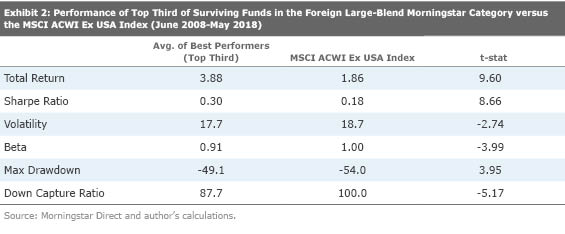

To test this hypothesis, I ranked all funds that survived the 10 years between June 2008 and May 2018 by their total returns and grouped them into thirds. I then compared the performance of the top third of the category (by total returns) to the MSCI ACWI Index. The results are presented in Exhibit 2.

These numbers indicate that the top performers did indeed have a defensive posture relative to a broad foreign market index. On average, they exhibited less volatility, had a lower down-capture ratio, and incurred a lower maximum drawdown than the MSCI ACWI Index. Furthermore, all of these differences were statistically significant.

Looking through the individual top performers in this cohort indicates that defense was part of their recipe. For example, one of the top performers,

Another way to play defense would be to construct a portfolio of stocks that attempts to minimize volatility. Silver-rated

Regardless of the individual strategies at play, the middling performance of index funds during a period of poor market returns illustrates a concept known as Dunn’s Law, which states that there is an inverse relationship between the performance of active managers and the performance of the area of the market they represent (this relationship was tested more thoroughly by my colleagues [1]). More specifically, active funds, on average, will be aided by their cash allocations when their area of the market performs poorly.

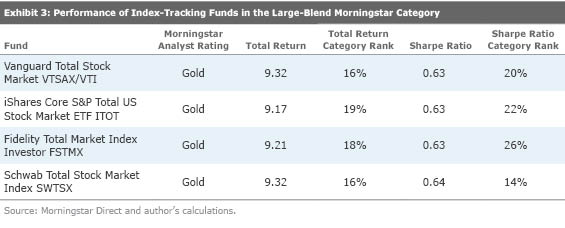

But deviating from the market can also hurt performance, because holding cash and reducing risk will act like a boat anchor on performance during a bull market. The other side of Dunn’s Law addresses this, and states that index funds should be among the best performers when a given market posts strong returns, since they are the purest representation of the market and are fully invested. Indeed, this has been the case in the U.S. over the 10 years from June 2008 through May 2018, where low-fee index-tracking funds have outperformed more than 80% of active managers in the large-blend category.

The argument for indexing foreign stocks is still valid. The mediocre performance of foreign index trackers over the past decade appears to be, at least in part, due to poor performance of the overall foreign stock market, and not a breakdown of their low-fee, broadly diversified nature. In my view, these funds should still outperform many of their high-fee competitors over the long run. But that, as this period would suggest, may be substantially longer than 10 years.

References

1. Bryan, A. and Adam McCullough. 2018. “Putting Dunn’s Law to the Test.” Morningstar.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)