May Brings More Upgrades Than Downgrades

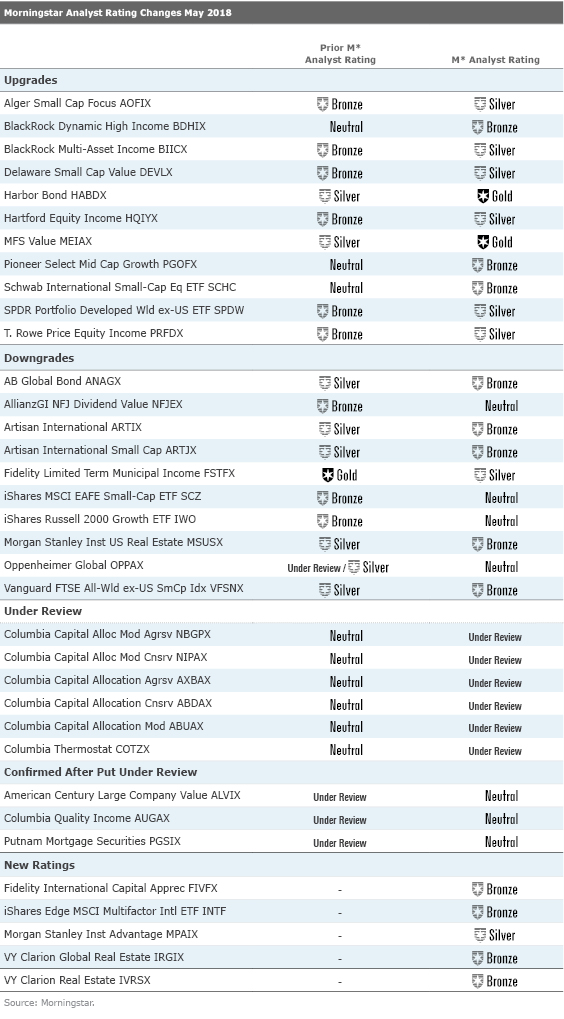

We had 11 upgrades, 10 downgrades, and 143 affirmed ratings of funds and target-date series.

In May, Morningstar manager research analysts affirmed the Morningstar Analyst Ratings of 141 funds and two target-date series, upgraded the ratings of 11 funds, downgraded the ratings of 10 funds, placed six funds’ ratings under review, and assigned new ratings to five funds. Below are some of May’s highlights, followed by the full list of ratings changes.

Upgrades

Increased confidence in

AOFIX management team drove an upgrade in its ratings to Silver from Bronze. Manager Amy Zhang helped to amass one of the small-growth category’s best risk-adjusted records at Gold-rated

Downgrades

Increasingly uncompetitive fees have taken some of the shine off

Concerns about

New Ratings

Financial professionals are accessing this research in our investment analysis platform, Morningstar Cloud. Try it today.

/s3.amazonaws.com/arc-authors/morningstar/e1746d1f-b066-4c24-a3bb-b037eb26aeac.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e1746d1f-b066-4c24-a3bb-b037eb26aeac.jpg)