2 New ETFs That Try to Buy Wonderful Companies at Fair Prices

These funds are yet another example of why it's important to look beyond the label to check what is in the tin.

Promising new ETFs are few and far between these days. The bulk of new funds being brought to market are increasingly niche, complex, and/or downright gimmicky. But hidden in this landscape, which is littered with the likes of

Buying good companies at reasonable prices is generally a winning strategy. There’s a guy in Omaha that’s made a decent chunk of change adhering to this approach. Many have tried to emulate it. Few have succeeded.

At face value, these funds seem awfully similar. But a closer examination of their indexes reveals important differences.

1 | What Is the Selection Universe? VALQ's bogy, the iSTOXX American Century USA Quality Value Index, draws from the STOXX USA 900 Index. The parent index sweeps in the 900 largest companies in the STOXX USA Total Market Index. It covers approximately 90% of the investable market capitalization of the U.S. stock market.

QARP’s benchmark, the Russell 1000 2Qual/Val 5% Capped Index, selects stocks from the Russell 1000 Index. The starting universe comprises the 1,000 largest stocks from the Russell 3000E Index and represents about 90% of the investable market capitalization of the U.S. stock market.

2 | How Does the Index Select Stocks? VALQ's index allocates dynamically between two distinct subindexes: the iSTOXX American Century USA Value Index and the iSTOXX American Century USA Income Index. The former scores stocks based on various quality and value measures. Stocks ranking in the bottom 20% of the universe or their supersector based on their composite quality/value scores are tossed out. The remaining stocks are run through an optimizer. When all is said and done, 200–300 stocks are left. The income index uses the same quality scores and a variety of dividend growth and sustainability metrics to choose stocks. After stocks are scored, they are run through an optimizer. The resulting portfolio will contain 75–100 stocks.

QARP’s index selects stocks based on the strength of their quality and value characteristics. In this case, quality is a composite of profitability (as measured by return on assets, asset turnover, and accruals) and leverage (operating cash flow divided by total debt). Value is a mashup of cash flow yield, earnings yield, and sales/price.

3 | How Does the Index Weight Stocks? VALQ's subindexes employ a fairly complex optimization process to weight stocks. QARP starts with stocks' market-cap weightings, then multiplies that weighting twice by their quality score and once by their value score to arrive at an unadjusted weighting for each stock in the universe. Stocks' final weightings are based on the strength of these scores.

4 | Are There Any Portfolio Constraints? VALQ's subindexes apply a variety of stock- and sector-level constraints based on active exposure versus the parent index and different measures of fundamentals and volatility. QARP's index applies certain stock- and sector-level constraints.

5 | How Frequently Does the Portfolio Rebalance? VALQ's index rebalances dynamically on a monthly basis between its two subindexes in 15-percentage-point increments based on a volatility-adjusted trend signal. It will allocate a minimum of 35% and a maximum of 85% to the value subindex. VALQ's component subindexes rebalance quarterly in February, May, August, and November. One-way turnover in each is limited to 20% per rebalance. QARP's index is reconstituted once a year in June. Two-way turnover is limited to 50%.

What Comes Out in the Wash? At first blush, the two funds appear awfully similar. After looking past their labels to see what's in the tin, it's clear that their approaches are very different.

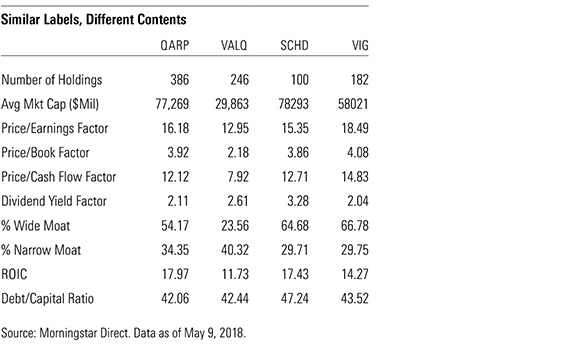

The accompanying exhibit shows just how different the contents of these two tins are. QARP’s portfolio is relatively broad and skews toward higher-quality mega- and large-cap names. This is evidenced by the fact that more than half its portfolio is currently invested in stocks with wide Morningstar Economic Moat Ratings. This is because its weighting schema starts with market cap and double-counts measures of quality while placing less emphasis on value.

At present, VALQ’s portfolio is far more concentrated and has pronounced tilts toward smaller, cheaper stocks. This is because the fund’s subindexes are relatively more concentrated. Also, it reflects the fact that its benchmark index dynamically rebalances between its component subindexes. At present, it favors smaller, less-expensive stocks. As market conditions evolve, there will be times when it will tilt toward larger, higher-quality stocks.

All told, I prefer the simplicity of QARP’s approach over VALQ’s relatively convoluted methodology. VALQ’s more pronounced and dynamic tilts toward its targeted factors could very well lead to better long-term returns versus QARP, but it will likely experience greater risk as well. Investors who wish to put this fund to good use should have a healthy appetite for tracking error.

Though I like QARP’s approach, I’m not certain it’s an improvement over comparable strategies that take different paths to a substantially similar destination. These include Vanguard Dividend Appreciation ETF VIG and Schwab U.S. Dividend Equity ETF SCHD, which have been assigned Morningstar Analyst Ratings of Gold and Silver, respectively. Of the two, I think SCHD strikes the most compelling balance between quality, value, and dividend yield.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)