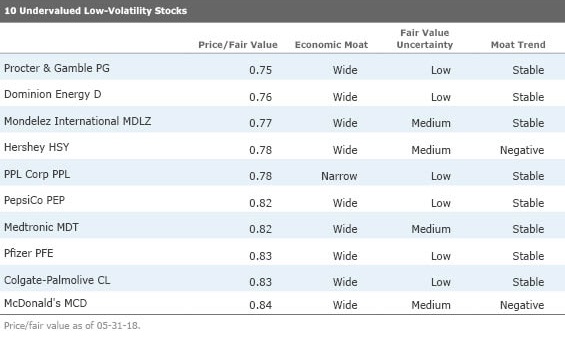

10 Undervalued Low-Volatility Stocks

These stocks could offer higher reward with lower risk.

It's a little bit of a paradox: Data has shown that over the medium and long term, stocks that are less volatile actually earn higher risk-adjusted returns than stocks that are highly volatile. So why would want anyone invest in high-volatility stocks? Investors in low-volatility funds and ETFs would say you needn't bother.

The idea behind "low-vol" strategies is to screen a universe of stocks by criteria that allows you to capitalize on this low-volatility anomaly. Some indexes screen out highly volatile stocks as measured by standard deviation, while others employ more complicated algorithms that go beyond individual stock volatility to see how stocks interact with each other. Some implement rules to prevent overweights to less volatile sectors such as consumer defensives and utilities.

To find some cheap low-volatility stocks with good prospects, we started with the holdings of the S&P 500 Low-Volatility Index. This index tracks the 100 least volatile stocks in the S&P 500, with volatility measured by standard deviation over the trailing 12 months. (Constituents are weighted relative to the inverse of their corresponding volatility, with the least volatile stocks receiving the highest weights.)

We then narrowed this search by ranking by lowest price/fair value. We focused only on firms that have economic moats of wide or narrow, which means our analysts think the company has a durable competitive advantage that will allow it maintain its profitability over the long term. The results of the screen are below, along with some highlights from our research reports on three of the companies.

Dominion Energy recently changed its name from Dominion Resources. But more importantly for investors, the company has also made a strategic pivot. Since 2010, it has focused on the development of new wide-moat projects with conservative strategies, exited the exploration and production business, sold or retired no-moat merchant energy plants, and made significant investments in moaty utility infrastructure.

We expect wide-moat businesses to generate roughly half of Dominion's operating earnings by 2020, up from 30% in 2016. The remaining earnings primarily come from narrow-moat regulated gas and electric utilities in states with long histories of constructive regulatory frameworks, solid sales growth, and high-return investment opportunities.

Dominion itself earns a wide economic moat due to the fact that a material share of its earnings coming from nonultility business with sustainable competitive advantages. We also believe Dominion's moaty conservative growth opportunities should drive high-single-digit EPS growth. We think the dividend yield and earnings growth could deliver double-digit returns through the next decade.

--Charles Fishman

PepsiCo's leading portfolio of beverage and snack brands has carved out a wide moat for the firm, ensuring excess returns on invested capital over the long run. We believe both Pepsi and Coca-Cola will continue dominating the domestic nonalcoholic beverage market. Each has a market share in the low-20s, more than double the next closest competitor, Dr Pepper Snapple. Pepsi and Coca-Cola's respective entrenched retail relationships and economies of scale create powerful barriers to entry. Moreover, Vora expects rational pricing relationships between the firms to persist over the long run, leading to gains from price and product mix.

Although Coca-Cola's carbonated soft drinks enjoy greater share abroad, Vora believes Pepsi's snack portfolio is well-positioned for international gains. Pepsi also has established agreements to distribute brands such as Starbucks, Sabra, and Rockstar Energy, further strengthening its retailer relationships. Pepsi's portfolio includes 22 brands that generate over $1 billion in revenue annually, leading to sticky relationships with distributors and retailers that depend on leading brands to generate store traffic, a dynamic we expect to continue given the resources that Pepsi has to reinvest in its brands.

Right now the beverage and snack food giant is selling at more than a 15% discount to our $123 fair value estimate, which we view as an attractive entry point for long-term investors.

--Sonia Vora

Medtronic's wide moat is rooted in its dominant presence in highly engineered medical devices to treat chronic diseases, including those beyond its historical stronghold in heart disease. Medtronic's moat comes from several sources.

In the cardiac area, Medtronic competes with roughly three competitors in total across its heart-related portfolio. The markets for pacemakers, ICDs, coronary stents, heart valves, and neuromodulation generally operate as rational oligopolies.

In the spine area, Medtronic's moat is strengthened by high switching costs for surgeons. Doctors often rely on medical device sales reps for their deep device knowledge as well as their experience with device usage in a wide range of patients. As a result, Medtronic's reps play the role of highly specialized experts who advise practitioners on implantation, programming, and maintenance of Medtronic devices and create sticky relationships with medical practitioners. This dynamic tends to keep spinal surgeons loyal to Medtronic's products, as long as the company does not fall too far behind its competitors when it comes to introducing new technology.

Finally, Medtronic's wide moat is bolstered by several intangibles, including intellectual property and carefully nurtured relationships with physicians. Thanks to its persistent ability to innovate, Medtronic is often first to market with new products in various therapeutic areas. We expect Medtronic to continue its record of innovation, based on its extensive patent portfolio.

--Debbie Wang

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TQKIUI6SDRCQFMUBSWCMD7OKPI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)