Unicorn Hunting: Large-Cap Funds That Dabble in Private Companies

Most funds have limited exposure to private companies, but some outliers highlight the challenge of such investments in an open-end format.

In recent years, prominent companies such as Uber have delayed IPOs, opting to raise money in the private market and build their businesses without the pressure that comes with being publicly traded. Mutual fund managers must increasingly keep tabs on these innovative companies given they could potentially disrupt the business models of their public company holdings. Some active managers have also invested in private companies with the hope that getting in early could reap bigger rewards than waiting for an IPO.

Morningstar's inaugural research report in 2016 found that a low percentage of mutual funds overall invest in private companies, and most that did so had small stakes. Here we take a fresh look at a subset of the industry that has embraced private-company investment the most: U.S. large-cap equity funds. The study focused on funds in the large-growth, large-blend, and large-value Morningstar Categories and excluded exchange-traded funds and funds of funds. It used holdings data as of December 2017. The screening list included 174 companies that were private as of December 2017, of which 85 had mutual fund ownership by large-cap funds.

Few Large-Cap Funds Invest in Private-Firm Equity As of December 2017, we found that 70 large-cap equity funds had some level of investment in the private companies on the screening list. Those funds equate to just 5.8% of the 1,204 large-cap equity funds in Morningstar's database. Their level of private-company investments accounted for $7.7 billion in assets in aggregate, or about 0.15% of the large-cap equity universe's $5.1 trillion tally as of December 2017.

Growth Funds Dominate

Among the 70 large-cap funds in the study that held private-firm equity as of December 2017, three fourths landed in the large-growth category, with only 13 in large-blend and four in large-value. Many early-stage companies tend to cluster in the technology and healthcare sectors, areas of particular interest for growth funds. Managers with growth mandates may be more likely to invest in young, nonpublic companies that have a long runway for growth, particularly since companies such as

Clear Favorites

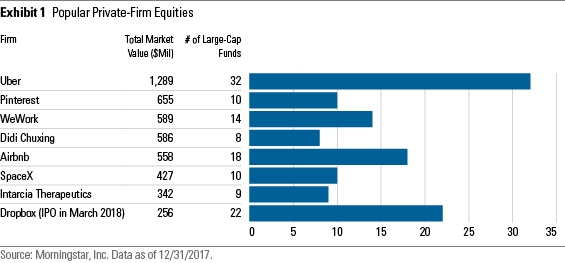

Some private companies proved more popular investments than others. By a long shot, the most widely held, heavily owned private business was ride-sharing company Uber. Thirty-two large-cap funds from 12 different fund families invested in Uber (some repeatedly in successive financing rounds) for a total of nearly $1.3 billion as of December 2017. But consistent missteps and public-relations crises at the company have caused some mutual fund managers to rethink their positions; when Softbank aggressively pursued shares of the company in late 2017, some managers scaled back their bets.

As Uber faced mounting public pressure throughout 2017, interest in its main U.S. competitor, Lyft, grew. Fourteen large-cap funds--nearly all from Fidelity--owned $212.3 million worth of Lyft shares as of December 2017; this was a significant increase from our mid-2016 study, which found that no large-cap fund owned Lyft. Meanwhile, eight large-cap funds owned Uber and Lyft's Chinese counterpart, Didi Chuxing, for a total of $585.8 million. There was little overlap in fund owners between the U.S. and Chinese ride-sharing companies, but

Some private firms garnered significant mutual fund investment in dollar terms but weren't widely held. For instance, the bulk of fund ownership in content-sharing website Pinterest came from funds run by Fidelity's Will Danoff ($610.4 million); a handful of other funds owned $45 million in Pinterest as of December 2017.

Most Funds Have Little Exposure to Private-Firm Equity Even among funds that held private-firm equity, total exposure was typically modest. The SEC limits private-equity investments to 15% of a fund's assets at time of purchase, a level that few funds ever approach. We found that 89% of the funds on the list invested less than 3% of assets in private-firm equity as of December 2017. The median fund in the study invested in three privately held companies, totaling 0.71% of overall fund assets.

Among larger funds that held private-firm equity, the dollar value of those investments can seem high. Fidelity Contrafund, for instance, invested $1.67 billion across 18 private companies as of December 2017--bigger than the entire asset base of some mutual funds. However, that stake totaled just 1.35% of Fidelity Contrafund's $123.5 billion asset base, meaning those private companies would be unlikely to make or break the fund's returns.

These small position sizes aren't a coincidence. Given the limited size and liquidity of private companies, plus regulatory and prospectus limits on a fund's stake in such names, most funds must tread lightly, including smaller funds that in theory could make a larger allocation to private-firm equity.

Exceptions to the Rule Company-specific risk is arguably magnified in funds that make private-company equity investments. If company fundamentals deteriorate, consumer preferences change, competition intensifies, valuations plunge, or an IPO does not happen as expected, the fund's manager might be stuck with the name. In that sense, a private-company stake is likely to pose greater risks than an equivalently weighted, publicly traded stock position.

Among funds with large stakes in single private-company positions,

The impact of fund flows shouldn't be ignored. As

Not Putting All Their Eggs in One Basket Some managers spread their bets around, recognizing that for every private firm that succeeds there are many others that miss the mark. Indeed, some of the private firms with previous mutual fund ownership have been written off, including Mode Media and fashion brand Reed Krakoff.

The downside to this approach is that it can be very time-consuming to monitor dozens of privately held companies where the market is not setting prices and due diligence could take longer. This approach is likely best suited for bigger fund companies like Fidelity and T. Rowe Price that have greater analytical resources for researching these private companies and keeping tabs on important developments. For example, as of December 2017,

In that vein, all 14 large-cap funds in this study that held 10 or more private companies as of December 2017 hailed from fund firms with over $500 billion in assets, including Fidelity and Wellington (subadvisor to the Hartford funds). That said, very few of the funds with large numbers of private-company investments staked much in them in the aggregate. Indeed, the median allocation of these 14 funds was a modest 2.4% of assets, though some of the Wellington-subadvised Hartford funds bucked the trend (their private-firm equity stakes topped 4%). And while five of the 20 biggest actively managed large-cap equity funds ranked by assets under management dabble in private equity, many don't, including prominent funds from Dodge & Cox, MFS, and Harbor.

Conclusion While fund managers have shown greater inclination toward investing in private-firm equity over the past few years, the impact for most fund investors is minimal. A handful of funds hold larger amounts in private-firm equities, and some funds may see stakes unintentionally rise because of a shrinking asset base or successful holdings soaking up a greater portion of assets. As a result, private-firm equity investments should be monitored as part of routine fund due diligence to make sure such holdings are consistent with a fund's strategy, are not disrupting portfolio construction, and can withstand any challenge fund outflows might present.

Financial professionals are accessing this research in our investment analysis platform, Morningstar Cloud. Try it today.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)