Valvoline's Strong Brand Should Drive Returns

We think the company can leverage its domestic product lineup as it grows internationally and builds its instant oil change presence.

We believe

Motor oil demand has also benefited from an aging light-vehicle fleet. Improving vehicle quality has helped push the average age of the fleet to nearly 12 years, with relatively stable scrappage rates despite light-vehicle sales that remain near record highs. Motorists with older vehicles are more likely to rely on third-party oil change facilities than those with new cars, who often go to dealerships for service. The vehicle aging trend appears robust; according to IHS Markit, the number of vehicles 6-11 years old will increase 5% and vehicles 12 years or older will grow 10% over the next five years, with vehicles 16 years or older forecast to grow 30% over the same period.

The story is complicated by changing engine technology that has shifted the nature of motor oil demand. For decades, manufacturers recommended oil changes every three months or 3,000 miles of driving, with conventional motor oil acceptable for most engines. The belief lives on despite tighter engine tolerances, better oil quality, and the introduction of oil life monitoring systems, all of which have led manufacturers to extend many new vehicles’ service intervals to 7,500 miles, and some even higher. The 3,000-mile interval persists in part because of most motorists’ lack of knowledge and the low cost of an oil change compared with a lubrication-caused drivetrain breakdown. A more important factor is the heavier-duty, stop-and-go driving endemic to much of the United States. Valvoline estimates motorists change conventional oil every 5,000 miles and synthetic every 6,000 miles, with the average moving higher by about 50-100 miles a year. Still, the shift has kept volume growth low, with sub-1% global expansion over the past several years. We forecast negligible gallon gains for the segment and Valvoline’s product volume in North America despite miles driven growth that we anticipate will remain in the low single digits long term and continued modest vehicle scrappage rates that should promote further aging of the vehicle fleet.

Changing engine needs and the demands of higher-mileage vehicles have more than compensated for the volume shortfall. Improving engine technology increasingly demands lubricants with higher viscosity, better low-temperature performance, and greater resistance to oxidation and thermal breakdown. This favors synthetic motor oils--premium products that carry higher margins--over their conventional counterparts. Newer engines, particularly those that are performance-oriented or engineered to maximize fuel economy, increasingly demand synthetic oils. About half of new vehicles now require synthetic oils, and that number is expected to rise to around 70% by 2021.

As newer vehicles age, the premiumization trend should become a greater factor in instant oil change facilities that already benefit from demand for high-mileage engine oil, which is a blended product, and synthetic lubricant. Quick lube facilities are able to extract a significant premium for synthetic motor oil changes versus their conventional counterparts, compensating for the longer service intervals that more-durable synthetic lubricants require.

Some of the differential is attributable to the higher cost of synthetic motor oil, and oil change centers that are owned or affiliated with a lubricant producer (such as Valvoline Instant Oil Change and Royal Dutch Shell’s RDS.A Jiffy Lube and Pennzoil offerings) can benefit from the entire value chain. We estimate the service center’s cost to perform a synthetic oil change is not materially different from a conventional service, and higher cost of goods only explains a portion of the differential between the price of the two offerings.

We believe the instant oil change industry should also continue to benefit from increasingly complex vehicles that are more daunting for motorists to service themselves. We expect the sector to mirror the aftermarket auto-parts industry from a demand standpoint, in that vehicle complexity should result in professional segment growth that is about 100 basis points higher than do-it-yourself growth over the next five years.

From an input cost standpoint, the motor oil industry is in an attractive position, and we anticipate the supply/demand balance should remain favorable. The cost of finished lubricant is split roughly equally between base oils and additives (primarily chemicals designed to reduce engine wear, clean carbon deposits, and improve durability), packaging, and operations. The additives used are the key to distinguishing products, and the blends are proprietary. Private-label and lower-cost offerings feature fewer ingredients meant to improve engine performance and reliability. While motor oil producers develop the additive packages, the chemicals themselves are sourced from outside companies.

Group II and III base oils are the key input for higher-quality lubricants, with conventional oil coming from the former and synthetics based on the higher-quality latter category. About 85% of the variation in base oil prices long term is explained by crude oil, and as with its source, sales are dollar-denominated. Industry capacity has moved favorably for motor oil sellers, with Group II up around 65% and Group III up roughly 130% since 2011, and Valvoline’s management has indicated that it expects stable conditions through 2020. The capacity increases have left the market amply supplied, and with utilization important to producer economics, we do not expect the unfavorable dynamics to reverse in the near to midterm.

Strong Portfolio, Brand Investments Should Lift Core DIY and DIFM Sales The core North America segment constitutes about half of Valvoline's overall sales; about 85% of its revenue comes from lubricants, with the remainder from other fluids and filters. This segment enjoys durable competitive advantages that should allow it to capitalize on the premiumization trend in motor oil even as lubricant volume growth remains flat industrywide. The company's advantages should deepen as vehicles increasingly require advanced products that draw on Valvoline's strong premium product lineup. Input conditions should remain favorable, considering Valvoline's ability to pass cost fluctuations on to its customers, and while vehicle electrification poses a threat, we do not expect powertrain shifts to materially challenge Valvoline's return-generating abilities for well over a decade (nonhybrid electric vehicles are well below 1% of the U.S. fleet currently, and we expect this share to remain under 10% into the 2030s).

While its conventional motor oil offering remains meaningful, the bulk of Valvoline’s competitive advantages lies in its good-better-best product assortment. Blended products for higher-mileage vehicles and synthetic offerings provide greater opportunities for value-added differentiation through additive packages that reduce wear and improve performance. Although Valvoline’s share of segment sales from premium products is in the mid-40s now, we anticipate a continued gradual shift upward as the prevalence of cars and trucks that demand synthetic oils increases.

Valvoline’s North American product sales are divided equally between the do-it-yourself and do-it-for-me segments, and we believe the balance is beneficial, given the changes in motorists’ vehicle-servicing habits. In DIY (which we believe is higher margin but slower growing than DIFM), the company’s scale allows it opportunities to connect with end customers and retailers that subscale rivals do not enjoy. Among end customers, Valvoline’s advertising allows it to generate demand from a user base that does not regularly encounter its products, particularly as oil change intervals lengthen (the company spent $61 million, or nearly 3% of sales, on such efforts in fiscal 2017, a level we see as sufficient and expect to hold steady as a share of revenue). As the synthetic shift increases motorists’ lubricant choices and Valvoline invests in new lineups, the company’s brand-building efforts are important to maintain its quality and innovation perception. The DIY motorist is especially receptive to category brand investments. Valvoline’s management cites internal survey data indicating that motor oil brand is meaningful to 90% of motorists who change their own oil, with only 10% considering the product a commodity. Valvoline has rightly focused on newer vehicles to build its brand while promoting mix-additive premium growth, as we believe late-model powerplants’ premium lubricant needs are especially conducive to differentiated product sales.

Furthermore, higher-profile motorsport sponsorships can confer a quality halo, given the performance capabilities that racing-oriented products require and the value that endorsements can provide. The company can also influence purchase decisions through packaging and other ancillary innovations that can be leveraged over its large sales base, allowing it to respond to customer desires more comprehensively than subscale rivals.

With retailers, Valvoline capitalizes on motor oil’s status as a traffic driver and on its comprehensive product portfolio. The company’s lineup stretches across the price spectrum and includes private-label products, allowing it to offer retailers category management capabilities to strengthen their partnership. Staging the category for retailers maximizes Valvoline’s ability to control its point-of-sale presence and allows it valuable data insights that can be applied to product development and further retailer engagement. We believe retailers are unwilling to provide untrusted or subscale entrants with such category-level responsibilities, and Valvoline should benefit longer term from its far sharper focus on the lubricant market.

In the DIFM segment, Valvoline sells to professional installers, other quick lube franchises, dealers, and vehicle manufacturers. Valvoline’s relationships with such customers are particularly valuable, in our view, given the shift favoring professional segment repairs as complexity rises and convenience plays an increasing role. The professional segment is motivated to seek quality as a shop’s reputation is more directly at stake if an end motorist experiences a failure as a result of lower-end products; also, its procurement costs are passed through to its customers with a markup. This is consistent with Valvoline’s internal survey data, which indicates that over 80% of professional customers claim using a “well-known” motor oil brand is important (management says its data indicates that Valvoline enjoys a 90% total awareness rate in the U.S.). Especially in the higher-end dealer and original-equipment manufacturer segments, Valvoline’s reputation and premium products carry outsize weight as the value differential between the vehicle and the cost of lubricant is at its greatest for new vehicles. We also see opportunity for the company to build its nonoil sales in this segment. For example, its EasyGDI product allows installers to upsell customers with direct-injected engines on a treatment meant to fight the carbon buildup to which these modern powerplants are prone.

We think the shift in fleet composition will allow Valvoline to trim its private-label production as synthetic lubricants gain share (unbranded items account for about 25% of volume but only 10% of profit for the segment). Private-label penetration is lower for synthetic products than for conventional oil. The cheaper additive package used in unbranded lubricants does not afford the same benefits (particularly wear protection and fuel efficiency) as its branded counterpart. Valvoline should be able to move customers up the value chain more easily as cars and trucks retain value for a longer period (as reliability improves) and as the frequency of required service decreases, raising motorists’ stakes for lubricant purchases. However, we believe the private-label offering does allow Valvoline to better engage its retail store customers with a comprehensive offering that regional blenders cannot provide. We think the private-label threat is most pronounced for midtier brands that do not carry the same user-facing advantages and retailer relationships that leading labels enjoy. As a result, we expect Valvoline, along with market leader Castrol as well as top brands like Mobil and Pennzoil, to maintain share as labels such as Quaker State and Havoline cede ground (we estimate the top four brands account for well over half of industry sales).

We believe Valvoline’s current product lineup stands to lose strength as electric vehicles gain share of the overall fleet; however, we expect it will take well over a decade for the difference to be material. The electric and hybrid share of U.S. new-vehicle sales remains in the low single digits, and while we are optimistic about growth in electric vehicles’ share of new auto sales globally, the displacement of conventionally powered cars and trucks across a U.S. fleet with an average age of 12 years will take time. Hybrid vehicles carry largely the same lubricant requirements as conventional internal combustion automobiles, making pure-electric and hydrogen vehicles the real threat to Valvoline’s business model. Valvoline estimates that improving internal combustion engine fuel efficiency will keep the powertrain (including gas-electric hybrids) dominant well through 2030, an assessment we see as reasonable.

The company has expanded its lineup of nonoil products, including fluids (such as battery coolants) that are critical to electric vehicles. We are encouraged that Valvoline is working with electric vehicle manufacturers to tailor offerings to such cars’ needs, though management agility will be required to build brand strength in an area outside Valvoline’s core competency (only 14% of 2017 North American product sales came from items other than lubricants). The company’s nonoil fluids offerings should allow it to capitalize further on modern engine technology, leveraging Valvoline’s brand strength in adjacent venues. Still, the prospect of a world with considerably lower motor oil demand prevents us from awarding Valvoline a wide economic moat rating, though continued progress in building brands for its other fluids offerings could cause us to reconsider.

Global Ambitions Should Build on Domestic Investments Valvoline has targeted international expansion as a growth source. We believe conditions are favorable for the company worldwide, and though non-North American (particularly emerging-market) sales are less profitable, we see the new markets as a way for Valvoline to leverage its existing capabilities.

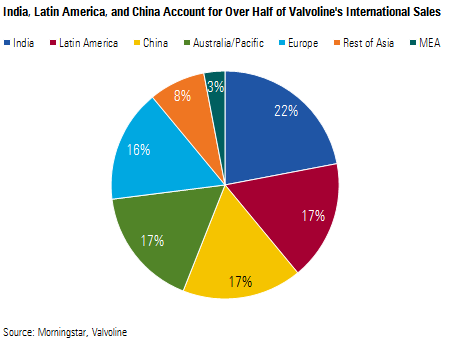

Emerging markets accounted for about two thirds of Valvoline’s fiscal 2017 international sales. We believe this positioning is prudent, considering increasing vehicle ownership and rising incomes, both of which should increase demand for high-quality lubricants.

In India and China, Valvoline has benefited considerably from a 50/50 joint venture with narrow-moat Cummins CMI, which has allowed it to quickly develop a strong presence by using specially designed oils for Cummins’ heavy-duty and industrial products as a beachhead to build heavy-duty sales. Cummins’ offerings are well established, allowing Valvoline to use its partner’s brand strength to build credibility over time. Consumers tend to attribute motor failures caused by poor lubricant quality to the engine manufacturer, encouraging producers to partner with established oil companies with high-quality, reliable products. Furthermore, the criticality of heavy and industrial equipment to owners’ operations relative to the cost of lubricant makes operators predisposed to higher-quality products.

The Asia-Pacific region accounts for slightly less than half of global lubricant demand, with China the largest consumer of products meant for heavy-duty applications. Valvoline estimates its share of the heavy-duty market is in the low single digits worldwide, which we believe indicates ample opportunity to build its presence. We believe the company’s activities in developing economies--including Latin America and its other emerging-markets automotive presence--will underpin international segment growth.

While the company’s European and Australian units are established, stable cash generators (Valvoline is the market leader in the latter geography), the international segment as a whole features structurally lower margins than its North American counterpart. We expect the differential to hold fairly steady over the decade ahead, growing at a low-single-digit compound annual rate (consistent with inflation). We see a potential inflection point when Valvoline’s global presence is significantly larger and more established--a process that should take longer than our 10-year explicit forecast.

We attribute the difference to different segment mix and the nature of Valvoline’s distribution network. The DIY and DIFM segments each account for about half of Valvoline’s North American sales, but the mix skews almost entirely toward the latter outside North America and Australia. As a result, relationships with installers and OEMs are particularly important to drive sales. The DIFM segment features lower margins and is more competitive as the segments depend less on end-user marketing and feature sophisticated customers who expect their higher order volume to result in lower pricing. Additionally, Valvoline has greater reliance on third-party distributors in its international segment, which combines with transport costs (apart from North America, the company only has blending operations in Australia and the Netherlands) to limit profitability.

Despite the margin profile, we believe the international unit plays a valuable role in enhancing Valvoline’s competitive standing. First, the segment allows the company to leverage research and development expenses over a broader sales base, improving its ability to monetize investments in more sophisticated lubricants relative to its subscale peers. Valvoline spends about 2% of gross profit ($13 million in each of fiscal 2016 and 2017) on R&D, generally deployed toward developing products with global applicability. We see the level of expenditure as sufficient and expect its share of gross profit to hold steady. We also believe the international unit is intrinsically constructive to Valvoline’s competitive standing. As the Cummins partnership indicates, global OEMs are receptive to partnering with established companies that have a demonstrated record of success in the markets in which they compete. This is also important in developing marketing relationships with manufacturers that encourage owners to use Valvoline products. For example, Tata Motors recommends Valvoline products for certain vehicles and began cobranding certain lubricants in 2014, which is significant given the importance of vehicles to motorists in a market where ownership of more than one car or truck per household is still uncommon.

We believe input cost dynamics are generally favorable outside the U.S., with commodities priced globally. As crude oil derivatives, base oil sales are U.S. dollar-denominated, which can act as a natural hedge against necessary input cost-driven price changes when dollar weakness contributes to high per-barrel prices. While we believe Valvoline has pricing power in its international segment (helped in part by its installer customer base, which can easily pass through price hikes to their end clients), limiting price volatility is important in developing markets where the company’s presence is relatively small. While this could impede profit expansion as costs can be volatile independent of local demand conditions, we think Valvoline’s diverse international exposure insulates it from the impact of changes in non-North American demand to a significant extent. The company’s largest presence outside North America from a revenue standpoint is India, which only accounts for roughly 6% of companywide sales.

We expect Valvoline’s international sales to grow at a high-single-digit rate on average over the next decade. Our estimate is underpinned by mid-single-digit expected volume growth (versus 7% average expansion since fiscal 2014), based on limited expansion in Europe and Australia and high-single-digit gallon growth in developing markets. Gross profit per gallon should remain lower than Valvoline’s roughly $4 average in North America, though cost leverage and inflation should move the metric higher, given Valvoline’s less established presence and lower emerging market disposable incomes.

Poised to Capitalize on Instant Oil Change Consolidation As the second-largest U.S. quick lube company, Valvoline stands to benefit from durable factors pushing the industry toward consolidation behind scaled players that can best leverage brand-building investments. The instant oil change customer is a valuable one, and premium value-added offerings, including synthetic and other higher-end product sales, account for over 60% of the services Valvoline performs in the channel. The segment accounted for about 26% of Valvoline's fiscal 2017 revenue.

This is partly a consequence of motorists’ dependence on trained in-store personnel (Valvoline requires over 270 hours of training for entry-level shop technicians) to determine the right lubricant for their car or truck, giving sales staff an opportunity to explain the benefits of a premium synthetic or blended product over a conventional oil. In addition to benefiting Valvoline’s premiumization push (synthetic changes at its locations cost about $85, versus roughly $45 for a conventional service), we believe the instant oil change offering’s regular customer interaction is additive to brand strength as it serves as a valuable customer engagement tactic.

Quick lubes garner at least half of their revenue from oil changes, with the remainder from light maintenance services such as filter, wiper, bulb, and fluid replacements and tire rotations. Such shops do not perform more complex repairs. As a result, servicers compete on convenience, speed of service, quality, and price. Out of the roughly 450 million DIFM oil changes performed in the U.S., about 100 million are done by quick lubes, with Valvoline holding a midteens share, according to the company. (By contrast, the company estimates that about 150 million changes are done by motorists themselves.)

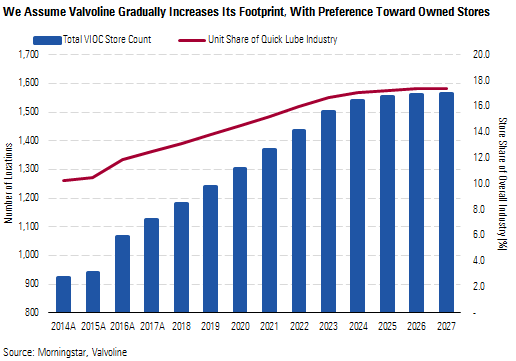

Valvoline targets the segment with two offerings: Valvoline Instant Oil Change and Valvoline Express Care. It has more than 1,100 franchised and owned VIOC locations (out of about 9,000 quick lubes in the U.S. overall) plus 320 Express Care locations. Company-owned VIOC locations (about one third of the instant oil change network) generate service and product sales revenue, while franchisees buy products and give Valvoline a royalty on other revenue. Express Care is targeted to smaller facilities with a slower business cadence, with Valvoline selling product to the operator along with some signage but without the same standard of support (marketing, data analytics, operational assistance) that VIOC franchisees receive. Express Care locations also typically offer services besides quick lube, such as auto repairs and car washes. Management has indicated it plans to concentrate on building its company-owned VIOC presence.

Valvoline’s store presence is second in the market behind Shell’s Jiffy Lube, which has more than 2,000 locations). The European oil conglomerate also owns Pennzoil 10-Minute Oil Change, which is analogous to Valvoline Express Care. The company-owned stores distinguish Valvoline from Shell, which exclusively uses franchises and signage agreements. We believe the company-owned locations are an advantage for Valvoline and the hybrid model balances economics with capital optimization. While franchise unit returns are high (above 30% cash on cash) against a small initial investment of around $100,000 per store, management indicates that company-owned locations still offer midteens cash-on-cash returns and 3-4 times the EBITDA dollars. Furthermore, we think company-owned locations provide a valuable way for Valvoline to optimize service practices, deploy advanced data analytics and marketing tools, and utilize sophisticated strategies to maximize the number of oil changes a store performs per day. By providing innovative practices in company-owned shops, Valvoline can accelerate adoption by franchisees and brand development without the need to invest in a fully owned network, in our view.

We also think the hybrid approach is a particularly valuable way for Valvoline to benefit from industry consolidation. The market is fragmented behind Valvoline and Jiffy Lube, and the top 50 chains identified by National Oil & Lube News account for about 80% of nationwide locations. Valvoline's unit and same-store sales growth has come as the number of locations industrywide has remained steady, reflecting both the company's acquisition activity and the gradual shift in favor of scaled chains. We expect this trend to continue, with Valvoline's projected same-store and new-store growth coming at the expense of subscale rivals.

In our view, Valvoline’s ability to use its owned stores to provide greater insight and introduce more sophisticated practices make it a more valued partner for franchisees than companies that do not have such operations (such as Jiffy Lube). This should maximize its ability to capitalize on a densifying industry. As smaller quick lube networks find it more difficult to compete with national chains that can bring advertising and service investments, sophisticated local-market analysis, targeted multiplatform marketing campaigns, training programs, and the associated cost leverage to make such efforts worthwhile, we expect skilled independent operators wishing to remain in the business to move into the franchise system with a company that can provide the most tools for success. Similarly, smaller players in less dense areas can use the Express Care offering to benefit from the Valvoline brand halo through signage programs.

The company’s optimization efforts have led to a strong customer experience alongside operational efficiency. In addition to 11 consecutive years of same-store sales growth, Valvoline boats a 70% customer retention rate at its oil change centers; this is high considering the lack of switching costs and the relative infrequency of motorists’ need for service. (Although the comparison is imperfect, an R.L. Polk Loyalty Study cited by WardsAuto showed a 51% retention rate for dealership service departments.)

Furthermore, the company’s mid-40s average number of oil changes performed daily per store outpaces the industry’s low 30s mark. In addition to promoting cost and capital leverage, the high daily changes metric suggests location quality that can be difficult to replicate for subscale peers that cannot afford sophisticated pre-entry real estate and market analysis.

We expect the store growth story to continue as Valvoline builds its presence and refocuses on growth. Despite its expansion into most major U.S. metropolitan areas, we think Valvoline can add density and its company-owned store network has room to grow particularly in California, Florida, Texas, and the Northeast, given its limited current presence and the attractive DIFM growth characteristics of each region. Management intends to boost its company store count by more than 150 over the next five years versus about 42 per year over fiscal 2014-17. We argue that greater geographic dispersion can enhance the company’s value proposition to local franchisees and permit deeper consumer data insights based on local-market fleet composition and motorists’ driving behavior.

We think Valvoline Instant Oil Change can grow to just over 1,400 company-owned and franchised locations over the next five years and well over 1,500 by the end of our 10-year explicit forecast. Assuming a flat industry store count, the company’s share of total quick lube locations would rise from about 13% to 16% by 2022.

As stores mature and Valvoline’s density increases (reducing the positive impact from incremental locations), we expect same-store sales to fall toward our long-term expectation for the overall DIFM automotive repair market at 3.5% annual revenue growth. Taken together with new store growth, we expect segment growth to decline from the mid- to high teens in fiscal 2016 and 2017 to a mid-single-digit rate long term.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KNTMDTIW3JFWJBYCASLAV3ZIJE.jpg)