Don't Get Thrown Off by Sustainable Fund Labels

Different terms like ESG, impact, or sustainable are unreliable guides to distinguishing among strategies.

Neuberger Berman Socially Responsive changed its name to

Neuberger Berman Sustainable Equity

NBSLX this month. Launched in 1994, the fund is one of the most successful SRI/ESG/sustainable funds ever, in my view. With $2.3 billion in current assets, plus more in other vehicles, the fund (Investor share class) has a 9.59% annualized 15-year return, net of fees, as of the end of April 2018, 4 basis points

better per year

than that of the S&P 500. No changes to the underlying strategy, just a name change and an update in the prospectus describing the fund’s approach:

"The Portfolio Managers employ a research driven and valuation sensitive approach to stock selection, with a focus on long term sustainability. This sustainable investment approach seeks to identify high quality, well-positioned companies with leadership that is focused on ESG as defined by best in class operating practices."

You can read the entire description of the fund's investment objectives here.

Last week, an SEC filing from Touchstone Funds announced a name change for Touchstone Total Return Bond. In July, it will become Touchstone Impact Bond TCPNX. No change to the subadvisor EARNEST Partners, but its claims to be assessing an issue's sustainability profile heretofore could be read only in the fund fact sheet, not in the prospectus. The new prospectus will now read, in part:

"EARNEST also believes that entities that are cognizant of ESG issues tend to be more successful over time. As a result, EARNEST prefers to invest in government programs and companies that have sustainable operating models and seek to achieve positive aggregate societal impact. This inclusive approach views positive impact characteristics as additive to an investment’s risk/return profile. When assessing an issue’s impact profile, EARNEST considers a wide range of factors, including but not limited to support for economic development, home ownership, and job creation."

Then there is the recently relabeled Goldman Sachs International Equity ESG GSIEX, formerly Goldman Sachs Focused International Equity. Its new prospectus, which can be found here, reads in part:

"The Investment Adviser uses a quantitative and qualitative process to identify, at the time of investment, issuers that satisfy the Fund’s ESG criteria. The Investment Adviser evaluates company ESG performance based on fundamental, proprietary research using internal and external data sources as well as engagement with company management. The Investment Adviser analyzes individual companies, incorporating the Fund’s ESG criteria as part of a fundamental, bottom-up financial analysis."

Three funds with new names, each using a different term: sustainable, impact, and ESG.

This got me to thinking about naming conventions, so I took a look at my list of intentional sustainable open-end funds and exchange-traded funds in the United States. To be on the list, these funds must have some reference to sustainable, responsible, impact, or ESG investing noted in their prospectus investment objectives.

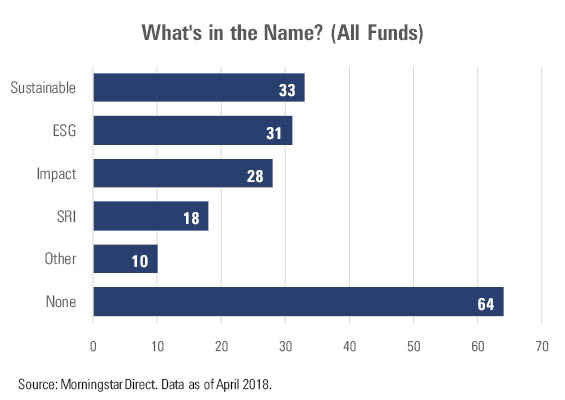

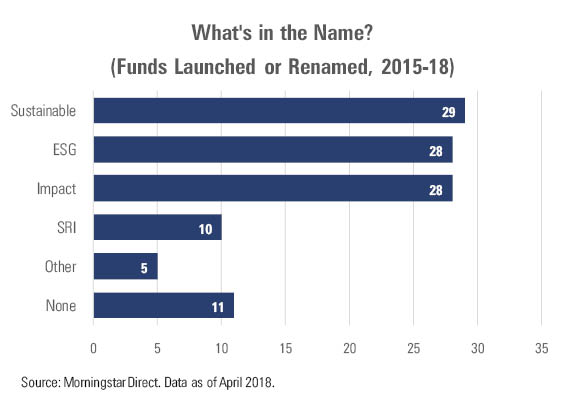

As shown in the accompanying chart, the most popular labels are Sustainable (or Sustainability) and ESG, with Impact coming on strong. References to Socially Responsible Investing (including the separate use of the terms "social" and "responsible" and the SRI acronym) is used almost exclusively by older funds.

Only 10 funds that have launched since 2015 use those more-traditional SRI-related terms, while 85 use the words sustainable, ESG, impact, or some combination thereof. A large group uses no reference word at all in their names, including Parnassus funds and most Calvert funds. But like references to SRI, this practice is also in decline.

Funds launched in the past few years overwhelmingly use some term in their names to indicate their focus on what I call sustainable investing. Among funds launched or renamed since the beginning of 2015, 100 out of 111 use a reference word in their titles.

The first use of "sustainability" in a fund name came in 2008 with Northern Trust's launch of Northern Global Sustainability Index NSRIX, followed later the same year by the DFA U.S. Sustainability Core DFSIX and DFA International Sustainability Core DFSPX portfolios.

"ESG" came along in 2010. In October, iShares FTSE KLD Select Social Index ETF became MSCI USA ESG Select ETF SUSA, reflecting MSCI's acquisition of KLD.

"Impact" was first used in a mutual fund in 2015, when Touchstone hired Rockefeller & Co. to subadvise a fund that had been known as Touchstone Large Cap Growth. In May 2015, it was renamed

Touchstone Sustainability and Impact Equity

TROCX, reflecting its new subadvisor’s approach. BlackRock soon followed with the October launch of

BlackRock Impact Equity

BIRIX.

My preference is for intentional funds and strategies to use "sustainable" or "sustainability" in their names. The term directly connects the investment with the broader concept of sustainability, which is really what is driving so much interest in the field. I think "ESG" and "impact" are better thought of as unique features that distinguish sustainable investing from conventional approaches.

ESG (environmental, social, and governance) describes the underlying factors that sustainable investors believe must be considered in any complete investment analysis; or put another way, the indicators of what makes an investment sustainable. The industry use of ESG as a neutral-sounding acronym perhaps reflects unease over using other, more values-laden terms. At the same time, ESG is insider jargon that makes it harder to connect to investors who may better relate to terms like sustainability and impact but need to have ESG defined and explained to them.

Impact, on the other hand, clearly resonates with investors. But there is debate over how to define and measure it. I don't want to see it used simply as a synonym with the other terms. If a fund claims it delivers impact alongside financial return, then it needs to demonstrate that to investors, something more funds are trying to do by issuing impact reports.

Are there any practical differences between funds that use "sustainable" and those that use "impact" or "ESG" in their names? The short answer is no, so if you are considering a sustainable fund, don’t be thrown off by the different labels.

The longer answer is that, while the labels themselves are not useful guides to differentiating among these types of funds, sustainable/impact/ESG funds are not all exactly the same. Some focus on tilting their portfolios toward companies with superior sustainability profiles. Others focus on best-in-class selection, and still others simply include an ESG evaluation in the investment process alongside other factors. More funds, but not all of them, are seeking to achieve measurable societal or environmental impacts alongside financial return. Many actively engage as shareholders with the companies they own. But you can’t tell any of this simply from the terms they use in their names.

The Morningstar Sustainability Rating provides a measure of how well the companies in a fund’s portfolio are handling material ESG risks and opportunities. Most intentional funds have high ratings (4 or 5 globes). If you are considering one that has lower ratings, it’s a sign that you need to dig deeper to understand how ESG factors are being incorporated into the investment process.

To find out about impact and active ownership also requires further investigation. Funds are making this easier by issuing impact and shareholder engagement reports. If you can’t find reference to impact or engagement in a fund’s materials or on its website, chances are the fund isn’t involved in those activities.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)