How Well Does Your Passive Dividend Fund Avoid Risky Stocks?

Successful dividend-focused funds find harmony between risk and yield.

Actively managed equity-income funds tout their ability to put together a portfolio of stocks that offer above-market dividend yield while avoiding riskier stocks. Chasing yield can be dangerous because the highest-yielding names are more likely to have weak or deteriorating fundamentals than lower-yielding stocks, which could lead to dividend cuts. More importantly, the market identifies firms with declining fundamentals, and these stocks' prices reflect their slumping prospects ahead of them reducing or eliminating their dividend payments.

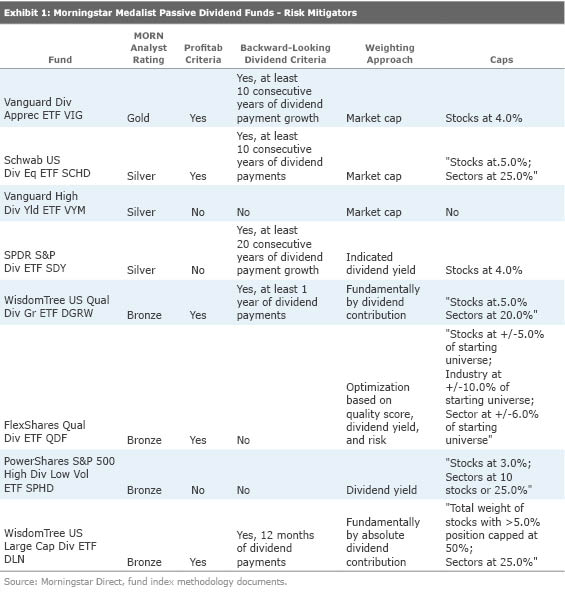

Dividend index funds use a handful of approaches to mitigate the risk of holding stocks with deteriorating fundamentals. These approaches can be roughly sorted into four categories:

1. Profitability Screens Metrics like dividend coverage ratios, return on equity, or earnings consistency help to filter out names that may not be able to generate enough income to support their dividend payments in the future.

2. History of Dividend Payments Dividend payment history is a backward-looking screen, but a history of consistent or growing dividend payments demonstrates a company's willingness and ability to return capital to shareholders. Long-dated screens weed out less stable companies, leaving firms with more stable fundamentals that can weather turbulent markets while consistently increasing or at least maintaining their dividend payments.

3. Stock Weighting Approach Weighting stocks by market cap can reduce risk because larger stocks tend to be more mature and profitable than smaller stocks and because stocks with deteriorating fundamentals become a smaller part of the portfolio as their prices decline. In contrast, weighting by dividend yield tends to increase a portfolio's exposure to stocks with declining fundamentals because yields go up as prices fall.

4. Stock and Sector Caps

Funds can employ single-stock and sector caps to avoid making outsize bets. Some sectors like utilities, consumer staples, and REITs have historically paid higher dividends than "

" sectors like technology or consumer discretionary.

(Don't) Gotta Catch 'Em All Passive funds primarily use the approaches from the first two categories, profitability metrics and history of dividend payments, to screen out names that may be unable to support their dividend payments in the future. More-profitable stocks are better able to support their ongoing dividend payment than less-profitable names. Although screening potential holdings based on past dividend payment or dividend growth is backward-looking, it can weed out firms that haven't been willing or able to support their dividend payments in the past.

Backward-looking screens also benefit from selection bias and favor more-stable firms that are better able to weather market turmoil and maintain their dividend payments. One drawback of a lengthy historical dividend payment screen is that it precludes some profitable firms that recently started paying dividends like

The latter two categories--weighting approach and position caps--can be thought of as approaches to reduce the impact of holding dividend-cutting funds. If a fund holds a stock with deteriorating fundamentals that cuts or decreases its dividend payments, then a market-cap-weighting approach can reduce the negative impact because the position size will decrease as its price decreases. If a fund weights its holdings by dividend yield, the fund may be upping the portfolio weighting of a name as its price decreases but its dividend yield increases. Single-stock and sector caps act as risk limits to the broader market so the fund doesn't take outsize bets that may (or may not) pay off.

Exhibit 1 shows U.S. dividend-focused funds that earn Morningstar Analyst Ratings of Gold, Silver, or Bronze and summarizes the risk mitigating approaches that these funds use and assigns them to the four categories highlighted earlier.

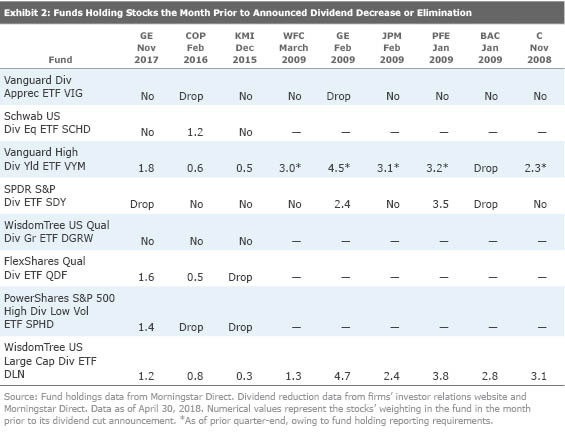

Catching stocks before they cut their dividend payments isn't a panacea to remove the risk of these funds. But to put their screening criteria to the test, I examined which of the dividend-oriented Morningstar Medalists held a sample of stocks that had cut or eliminated their dividend payments during the past decade through December 2017. These stocks span from

In Exhibit 2, "No" indicates that the fund did not hold the stock in question from January 2008 to the stock's dividend cut announcement. "Drop" indicates the fund held the stock but dropped it prior to its dividend cut announcement. Numerical figures represent the percentage weighting of the stock in the fund in the month prior to the stocks' dividend reduction announcement. These are the funds that held the stock going into its dividend cut.

The two dividend growth funds, Gold-rated

If the Stock Cuts, It Cuts

Other yield-focused medalists like Silver-rated

When choosing among dividend funds, investors do best by keeping the following considerations in mind:

1. Does the fund target dividend growth or dividend yield? Funds that focus on dividend growth usually hold high-quality names that tend to hold up well in down markets but may not offer the highest dividend yields. In contrast, funds that favor dividend yield are usually riskier than dividend-growth funds and land on the value side of the Morningstar Style Box.

2. How does the fund avoid buying firms that may cut their dividend payments? Does the fund screen for profitable companies or those with long track records of paying dividends?

3. How does the fund mitigate the risk of holding stocks that cut their dividend payment? Is the firm broadly diversified and does it weight its holdings by dividend yield?

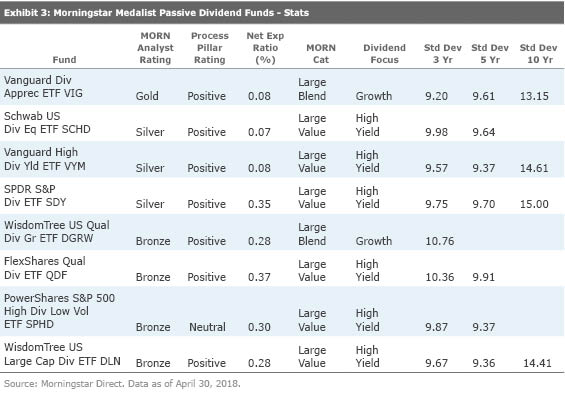

Using these three questions as starting points and understanding the fund's investment process can help dividend investors set risk and return expectations early, which may help them better weather turbulent markets. Exhibit 3 shows U.S. dividend-focused medalists that draw from a large-cap universe of stocks.

Nearly all of the dividend-oriented strategies listed in Exhibit 3 that are Morningstar Medalists also carry Positive Process Pillar ratings. None of these risk-mitigating approaches is a silver bullet.

My favorite dividend growth fund is VIG. This fund focuses on profitable stocks that have consistently raised their dividend payments in 10 consecutive years, which favors highly profitable stocks with durable competitive advantages and limits exposure to firms with weak fundamentals that may not be able to sustain their dividend payments. Its low fee contributes to its edge, and it should continue to produce top-of-category risk-adjusted returns over the long haul. However, this is more of a quality strategy than a yield strategy. VIG's dividend yield is similar to the S&P 500's, though it should hold up better during market downturns.

Two of the more compelling options for higher yields include Silver-rated

the impact of stocks that cut their dividends or have deteriorating fundamentals, which is good because it will inevitably hold some of them. SCHD and VYM charge fees of 0.07% and 0.08%, respectively, which should contribute to their persistent advantages.

Funds that use a handful of these risk-mitigating approaches, charge a low fee, and are broadly diversified are more likely to outperform their dividend-targeting peers on a risk-adjusted basis than those that narrowly target dividend yield.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets,

or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)