Balancing Act: Picking Actively Managed Bank-Loan Funds

Navigating the bank-loan fund landscape.

In a recent article, my colleague Phillip Yoo highlighted developments and risks in the bank-loan market, including rising leverage ratios, the proliferation of so-called “covenant-light” loans, and the liquidity risk inherent to the asset class. These challenges all have implications for how we evaluate actively managed funds in the bank-loan Morningstar Category.

Credit Research Is Paramount Bank loans are higher in the capital structure than bonds, so they have a better claim on a company's assets in the event of a restructuring and have historically featured higher recovery rates than high-yield bonds. As a result, they are often viewed as a more defensive way to access credit risk. That said, most bank loans carry below-investment-grade ratings, and there are plenty of risky loans out there, including those issued by companies that rely only on the bank-loan market for credit.

Given the credit risk inherent to the asset class, as well as the vagaries of what is still essentially a private market, the experience of bank-loan managers is paramount. We prefer managers who have a long history of investing in the asset class and who are backed by deep analyst teams with equal experience investing in bank loans or other forms of leveraged finance.

Because most companies that issue bank loans are rated below investment-grade, bankruptcy is a real concern. While the default rate among bank loans remains low, the market has been hit by a few high-profile bankruptcies over the past 18 months. In 2017, notable names included Avaya AVYA, Ocean Rig UDW ORIG, Payless, Gymboree GMBE, and J. Crew. In 2018, the major bankruptcy announcement has been Clear Channel (also known as iHeartMedia). The company is one of the largest bank-loan issuers in the market, and its filing increased the default rate of the S&P/LSTA Leveraged Loan Index to 2.4% from 1.8%. This is below the long-term average of 3.1% but still a significant jump.

A large number of loans issued by companies going through bankruptcies--especially in the current low default environment--can be a sign of a manager who is taking on a lot of risk. Moreover, bankruptcy restructurings require a sizable commitment of time and resources and may have the potential for binary outcomes: Either loan-holders are made whole or they take a painful haircut. If positions are big enough, these make-or-break outcomes have the potential to overwhelm contributions from the rest of the portfolio and have an outsize impact on fund performance. Even in cases where the recovery is close to the 80% average, the outcome for investors is highly dependent on what price the loans were purchased at. If the loans were bought near par, then an 80% recovery is still a 20% loss.

Managing Liquidity Risk While bank loans typically carry less credit risk than high-yield bonds, they do carry significant liquidity risk. Because of the structure and private nature of the bank-loan market, trades can take anywhere from seven to 20 days (or longer, in some cases) to settle. Larger, more-liquid loans may get bids quickly and settle at the short end of that range, but less-liquid holdings can easily fall on the long end of that range. If the fund is suffering from heavy, sustained outflows, this can cause trouble for shareholders.

With that in mind, we generally like managers who make liquidity management a priority. Many, for example, keep a healthy slug of cash on hand, pay close attention to the liquidity of individual positions, and keep individual position sizes in check. Conservative bank-loan managers often limit positions sizes to 1% or less; top holdings that run well above these levels, particularly in less liquid or riskier names, can indicate an aggressive strategy that may post impressive returns under normal conditions but is at risk during credit sell-offs.

Most bank-loan funds have a dedicated line of credit that they can draw on to help bridge the gap between outflows and trade settlements, and it wasn’t uncommon for managers to put them to use in late 2015 when the energy-driven sell-off roiled the market. Lines of credit can allow a manager to meet outflows as loans settle, but we prefer them to be used only for short periods and as a last resort. Large or sustained use, especially combined with a period of unexpectedly heavy or extended outflows, effectively introduces leverage to the fund and can exacerbate losses.

Balancing Quality and Return Bank-loan managers are often presented with a Catch-22: The highest-yielding (and often best-returning) securities frequently carry the highest credit and liquidity risk, while higher-quality, more liquid, and defensive securities not only carry lower yields but are also regularly refinanced at par, which limits their upside potential. (Bank loans have very limited call protection, which means they can be easily refinanced and, unlike high-yield bonds, rarely trade above par.)

So, the returns of the conservative loan managers who traffic in these higher-quality companies have looked lackluster compared with managers willing to load up on credit and liquidity risk. As a result, bank-loan fund investors, rather than simply looking for the best-performing fund, should have a clear thesis as to why they are adding exposure to the asset class. A mismatch between fund style and investor behavior can lead to disappointing outcomes for both. Investors who rotated into bank loans to protect against interest-rate risk may not be prepared for the credit risk of loans.

On an absolute return basis, conservative loan managers can look out of step for years, often only outperforming during big credit sell-offs such as 2015 and 2008. But they often have noticeably lower volatility (standard deviation) than peers and higher Sharpe ratios, which makes them attractive as a long-term holding on a risk-adjusted basis, especially for investors who are more interested in managing the volatility in their portfolios than aiming for the biggest yield.

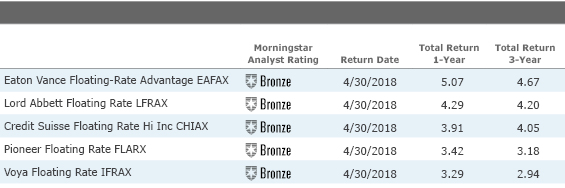

Our Picks There are nine Morningstar Medalist funds in the bank-loan Morningstar Category (all Morningstar Analyst Ratings of Bronze), and they run the gamut from conservative to aggressive. Here are five of the most notable.

- source: Morningstar Analysts

At the conservative end are funds like Pioneer Floating Rate FLARX and Voya Floating Rate IFRAX. Both funds are run by solid teams that tend to avoid the riskiest parts of the loan market, and it shows in their risk-adjusted returns. They have lagged recently in this market, but that is expected given their strategies.

At the aggressive end are funds like Eaton Vance Floating Rate Advantage EAFAX and Lord Abbett Floating Rate LFRAX. While the former usually doesn’t hold many loans rated CCC or below--which are among the riskiest in the bank-loan universe--it does use leverage to boost its returns. Lord Abbett Floating Rate currently has an overweighting to CCC rated loans and has historically been comfortable taking on more risk than peers. Both funds are supported by large teams that are thoughtful about liquidity management and other risks.

Landing in the middle of the risk spectrum, Credit Suisse Floating Rate High Income CHIAX has historically been more tactical about its allocation to higher-risk areas like second-lien loans and CCC rated debt. This introduces the opportunity to make a misstep and judge the market wrong, but thus far it has used its flexibility well.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)