Active Funds Are Dead. Long Live Active Funds.

Is low-cost really the "new past performance"?

Key Takeaways

- Recent reports suggest investors are fleeing active funds in droves, and not even successful active funds have been immune.

- This is largely a phenomenon among active U.S. stock funds; in other asset classes, past performance still appears to strongly influence flows to active funds.

- Among active U.S. stock funds, past performance appears to explain asset growth, even after accounting for fee differences.

- Some successful active U.S. stock funds are likely seeing outflows as part of a larger structural shift toward indexing and wider diversification; this reflects broader currents, including changing advice practices.

- Winning large-growth mutual funds account for a disproportionate share of outflows from successful active U.S. stock funds overall.

No Good Deed Goes Unpunished Barron's recently ran a story on the trend of successful active mutual funds getting the cold shoulder from investors. To quote Barron's:

This wouldn't seem to make sense. Investors are notorious for chasing outperformance, not fleeing it. If winning active funds are getting redeemed, then we have to ask whether it's curtains for active funds altogether.

The Fuller Story Alas, it's not as bleak as the story might have led one to conclude.

The Barron's piece responsibly notes some of the quirks affecting fund flows. For instance, some institutional investors have been shifting to unregistered collective accounts that replicate a fund's strategy, but at a lower cost. In situations like these, records capture the redemptions (that is, out of the affected funds) but not the offsetting inflow (to the collective investment trust). This can make the flow picture look worse than it is, which Barron's correctly notes.

The bigger issue is that the story focuses largely on trends among active U.S. equity funds, which have been hardest hit from incursions by passive funds. But that trend doesn’t hold to the same degree in other asset classes. For instance, active bond funds continue to sell briskly. Moreover, even among active U.S. equity funds, there’s evidence that investors continue to reward funds that have delivered high performance and punish those that have fallen short.

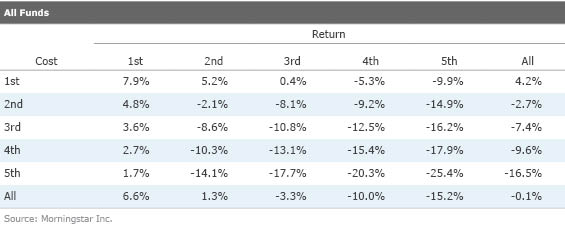

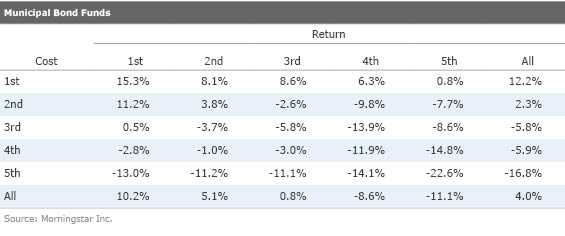

The Evidence To illustrate, here's a two-by-two analysis of all active funds' trailing 12-month organic growth rates as of April 30, 2018. The vertical axis groups active funds into quintiles based on their most recently reported expense ratio (versus Morningstar Category peers) while the horizontal axis does the same based on trailing three-year returns (again, versus category peers, as of April 30, 2018).

For example, we find that the cheapest (that is, the first quintile on cost) and highest-performing (first quintile on return) active funds grew 7.9% over the year ended April 2018. Meanwhile, the priciest (fifth quintile on cost) and lowest-performing funds (fifth quintile on return) shrank 25.4% over that same period.

Overall, performance appears to have strongly influenced growth even after controlling for fee differences. At every cost quintile (row), organic growth improved with performance (that is, moving left to right across each column). True, growth also rose as cost fell (moving bottom to top in each column), but taken together the highest-performing active funds grew more quickly (6.6%) than the cheapest (4.2%).

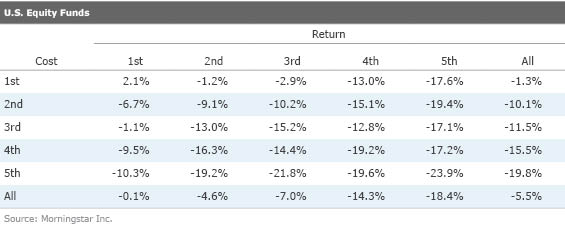

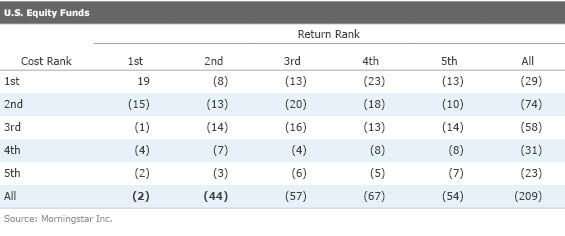

This pattern held even for active U.S. stock funds, as shown below. To be sure, the growth rates are lower in absolute terms across the board, reflecting the market-share that passive funds have taken from active U.S. equity funds. But returns still influenced growth at each fee quintile. In other words, performance mattered, even after accounting for cost differences.

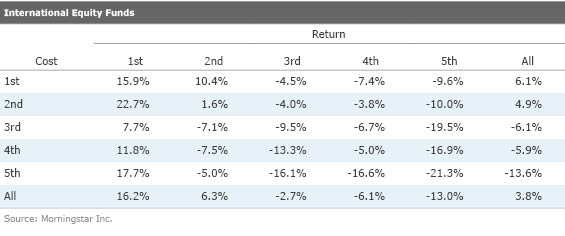

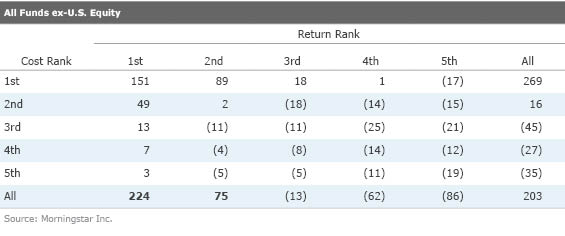

This relationship was even more apparent in other asset classes. For instance, here is the same two-by-two analysis for active international stock funds.

The top-performing quintile grew 16.2% over the year ended April 2018 while the cheapest quintile grew only 6.1% (the cheapest and highest-performing grew 15.9%). Cost mattered, yes, but performance did, too.

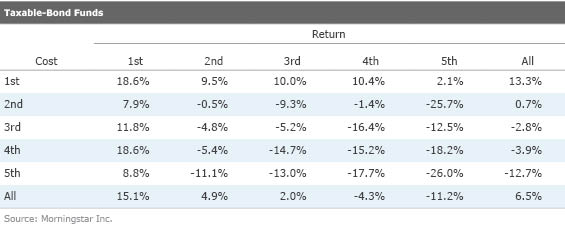

That held true for active bond funds as well, as shown below.

As shown above, cost doesn’t appear to have impeded growth among high-performing active taxable-bond funds, as illustrated by the positive organic growth rates at each cost quintile. When we control for cost differences among bond funds, performance more or less sorts growth.

What Gives? Based on the data, it seems that the phenomenon of successful active funds getting hit with outflows is largely limited to active U.S. stock funds. For investors in other asset classes, cost has not become the "new past performance" as some have suggested.

But why are ostensibly successful active U.S. stock funds getting hit? In the three years ended April 2018, winning U.S. stock funds--that is, those whose returns ranked in the top two quintiles of their peer group--saw $46 billion in outflows. While this was less severe in absolute and percentage terms than what losing funds endured (those in the bottom three quintiles, which saw $177 billion in outflows), it paled when compared with other asset classes where successful funds hauled in nearly $300 billion in aggregate.

Active U.S. stock funds have been the largest part of the active U.S. fund industry. This reflects the lineage of the U.S. fund business, which more or less got its start with active U.S. equity funds and rode that through several booms. (It also likely reflects prevailing sales practices—active U.S. stock funds, especially growth funds, were arguably oversold to investors in the 1990s and first half of the 2000s.)

With changes to sales and advice practices and the advent of new approaches to portfolio construction, active U.S. stock funds have increasingly found themselves on the outside looking in. For instance, as advisors have shifted to fee-based business models, they’ve aimed to drastically lower the cost of the investments they offer to clients while seeking greater portfolio diversification. Because advisors had previously put many of their clients in active growth funds, this meant selling those funds in favor of low-cost core U.S. stock index funds while rounding out the portfolio’s allocation to other asset classes.

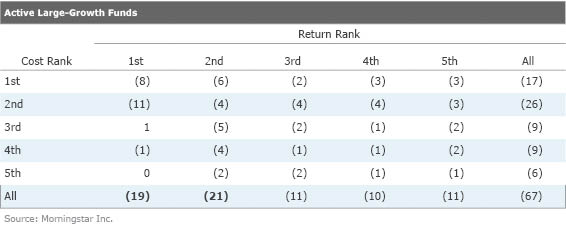

The table below, a two-by-two analysis of flows (in billions of dollars) among active large-growth mutual funds over the year ended April 2018, puts that in sharp relief.

What we find is that outflows from successful (the top two quintiles based on return rank) active large-growth funds account for almost all of the outflows from winning active U.S. stock funds. All told, successful large-growth funds saw around $40 billion in outflows while winning U.S. equity funds suffered $46 billion in outflows.

Thus, it not only appears to be a phenomenon limited to active U.S. stock funds, but to active large-growth funds in particular.

Conclusion Cost has indeed strongly influenced flows of assets, but so, too, has past performance. While this relationship hasn't held as strongly among U.S. active stock funds, that's largely a consequence of investors rebalancing their portfolios away from active large-growth mutual funds and into other types of investments and asset classes. In other asset classes, past performance still appears to have a hold on investors, influencing flows even after accounting for fee differences among like funds.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)