Screening for Low-Carbon Medalist Funds

The number of choices varies across Morningstar Categories.

The new Morningstar Low Carbon Designation is given to funds that exhibit low overall carbon risk and have lower-than-average exposure to companies with fossil-fuel involvement. Carbon risk is an assessment of how vulnerable a company is in the transition away from a fossil-fuel intensive economy. Specific risks include policy and legal regulations that limit carbon emissions or put a cost on carbon emissions; public and consumer pressure on companies to align their strategies with the Paris Agreement's 2-degree scenario; and switching costs to new green technologies. More than half of the 4,000 companies in Sustainalytics' coverage universe have some exposure to carbon risk, based on Sustainalytics' new assessments of company carbon risk. To evaluate carbon risk at the portfolio level, Morningstar rolls up the Sustainalytics company carbon risk scores on an asset-weighted basis.

For a fund to receive the Low Carbon designation, it must have a Morningstar Portfolio Carbon Risk Score below 10 for the trailing 12 months and exposure to companies with fossil-fuel involvement below 7% over the same trailing 12 months. Sustainalytics sorts companies with risk scores below 10 into the Low risk category, so we are requiring the same for portfolios. The portfolio exposure threshold for fossil-fuel-involved companies was set at 7% because it represents about a one-third lower level of exposure to these companies than that of major global indexes.

Investors concerned about carbon risk can incorporate the Low Carbon designation into their selection process. To demonstrate, I used it to screen six diversified equity Morningstar Categories. As a measure of overall fund quality, I also screened for Morningstar Medalists, which are funds that our analyst team has evaluated as likely to outperform their benchmark and/or category peers going forward.

I found that investors have nearly 100 low-carbon medalist funds from which to choose in these six categories. However, the choices are not spread evenly across the categories because carbon risk is related to style and, especially, sector exposures. It's easier to earn the Low Carbon designation for a fund that has less exposure to high-carbon-risk sectors and more exposure to low-carbon-risk sectors.

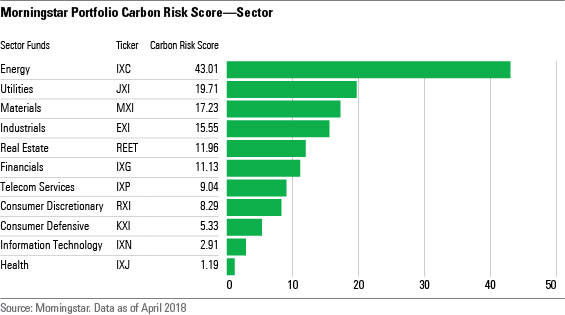

The exhibit below shows Carbon Risk Scores by sector, using iShares' global sector exchange-traded funds as proxies. The energy sector, not surprisingly, carries the greatest carbon risk, at 43.01, more than twice that of utilities, which has a Carbon Risk Score of 19.71. Materials and industrials also have higher relative scores. On the low end of the range are technology, which weighs in at 2.91, and healthcare, which has an ultralow score of 1.19.

Large Growth More than half of the low-carbon Morningstar Medalists are U.S. large-growth funds. Why? Because growth funds tend not to invest in companies in the three sectors with the most carbon risk (energy, utilities, and materials) while having significant investments in technology companies, which carry very little carbon risk. Among all large-growth funds, 79% receive the Low Carbon designation. Among the higher-quality group of large-growth medalists, 89% receive the Low Carbon designation. It's easy to find a good low-carbon large-growth fund.

Large Value

It's significantly harder to find low-carbon medalists on the value side, where only 4% of funds in the large-value category receive the Low Carbon designation. In fact, our screens turned up a grand total of two funds that are both low-carbon and a medalist:

To find additional lower-carbon options in the large-value category, use the Carbon Risk Score rather than the Low Carbon designation, and search for funds with scores in the category's lowest quartile. That's a weaker screen than the Low Carbon designation because it doesn't include an explicit fossil-fuel exposure component, but it is a measure of carbon risk that can be compared with other funds. Using the Carbon Risk Score turns up an additional seven medalists, including Gold-rated

Large Blend

In the large-blend category, where just under 20% of funds receive the Low Carbon designation, we found 15 low-carbon medalists, including Gold-rated funds

Foreign Large Blend

Just under 15% of funds in the foreign large-blend category receive the Low Carbon designation. Eleven medalist funds are low-carbon, including Gold-rated

World Large Stock

The world large-stock category, where 29% of funds overall are low-carbon, also yields 11 medalist funds that receive the Low Carbon designation. Among them are Gold-rated funds

Diversified Emerging Markets Even fewer emerging-markets funds than large-value funds receive the Low Carbon designation. Emerging-markets managers generally must choose among companies with higher carbon risk compared with developed-markets managers. In the automobile industry, for example, emerging-markets firms have an average Carbon Risk Score of 41.2, in the High risk range, while developed-markets firms have a much lower average Carbon Risk Score of 26.3, in the Medium risk range. Funds in all emerging-markets regions, except for Africa/Middle East, have average Carbon Risk Scores of 15 or higher.

Only two diversified emerging-markets medalist funds also receive the Low Carbon designation:

To find additional options, use the Carbon Risk Score rather than the Low Carbon designation, as we did for large value, and search for funds with scores in the lowest quartile. That turns up an additional nine medalists, including Bronze-rated

Click here for a full list of Morningstar Medalists that receive the Low Carbon designation in the six categories discussed above.

To find a fund's portfolio carbon-risk metrics on Morningstar.com, click here.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)