Funds That Buy Like Buffett, 2018

These funds hold some of the same stocks as the Oracle of Omaha and tend to have similar investment philosophies.

This coming Saturday, May 5, Omaha, Nebraska will host the event sometimes referred to as "Woodstock for Capitalists": the annual

.) That means it's time for our annual look at the mutual funds with the biggest stakes in the stocks held in Berkshire Hathaway's investment portfolio, as listed in

and in

.

This year's letter, like previous ones, included Buffett's explanations and opinions on a variety of topics. Morningstar's Jeremy Glaser discussed all that back in late February when the letter came out. The list of the top stocks in Berkshire's investment portfolio comes near the end. This portfolio used to be managed entirely by Buffett, but for the past few years some of it has been run independently by Todd Combs and Ted Weschler, who each now manage more than $10 billion. (Thus, a more accurate title for this article might be "Funds That Buy Like Buffett, Combs, and Weschler," but that's not as snappy.)

The top holding by market value as of Dec. 31, 2017, was longtime Buffett favorite

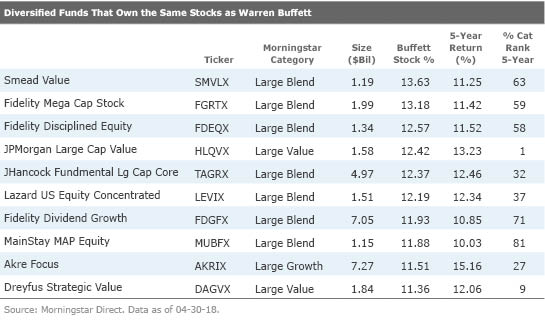

Following the release of the past eight Berkshire Hathaway annual reports, we looked at the funds with the highest percentage of their portfolio in Berkshire's top 10 stock holdings at the end of 2009, 2010, 2011, 2012, 2013, 2014, 2015, and 2016. The table below shows funds with the biggest combined weightings in Berkshire's top 10 stock holdings at the end of 2017, as listed above. We left out sector funds such as Fidelity Select Computers FDCPX, which would otherwise be the top fund because of its Apple stake, as well as funds with under $1 billion in assets, those with less than a five-year track record, and those that are clones of other funds on the list. With those constraints, the following table shows the 10 funds with the most Buffett-like taste in stocks, including each fund's five-year return and percentile rank in its Morningstar Category through April 30, 2018:

The top fund on this list,

The tenth fund on the list,

Of the other funds on this list, several have broadly diversified portfolios focused on blue-chip stocks, which include several of the "Buffett stocks" among many other holdings. This is the case for Fidelity Mega Cap Stock FGRTX and Fidelity Disciplined Equity FDEQX, each of which holds more than 100 different stocks. Although they're managed by different people, both of these funds have Bank of America, Apple, and Wells Fargo among their top 10 holdings, and each also holds several other Buffett stocks. Both of these funds have been middling performers over the past five years.

On the other hand,

/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)