Why Diversification Pays in Rising Markets, Too

Broad and deep diversification is a prudent investment approach, no matter the market environment.

In last month’s column, I explained--and showed graphically--the superiority of a portfolio designed to broadly and deeply diversify risk compared with two less well-diversified portfolios. That superiority stemmed, in part, from the notion that the well-diversified portfolio would be expected (but not guaranteed) to fall less in value in a market downturn than its two less diversified brethren.

However, my purpose in writing the column did not include disclosing the composition of the featured portfolios during any particular part of the momentous 17-month downturn in the stock market in 2007-2009. Portfolio A was simply a 60/40 allocation, while the values of the two other portfolios were based on feedback from many plan participants who I had counseled face-to-face during that stressful period of time. I didn't want a focus on the portfolio investments to the detriment of the big picture I was attempting to portray.

Rather, my purpose, as noted, was to show graphically how a broadly and deeply diversified portfolio could be expected (but not guaranteed) to be superior to two less diversified portfolios in a market downturn, and then what would happen to the three portfolios in terms of time and magnitude in value in four different recovery scenarios in the market. The sharply differing outcomes showed conceptually why it's better ordinarily to be invested in a well-diversified portfolio--that is, to be in a shallower hole in at the start of a market upturn than in the deeper holes dug by less diverse portfolios in such situations.

But let's take a look at the flip side of all this: While a broadly and deeply diversified portfolio would be expected (but not guaranteed) to go down less in value in market downturns than less well-diversified portfolios, financial theory suggests that in rising financial markets, less diversified portfolios would be expected (but not guaranteed) to go up in value more than well-diversified portfolios.

It's therefore reasonable to ask: Is holding a broadly and deeply diversified portfolio ordinarily a prudent long-term investment strategy? I would say, by all means, yes.

In the first place, it's important to remember that the legal default position of modern prudent fiduciary investing is to diversify a portfolio. For example, the Employee Retirement Income Security Act of 1974 commands fiduciaries responsible for retirement plans to "[diversify] the investments of the plan so as to minimize the risk of large losses …"

In addition, the 1994 Uniform Prudent Investor Act mandates that "A trustee shall diversify the investments of the trust unless the trustee reasonably determines that, because of special circumstances, the purposes of the trust are better served without diversifying." This diversification standard has been enacted into law--along with the rest of the UPIA--verbatim or nearly verbatim by nearly all the states plus the District of Columbia and the U.S. Virgin Islands. The UPIA's array progeny such as the 2006 Uniform Prudent Management of Institutional Funds Act, which governs the investment and management of endowment funds of charitable institutions, have also tracked this diversification language verbatim or nearly verbatim. This is why in previous columns I have likened the UPIA to an octopus with tentacles reaching far and wide into virtually every corner of modern prudent fiduciary investing.

The UPIA draws upon, and codifies, the principles of investment prudence laid down by the 1992 Restatement (Third) of Trusts which specifies that "Sound diversification is fundamental to risk management and is therefore ordinarily required of trustees." The word "ordinarily" acknowledges the great flexibility accorded to principles of investment prudence when applied to particular situations such as the one I wrote about last year in which I opined that, "because of special circumstances," holding only one stock in a portfolio is prudent.

The second reason why investing in a broadly and deeply diversified portfolio ordinarily is a prudent long-term investment strategy involves the laws of (lower) mathematics.

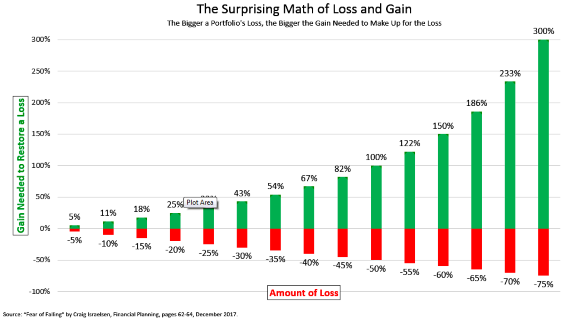

The chart below demonstrates the surprising math of loss and gain: the bigger a portfolio’s loss, the bigger the gain needed to make up for that loss. For example, a portfolio with a 35% decrease in value (Portfolio B in last month's column) must achieve a 54% gain to get back to its original value, while a portfolio with a 45% decrease in value (Portfolio C in last month's column) must gain 82% to recover its original value. But a portfolio with a 22% decrease in value (Portfolio A in last month's column) must achieve only a 28% gain to get back to its original value.

The magnitude of the differences among a 28% gain, a 54% gain and an 82% gain are significant. Portfolio C must achieve a gain that’s nearly 3 times greater--82% vs. 28%--than Portfolio A to get back to its original value. Likewise, Portfolio B must achieve a gain that's nearly two times greater--54% vs. 28%. That's a lot of extra ground to cover, even for less diversified portfolios that are expected (but not guaranteed) to outperform well-diversified portfolios in financial market upturns.

Focusing on the red of losses in the chart reveals that the bigger a portfolio's loss, the bigger the gain needed (vis-a-vis the loss) to make up for the loss. Reciprocally, focusing on the green of gains in the chart reveals that the bigger a portfolio's gain, the smaller the loss needed (vis-a-vis the gain) to cancel out the gain. This shows that the bad effects of portfolio losses count more mathematically than the good effects of gains. Perhaps this is linked in some way to what psychologists tell us: the pain of loss is felt more deeply--3 or 4 times more--than the pleasure of gain.

The third and most important reason why investing in a broadly and deeply diversified portfolio ordinarily is a prudent long-term investment strategy is that it's mentally easier on what should be the central focus of advisors: their clients. To be sure, there are many ways to measure investment risk.

But in my view, the most meaningful and relevant way for advisors to treat the subject when dealing with their clients is the volatility of portfolios. After all, it is volatility which clients--whether individual retail investors or participants in retirement plans--focus on and often react to in a financially and/or emotionally destructive way. Well-diversified portfolios minimize "variance drain" which contributes to less risk (less volatility) and more gain. Both these factors help advisory clients keep more money in their pockets while making them less stressed investors.

W. Scott Simon is an expert on the Uniform Prudent Investor Act and the Restatement 3rd of Trusts (Prudent Investor Rule). He provides services as a consultant and expert witness on fiduciary issues in litigation and arbitrations. For more information, visit Prudent Investor Advisors, or email ssimon@prudentllc.com.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)