Finding Morningstar's New Carbon Score for Funds

We created a new component in the Morningstar Fund Report beta to help individual investors easily identify portfolios with low carbon exposure.

Morningstar recently launched portfolio carbon metrics for 30,000 funds globally. These metrics help investors evaluate a portfolio's exposure to carbon risk.

We collaborated with Sustainalytics, a leading ESG research provider, to create an innovative carbon risk rating that evaluates how companies manage carbon risk. Morningstar leveraged Sustainalytics' carbon risk rating to generate asset-weighted portfolio carbon metrics that evaluate how well companies in a portfolio prepare to transition to a low-carbon economy by limiting carbon emissions and minimizing switching costs to new technologies. Core to Morningstar's new offering is the Morningstar Low Carbon Designation, a simple way to allow investors to easily identify funds that have low carbon transition risks and low fossil fuel exposure.

Jon Hale, director of sustainable investing research, has taken a deep dive in to how the score is calculated and how investors can use it.

How to Find Carbon Metrics on Morningstar.com We created a new component in the Morningstar Fund Report beta to help individual investors easily identify portfolios with low carbon exposure. To access the component, click on "Coming Soon: See a Preview of our New Fund Quote Page" at the top of any fund quote page.

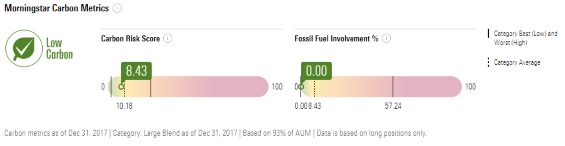

The new carbon component appears in the middle of the new fund quote page beneath the component that highlights the portfolio's Morningstar Sustainability Rating. An icon appears on the left if the fund meets the threshold for low carbon exposure, a 12-month average portfolio Carbon Risk Score less than 10 and portfolio Fossil Fuel Involvement under 7%. The key contributors to the Low Carbon Designation appear to the right of the designation. Category high, low, and average values provide context on how a fund's carbon levels compare to its peers in the Morningstar category.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CQP5OBZT3NBS7M76RDJCKLIFVM.png)