Tax-Efficient Retirement-Saver Portfolios for ETF Investors

Composed of broad-market equity ETFs and smaller allocations to municipal bonds, these portfolios are designed for retirement savers’ taxable accounts.

Market returns are uncertain. Given that, the best way to concentrate your energies and preserve your sanity is to focus on what you can control. That includes maxing out contributions to tax-sheltered accounts, minding expense ratios, and working to reduce the drag of taxes for taxable holdings.

With the last two goals in mind, I’ve developed tax-efficient exchange-traded fund portfolios. These portfolios are designed for retirement assets held outside of the confines of IRAs and 401(k)s—in taxable, nonretirement accounts where investors pay taxes on each and every dividend and capital gains distribution their holdings kick off. As such, they’re designed to keep those distributions—especially from capital gains—to a minimum. They also avoid taxable bonds, whose income is taxed at investors’ ordinary income tax rates.

About the Portfolios

Exchange-traded funds aren’t the only vehicles that are appropriate for investors’ taxable accounts. But ETFs, especially equity funds, lend themselves particularly well to taxable portfolios. For one thing, their turnover is low, and most ETF shares are traded in the secondary market among ETF buyers and sellers. Both of those factors keep an ETF manager from having to sell appreciated securities and unlock taxable capital gains. The creation and redemption mechanism for ETFs helps to further enhance ETFs’ tax efficiency. Those tax benefits have been common knowledge since the first ETFs launched a couple of decades ago. But the advent of good-quality municipal-bond index ETFs—a relatively recent development—makes it simple to assemble a well-diversified, tax-friendly portfolio that consists exclusively of ETFs.

As with all of the other model portfolios, I used the Morningstar Lifetime Allocation Indexes to help shape the portfolio’s basic asset allocations. I worked with Morningstar’s passive strategies research team to populate the portfolios, relying on their lineup of Medalist ETFs.

How to Use Them

These portfolios are designed for educational purposes and to help investors benchmark their own portfolios. Accumulators will want to be sure to “rightsize” the components of these portfolios based on their human capital, their risk capacity, and the complexion of their tax-sheltered portfolios, however. For example, a 50-year-old who is focusing on equity funds within her 401(k) because her plan doesn’t offer many decent bond options may want a higher bond allocation in her taxable portfolio. And because these portfolios aren’t geared toward investors who are actively tapping their principal, I didn’t include a cash component. But investors who are using their taxable account to house their emergency reserves should definitely hold cash in lieu of bonds.

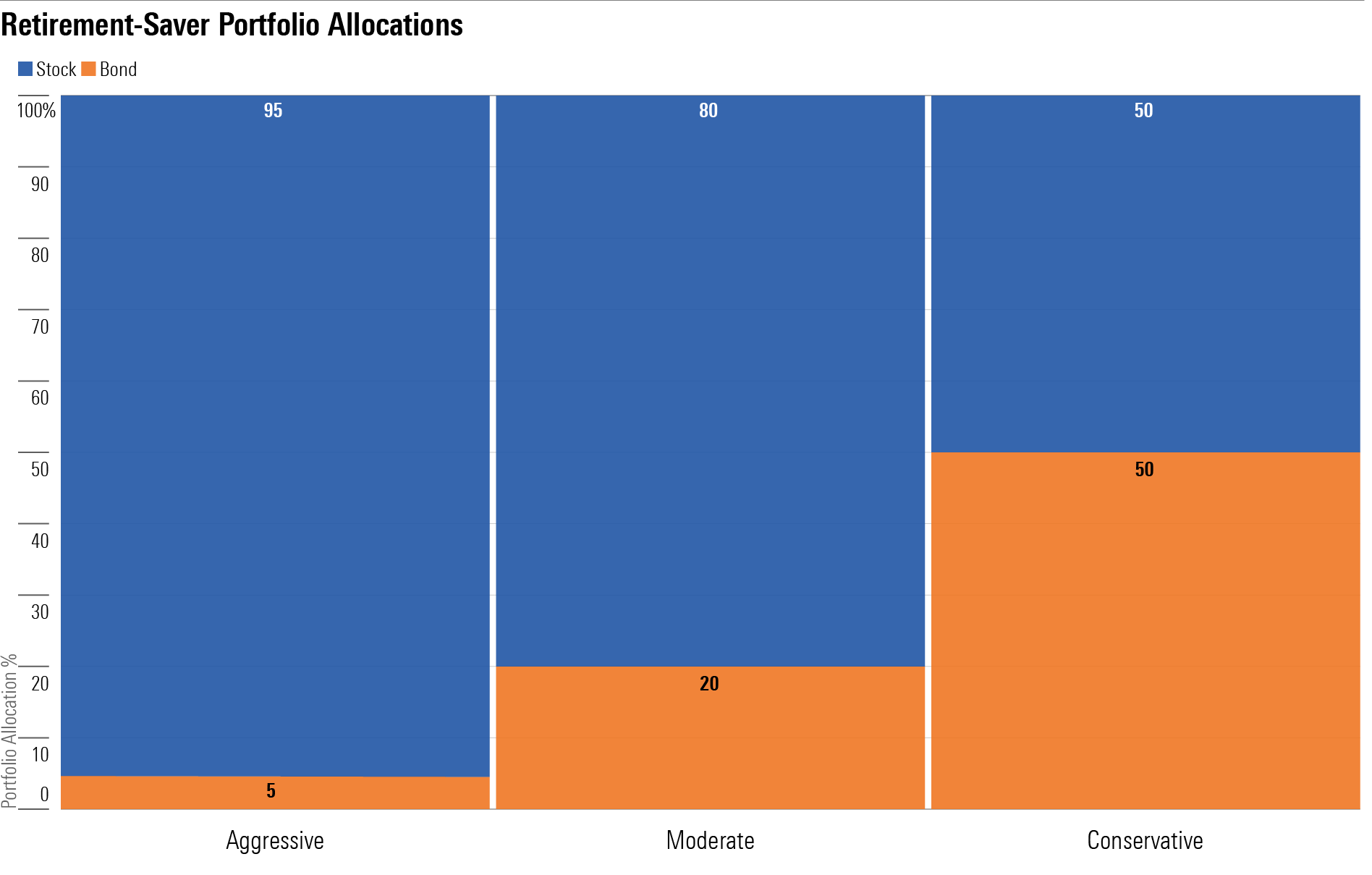

Retirement-Saver Portfolio Allocations

Aggressive Tax-Efficient Retirement-Saver Portfolio for ETF Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 55% Vanguard Total Stock Market ETF VTI

- 40% Vanguard Total International Stock ETF VXUS

- 5% Vanguard Tax-Exempt Bond ETF VTEB

Moderate Tax-Efficient Retirement-Saver Portfolio for ETF Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Medium

Target Stock/Bond Mix: 80/20

- 48% Vanguard Total Stock Market ETF VTI

- 32% Vanguard Total International Stock ETF VXUS

- 20% Vanguard Tax-Exempt Bond ETF VTEB

Conservative Tax-Efficient Retirement-Saver Portfolio for ETF Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)