Making Sense of Messy Funds

The task is becoming easier, thanks to a Morningstar enhancement.

Clear as Mud The mutual fund industry hasn't led investment innovation, but it hasn't boycotted modernity, either. Standard futures and options contracts, once rare among mutual funds, have become commonplace. In recent years, they increasingly have been joined by custom contracts--exotica such as total-return and credit-default swaps.

Understanding such portfolios is a difficult task. Interpreting a standard stock or bond fund is straightforward. Annual reports group securities by geography, industry sector, and issuer. Determining that a fund is, for example, mostly invested in U.S. stocks with a small-company and technology focus requires no special insights. Not so with a fund that is stuffed with derivatives.

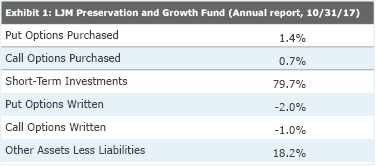

Consider the late, not-so-great LJM Preservation and Growth Fund, which came as close to going to zero as any mutual fund ever has before liquidating its assets a few weeks back. This was how the fund's holdings were categorized in its final annual report, dated Oct. 31, 2017:

- source: Morningstar Analysts

The filing provided some additional information--the details for the fund’s call and put options, which were on S&P 500 futures. However, rare would be the reader who could have determined the fund’s net exposure. Was it long? Short? If the stock market spiked, how would the fund have behaved? I could not have answered those questions myself, not without creating a spreadsheet and inputting statistics from an options database. What’s more, even that exercise would not have addressed that mysterious 18.2% position in “other assets minus liabilities.”

A New Template Happily, change is in the air. For several years, Morningstar has been developing an Advanced Portfolio Template--an improved way for funds to give their holdings--so that Morningstar will have the information it needs to decipher derivative positions and to calculate a fund's aggregate exposures.

The SEC has proceeded similarly with a project called N-PORT, which it will begin to implement in 2019. However, Morningstar users need not wait that long to receive better mutual fund data. Several hundred funds have already complied with APT.

Before

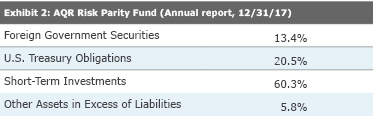

One example is

- source: Morningstar Analysts

It seems that a “risk parity” fund is a short-term bond fund, renamed. Who knew?

Of course, a risk parity fund is not that at all. The case instead is that much of AQR Risk Parity’s performance comes from derivatives, which are overlooked with official accounting. To AQR’s credit, it supplements the fund’s initial description with additional information. It devotes several pages to the fund’s credit default swaps, interest-rate swaps, and total-return swaps; its long and short futures contracts; and its foreign-currency forward contracts. Then it provides an inventory of its counterparty risk.

Thus, a shareholder would have been aware that something was up. The accounting presentation disguised much of the fund’s economic exposures, but the supplemental disclosure indicated that many investments lay beneath its fixed-income surface. This was no conventional bond fund. Unfortunately, even in the unlikely case that a shareholder could model all those derivatives, the fund did not give enough detail about its custom contracts to permit such an exercise.

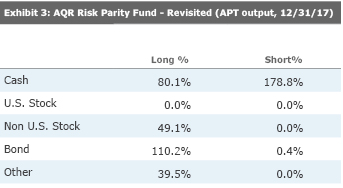

And After It does when submitting the APT form, however--which, to AQR's credit, it completed for its Risk Parity fund. That permitted Morningstar to calculate the following asset allocation:

- source: Morningstar Analysts

This revised presentation is not perfect. That 39.5% position in Other illustrates that Morningstar's standard asset-allocation chart has its limitations. AQR Risk Parity invests heavily in commodities (Lean Hogs, anyone?), which do not fit within the customary stock/bond/cash buckets. (Currency contracts are also a problem.) Thus, Morningstar places a large chunk of AQR's portfolio into its miscellaneous drawer. (Morningstar's data team tells me that it is in the process of adding a Physical grouping to its classification scheme, which should fix this issue).

Nonetheless, the APT’s version of asset allocation delivers several new items. It shows that AQR Risk Parity has substantial exposure to foreign equities--information that was lacking in the annual report’s first table and difficult to quantify from the supplemental listings. It clarifies that the fund lacks U.S. stocks. And it demonstrates that, while the accounting statements suggest that the fund holds only a modest bond position, the reality is otherwise. Effectively, it holds more than 100% of its assets in bonds.

In addition, the APT’s look-through capabilities permit Morningstar to calculate other statistics, including industry and country weightings for the fund’s equity exposures, and credit quality, country weightings, and maturity distributions for the fixed-income portfolio. (It also allows for determining net currency exposures, although those currently are not displayed on Morningstar.com). In theory, any statistic that can be generated for standard securities can also be computed for derivatives--even if they are customized.

Delighted to Comply Convincing fund companies of APT's benefits has been easy. Although fund executives are sometimes guilty of downplaying the risks associated with their funds' investment approaches, few if any of them wish for their funds to be misrepresented. It does them no good whatsoever if investors feel that they were misled. Such beliefs can lead to lawsuits--and nobody wants that.

What’s more, APT aligns fund-company communications with Morningstar’s. Although, because of accounting conventions, the portfolios that are printed in annual reports may continue to differ from what Morningstar shows, the profiles that fund companies publish on their websites will likely converge. Those profiles typically show economic exposures (rather than accounting-based figures)--the very economic exposures that APT was designed to bring out.

As this author can fervently attest, having spent the good part of a decade overseeing Morningstar’s data calculations, when Morningstar’s figures match a fund company’s, everybody is pleased. When they do not, nobody is content.

Perhaps in the not-too-distant future, all will be pleased.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)