Our Favorite Core Passive Funds and ETFs

If you’re in the market for a passive core holding, these low-cost large-cap index funds are a great place to start.

This article is part of Morningstar’s Guide to Passive Investing special report.

There are many logical reasons to opt for a passive core holding. Some index investors are strong believers in the efficient market hypothesis: They believe asset prices fully reflect all the information out there, and it's nearly impossible to "beat the market" through active management. But for most passive fund investors, the attraction is more likely that passive funds provide a straightforward, low-cost, and low-maintenance way to gain core exposure.

If you're in the market for a passive core holding, a low-cost large-cap index fund is a great place to start. The stock market is dominated by large companies; such firms account for roughly three fourths of the value of the U.S. market. Assuming that you'd like your portfolio to participate in the movements of the broad U.S. market, as opposed to just a small subsection of it, you'll want to use a large-company-focused fund as your core stock holding.

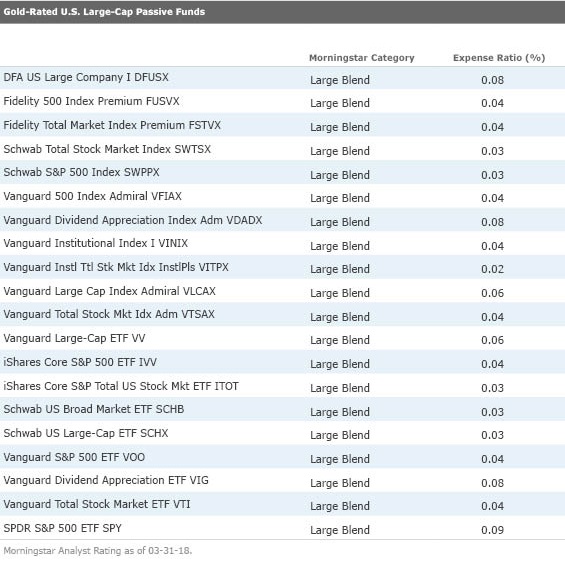

As you can see from the list below, all of our Gold-rated large-cap index funds are in the large-blend category. This is because market indexes that provide high-fidelity tracking of the stock market as a whole tend to fall into the large-blend category. Total market indexes such as the Morningstar US Market Index, which covers 97% of the investable equity market, has about equal exposure to large-cap stocks of varying styles--25% large value, 26% large blend, and 28% large growth--which nets out to large blend. Indexes tracking the popular S&P 500 Index are a similar story, with a purer large-cap focus but similar splits across equity styles; as a result, S&P 500 index-trackers also land in the large-blend category.

The list below contains our 20 highest-conviction core holding index funds and exchange-traded funds. They are all compelling offerings that efficiently track a broadly diversified and representative benchmark at a low cost.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)