Stop Teaching, Start Coaching

The limitations of the advisor-as-educator role.

While some advisors see client financialeducation as a primary service, others are notconvinced that the practice has real value.Decades of academic research only serves tointensify the debate because studies can be foundto both defend[1] and refute[2] the effectiveness offinancial education. How do we make sense of allthese (often conflicting) findings? Thankfully, amore recent and careful meta-analysis of over 200studies on the effects of financial education pointsto an answer. This article summarizes thesefindings, as well as original work performed byMorningstar researchers, and offers practical stepsto put the findings to use in your own practice.

Effects of Education What does the research really say about the valueof teaching financial concepts? Hundreds,perhaps even thousands, of studies have beenconducted to measure the impact of financialeducation on people's financial behavior. Some ofthese report increases (albeit small) in criticalbehaviors like saving and debt reduction, whileothers find no effect of education on behavior.To better understand what this collective body ofwork can tell us, a team of three prominentresearchers carefully examined the results of 201individual studies on financial literacy andeducation.[3] The meta-analysis led to two importantconclusions:

- Whenever an effect was found for financial education on behavior, it was very small. In many studies, there was no effect whatsoever.

- As with other types of education, the knowledge gained was quickly forgotten.

Given this rather devastating verdict, it wouldbe easy to write off financial education asuseless. Yet we can’t ignore the obvious fact thatfinancial knowledge matters. Without it, peoplewould be at the mercy of unscrupuloussalespeople and predatory products. Withoutfinancial literacy, financial experts could not addvalue, and if knowledge truly had no impacton behavior, experts would make the same baddecisions as novices.

Why, then, do education efforts appear to havelittle or no effect on behavior? And comingback to the practical question at hand: Whatdoes this mean for advisors and otherprofessionals working with investors? It may bethat current efforts aren’t working, but otherscould work to help investors. Or that financialliteracy is a lost cause, and industry professionalsshouldn’t waste their time. There are three thingscomplicating financial-literacy efforts:

1 How It's Taught Is Not a Factor One might propose that the problem is in themethods used to teach. However, the meta-analysislooked at many types of financialeducation: counseling, high school classes,seminars, workshops, multisession courses, andmore. It would appear that the mode ofinformation transfer is not a large factor in theeffect of that information on behavior.

2 What Is Taught Has Limited Practical Use The standard measures of financial literacy arebased on simple multiple-choice questionsabout fundamental financial concepts. They readvery much like a high school math quiz and test aperson's understanding of interest rates,inflation, and risk. While these are importantconcepts for investors, they have littleto no bearing on day-to-day financial habits orspending behaviors.

3 Other Factors Overpower the Effect of Knowledge

In our view, this third factor is of primaryimportance. If factors other than knowledge areoverpowering decision-makers’ ability to apply that knowledge, then our focus is best placed onthese other influences.

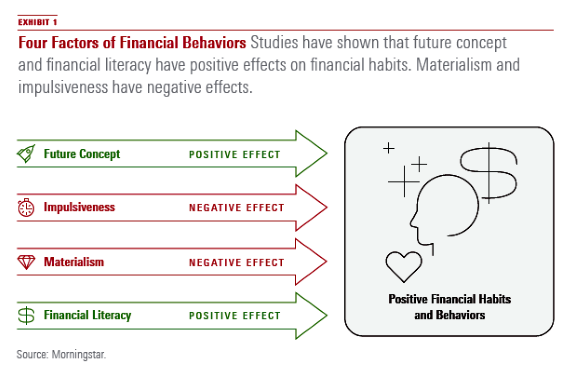

In 2014, before working at Morningstar, Iconducted a study designed to compare therelative impacts of several factors on financialbehavior.[4] The goal of the study was to learnwhether or not psychological factors had a greaterimpact on behavior than knowledge. In this study, based on numerous previous works,we chose to measure the effects of financialliteracy, materialistic values, impulsiveness, andone's conceptualization of the future (EXHIBIT 1).We then compared the effects of all four factorson self-reported financial behaviors.

First, we saw a result that was similar to theresults in the meta-analysis. The effect size offinancial literacy was small but positive, consistentwith the findings of previous studies.

However, while financial literacy was positivelyassociated with good financial habits, other factorswere also significantly related to behavior. The relative magnitude of the effect sizes is whatreally matters here, and what we found wasthat other factors had effect sizes that were similarto, and often greater than, financial knowledge. Inother words, someone who has a lot ofknowledge but is also highly impulsive, or thinks inthe very short term, may still exhibit badfinancial habits because knowledge on its ownis not enough.

These findings support the idea that people’sfinancial habits are influenced by a lot more thanknowledge. Impulsiveness, future thinking,materialism, and other factors play into thedecision-making process as well. What this meansfor advice-givers is that if these other factorsare not addressed, financial knowledge may nevertranslate into action.

How Coaching Can Help The concept of coaching is different fromfinancial-literacy teaching, though some elementsoverlap. Teaching is about knowledge transfer,while coaching is about action and skills. Teachersmay lecture and assign work, but coachesare right there with people as they make theirattempts to excel.

The analogy of a fitness trainer may be especiallyapt here. Fitness coaches do not lecture for weekson nutrition, muscle groups, and metabolism.Instead, they offer real-time advice and feedbackon a person’s posture, technique, and diet.Coaches have deep knowledge of many things, buttheir job is not to teach all of their knowledgeto the one being coached. Instead, they offer justenough information for the task at hand and usethe events of the moment to train the person beingcoached into developing positive habits over time.

As other articles in this issue mention, a behavioralcoach might help clients to understand theirown decision-making biases, help them overcomethe inevitable obstacles that emotions andcognitive biases bring to the mix, and challengethem to focus on how their own behavior (more sothan the market’s behavior) affects their abilityto meet their goals.

With this in mind, here are some ways advisorscan practically coach client financial behavior:

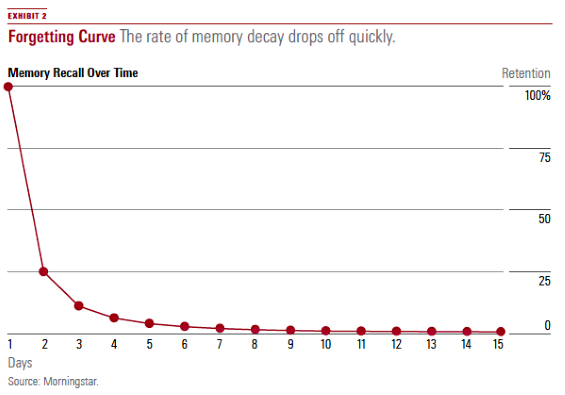

1 Take a Just-in-Time Approach to Teaching Clients Memory retention research shows a clear patternof knowledge decay over time (EXHIBIT 2). Therate of memory decay is exponential, meaning thatit drops off extremely quickly.

Because knowledge retention follows thisexponential decay curve, it is best to offerimportant information just before it needs to beapplied. In many ways, good advisors applythis rule intuitively. Information about the purposeand merits of annuities might fall on deaf earsif clients are focused on building a family, butwhen they approach retirement, and are curiousabout how to deploy their assets to ensure astable income, they will make far better students.[5]

A few other examples of how to performjust-in-time education are:

- Use the death of a parent (once the grieving has subsided) to teach the importance of wills and trusts in your client's own estate planning.

- If market fluctuations generate anxiety for some clients, consider it a moment ripe for teaching the purpose of diversification.

- If a client has a windfall, there may be an opportunity to show the long-term benefits of an early mortgage paydown or a one-time lump-sum retirement contribution.

There are thousands of small decisions that peoplemake that require financial knowledge. Just-in-timeinformation can benefit clients immensely byhelping them avoid unnecessary losses orpredatory products. The downside to just-in-timeeducation is that it can be hard to anticipatewhich choices people will face at what time.Advisors are in a unique position to foresee thesechanges and offer just what clients need toknow at just the right time.

2 Use Psychology to Enhance Memory Even with the best timing, memories decay. Here,we can turn to research on teaching andmemory for additional tools to boost the likelihoodof memory retention over time.

Make It Emotional We are more likely to remember things that arevivid and emotionally charged. For example,consider a client who has been offered a jumboloan with a variable interest rate. Insteadof simply explaining that a variable-rate mortgagemay cost her more than a fixed rate in thelong run, it may be more helpful to ask how shewould feel if she had to abruptly change herlifestyle, or else face foreclosure.

Use the Self-Generation Effect Information is better remembered when it isgenerated from our own minds. Helpingyour clients remember an important concept maybe as simple as asking them to put it intotheir own words.

Coach the Whole Person, Not Just the Portfolio Behavioral coaching goes beyond portfoliomanagement to work with clients on developingand maintaining their motivation, fosteringa sense of financial empowerment, and helpingthem create a vision for their financialfuture in which they are emotionally, as well asfinancially, invested.

Most financial advisors already act in a coachingcapacity, because it is impossible to completelyuncouple our emotional and financial lives.By understanding which areas of psychologyhave been shown to affect financial decisions,advisors can target their coaching effortsmore efficiently.

Where to Find Help While financial knowledge matters, it is insufficientfor changing behavior, especially when othermental factors work against our better judgment.Morningstar has developed several resources tohelp advisors learn about the areas of psychologythat give their clients the best chance ofovercoming impulsiveness and developing ahealthy attitude toward money.These tools are available (at no cost) on ourBehavioral Insights page.More tools are being added as ourresearch continues.

[1] See Lusardi, A. 2008. “Financial Literacy: An Essential Tool for Informed Consumer Choice?” National Bureau of Economic Research, Working Paper No. 14084.

[2] See Mandell, L. & Klein, L.S. 2009. “The Impact of Financial Literacy Education on Subsequent Financial Behavior.” Journal of Financial Counseling and Planning, Vol. 1, No. 20, pp. 15–24.See also Newcomb, S. 2015. “Psychological Barriers to Sound Money Management: Advances in Theory of Human Decision With Practical Applications to Financial Education.” ProQuest Gradworks,Dissertation & Theses.

[3] Fernandes, D., Lynch, J., & Netemeyer, R. 2014. “Financial Literacy, Financial Education, and Downstream Financial Behaviors.” Management Science, Vol. 60, No. 8, pp. 1861–1883.

[4] Newcomb, 2015

[5] Fernandes, Lynch, & Netemeyer, 2014.

This article originally appeared in the April/May 2018 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/6c608d29-bb89-4580-943a-7819645ad538.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6c608d29-bb89-4580-943a-7819645ad538.jpg)