A Closer Look at 3 Strong Multifactor ETFs

These exchange-traded funds are all worthy of consideration, but there are important differences among them that can affect their performance.

This article is part of Morningstar's Guide to Passive Investing special report.

Multifactor funds imitate active strategies that have been successful in the past and reduce risk by diversifying across those that tend to work at different times. They charge much less than traditional active managers and follow a set of predefined rules, eliminating key-person risk. These are all desirable traits.

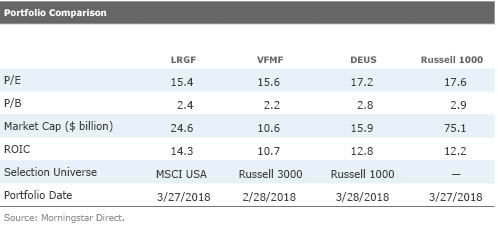

That said, multifactor funds that seem similar on the surface can look and behave quite differently from one another. This is often due to differences in their starting universes and portfolio constraints, as well as the factors they target, how they combine them, and how aggressively they pursue them. Here we take a closer look at three multifactor funds that appear similar at first blush but are actually quite different from one another.

iShares Edge MSCI Multifactor USA ETF LRGF

This fund aggressively pursues large- and mid-cap stocks with a combination of attractive value, quality, momentum, and small size characteristics, which have all been associated with market-beating returns over the long term. To do that, it assigns a composite score to each stock in the MSCI USA Index based on its four factor characteristics and uses an optimizer to maximize the portfolio's composite score, subject to several constraints. These include matching the fund's expected risk to the MSCI USA Index's, limiting exposure to individual stocks and turnover, and keeping sector tilts within 5% of the parent index.

The sector tilts in the portfolio are primarily driven by momentum and small size, since the fund measures each stock's value and quality characteristics relative to its sector peers. These sector-relative comparisons improve comparability and reduce persistent sector bets, which could be a source of active risk not directly related to the targeted factors.

The resulting portfolio has a high active share relative to the MSCI USA Index (86% at the end of February 2018). The fund currently sits in the large-value Morningstar Category, though its value tilt is less pronounced now than it has been in the past. Still, its holdings tend to trade at lower valuations and have smaller market capitalizations than the constituents in its parent index. By design, the fund takes considerable factor risk, but it effectively diversifies firm-specific risk, only parking a fifth of the portfolio in the top 10 holdings.

Overall, we like this fund's strong factor tilts, sector-relative approach to measuring value and quality, and reasonable 0.20% expense ratio, along with its risk, sector, and turnover limits. But the construction process is complex and opaque, which coupled with the fund's short live record, limits its Morningstar Analyst Rating to Bronze.

Vanguard U.S. Multifactor ETF VFMF Vanguard U.S. Multifactor ETF takes a holistic approach to stock selection that's similar to the iShares fund, focusing on many of the same factors. But there are some notable differences. Most importantly, this fund applies its strategy across the entire market-cap spectrum, extending its reach further down the market-cap ladder than LRGF. That not only improves diversification but should also improve the efficacy of the strategy. Factor investing has tended to work the best among the smallest stocks, where mispricing may be more likely. (The previously published article "For Factor Investors, It Pays to Go Small" provides further reading on this topic.)

Secondly, unlike LRGF, which tracks an index, Vanguard U.S. Multifactor is actively managed, though not in the traditional sense. This is a rules-based strategy that does not rely on fundamental stock selection. However, the managers have discretion to rebalance the portfolio when they see fit, aiming to balance the costs of trading against the benefits. This flexibility should help reduce the market impact costs of trading if the fund becomes large.

This fund starts with the stocks in the Russell 3000 Index and filters out the least liquid stocks from that universe. The managers divide the universe into three size buckets: large cap, which includes the largest 200 stocks; mid-cap, which includes the next-largest 800 stocks; and small cap, which covers everything else. Within each of the three size buckets, the fund removes the most volatile 20% of stocks (by count), which should modestly reduce turnover, as these stocks tend to have less stable factor exposures. This exclusion also keeps the fund away from some of the riskiest names in the market.

The managers assign a composite factor score to all the remaining stocks, based on their value, momentum, and quality characteristics, and target those representing the best-scoring third by market value in each size bucket. Unlike LRGF, the fund measures each stock's value and quality characteristics against the entire universe, rather than just against its sector peers. This, coupled with an absence of sector constraints, can give the Vanguard fund larger and more persistent sector biases than LRGF, as exemplified by its sizable overweighting to financial-services stocks, as of this writing.

The fund allocates a third of its portfolio to each of the three size buckets, but within each sleeve, it weights its holdings by the strength of their factor characteristics. This gives the fund a smaller market-cap orientation than LRGF even though it doesn't explicitly target the small size factor. It has a slightly lower active share (77% at the end of February) than LRGF relative to its parent benchmark, but it still effectively diversifies firm-specific risk. The top 10 holdings only account for 10% of the portfolio. This portfolio's lack of risk and sector constraints, demanding selection criteria, and factor weighting approach should give it high exposure to its targeted factors.

Among this fund's strengths are its potential to deliver strong factor tilts and reach across the entire market-cap spectrum, transparent construction, low 0.18% fee, and active implementation. This last feature should reduce the fund's transaction costs, allowing it to handle a large asset pool better than LRGF. Large scale isn't a problem for the fund yet. If anything, it's somewhat problematic that VFMF still has a tiny asset base and, as such, is thinly traded. Until this exchange-traded fund attracts more assets, it is probably best to stick to the mutual fund version of the strategy, Vanguard U.S. Multifactor VFMFX. The biggest shortcoming of the fund is its lack of sector constraints, but it is still a compelling strategy.

Xtrackers Russell 1000 Comprehensive Factor ETF DEUS Xtrackers Russell 1000 Comprehensive Factor ETF takes a different approach from LRGF and VFMF. Rather than using composite factor scores to select stocks, this fund starts with the Russell 1000 Index portfolio and adjusts each stock's weighting based on its value, quality, momentum, (low) volatility, and (small) size characteristics.

To do this, the fund multiplies each stock's market-cap weighting by each of its individual factor scores and rescales the weightings to 100%. As a result, stocks that score poorly on any one dimension tend to receive low weightings in the portfolio or are excluded altogether. While the fund excludes stocks with very small implied weightings, it currently holds around 800 of the 1,000 stocks in its selection universe. This gives it a lower active share (61% as of February 2018) than LRGF and VFMF, but it still takes a fair amount of active risk, significantly overweighting the smaller names in the Russell 1000 Index.

Like VFMF, DEUS does not make any sector-relative adjustments in its assessment of value and quality. However, it does constrain its sector tilts relative to the Russell 1000 Index. It also limits turnover but at a higher level than LRGF.

Of the three multifactor funds, this one should be the least risky. Its explicit inclusion of low volatility enhances its quality tilt (as these two factors are correlated) and should help it hold up a little better during market downturns. And because of its broad reach, this fund tends to have less pronounced value and momentum factor tilts than LRGF and VFMF, reducing the potential magnitude of underperformance when those styles are out of favor. However, these less aggressive tilts can also limit the fund's upside potential. Additional benefits of this fund's approach include its straightforward portfolio construction, low 0.17% fee, and sector constraints.

Source: Morningstar.

And the Winner Is … All three funds are cheap, well-constructed, and worthy of consideration. It's hard to tell with confidence which of these funds will offer the best performance over the long term. For example, differences in these funds' sector weightings will drive differences in their performance, but it is difficult to predict how. That said, LRGF and VFMF should offer greater upside potential than DEUS because they take more active risk, favor less defensive stocks, and tend to have stronger value and momentum factor tilts.

VFMF's full market-cap reach should give it a slight edge over LRGF because factor investing tends to work better among smaller stocks. However, investors could achieve similar market coverage by pairing LRGF with iShares Edge Multifactor USA Small-Cap ETF SMLF (0.30% expense ratio), which applies the same approach in the small-cap arena.

The index that LRGF tracks is more precise than Vanguard's approach, directly matching the parent index's risk, sector-adjusting its measurement of value and quality, and constraining its sector weightings and turnover. On paper, that precision leads to a better portfolio, but it isn't clear whether the benefits are worth the added complexity. Vanguard's multifactor fund is more straightforward. While it would be better with sector limits, this fund's focus on the entire market-cap spectrum and active approach, which reduces transaction costs, more than make up for this deficiency.

All three funds are good, but if I had to choose one, I'd go with the Vanguard U.S. Multifactor mutual fund.

(Full disclosure: I own iShares Edge MSCI Multifactor International ETF INTF, which applies the same approach as LRGF in foreign developed markets.)

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)