Morningstar's Take on the 1st Quarter

Stocks broke their winning streak as volatility returned with a vengeance to kick off the year.

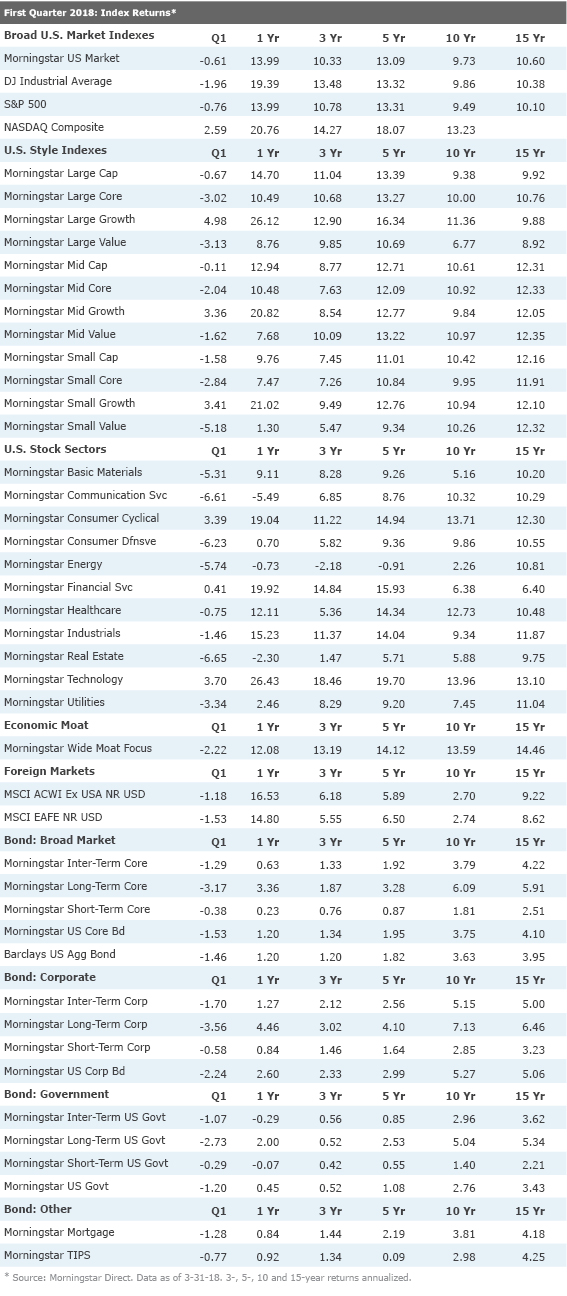

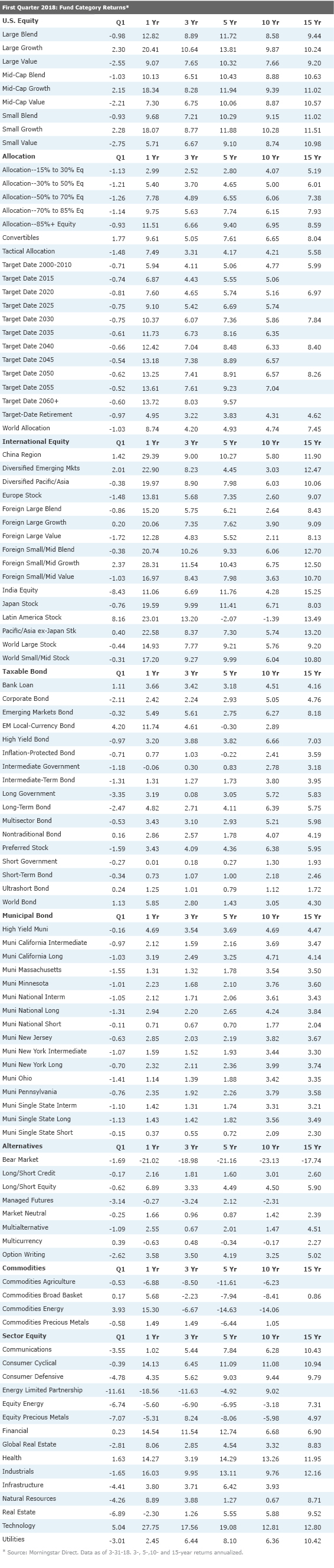

Stocks broke their winning streak in the first quarter of the year as volatility returned with a vengeance. Everything from worries about inflation, the threat of trade war with China, and the prospect of new regulations on tech firms drove the market. Against that backdrop, economic data remained upbeat, and the Fed, under new Chair Jerome Powell, moved to raise rates again. The broad-based Morningstar US Market Index was down 0.6% in the quarter but is still up almost 14% over the last 12 months.

Morningstar's analysts have provided in-depth reviews and outlooks across equity sector, fund categories, and private markets. Their takes are below along with quarter-end fund category and index data.

Morningstar's Quarter-End Coverage

Stock Market Outlook: Stocks Look Slightly Overvalued Today 4- and 5-star stocks are harder to come by in today's market, but a few values are still out there.

Credit Market Insights: A Decidedly Negative Quarter for Fixed-Income Markets Rising rates and widening credit spreads took their tool in the first quarter of 2018.

Basic Materials: Still Overvalued Despite Protective Tariffs Our bearish view on the mining and metals sector means the basic materials coverage universe trades at a market-cap-weighted 30% premium to our fair value estimates.

Communication Services: The Most Undervalued Sector We Cover We see value in several firms as consumers migrate away from traditional TV bundles and Europe invests in fiber and 4G.

Consumer Cyclical: Confidence, Demographics Support Consumption Gains E-commerce market share gains present challenges for some, but trends continue to support healthy profitability for many companies.

Consumer Defensive: Looking to M&A, Online Sales for Growth We see a few values for long-term investors amid intense competition.

Energy: Looming U.S. Shale Supply Should Temper Optimism Huge output decline boosts near-term fundamentals, but lofty prices likely to trigger dangerous shale growth later.

Financial Services: Regulations and Interest Rates Remain in the Spotlight for 2018 We see financial services stocks across the globe as fairly valued today.

Healthcare: Values Among Drug, Biotech, and Supply Chain Firms Innovation, consolidation, and a mixed regulatory picture for healthcare stocks in the first quarter.

Industrials: Healthy Demand, but Few Values Among a mostly fairly valued industrials sector, some good values remain.

Real Estate: Rising Rates Won't Derail Strong Fundamentals REITs have focused on strengthening their portfolios, deleveraging, and capital recycling in the face of higher bond yields and new construction.

Technology: Shift to Cloud Computing Most Important Story The sector looks modestly overvalued as a whole, but there are some attractive firms in enterprise software and IT services.

Utilities: Under Pressure in Early 2018 Utilities sell-off presents opportunities for long-term investors.

Venture Capital Outlook: Despite Slow Volume, Liquidity Prospects Remain We expect ample opportunity in the VC-backed IPO market as alternative liquidity routes gain popularity.

Private Equity Outlook: Carveouts on the Rise as Fundraising Slows As dealmakers look to innovate their origination process, we anticipate a continued rise in take-privates and corporate divestitures.

Data Report

Open-End Fund Category Returns Index Returns Download Data (Excel)

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)