Venture Capital Outlook: Despite Slow Volume, Liquidity Prospects Remain

We expect ample opportunity in the VC-backed IPO market as alternative liquidity routes gain popularity.

- Driven by a group of aging, more cash-efficient businesses, we see ample opportunity for the IPO markets to open up for VC-backed listings.

- We maintain our expectation to see continued use of alternative liquidity routes, with various private tech-focused SPACs already coming to market.

- As the Spotify direct listing nears, we believe the massive trading volume seen in its direct secondary shares may help better price the final listing. Should this be the case, we think that direct secondaries may become a mainstay in the late-stage venture markets.

Despite pure exit activity coming in relatively subdued through the first part of the year, we actually see ample opportunity for VC-backed public offerings to pick up steam as we continue to progress through the next few quarters of 2018. Late-stage capital is certainly available to continue funding such companies, however, we see a plethora of increasingly mature companies that have been able to build cash-efficient business models that are attractive to institutional shareholders on the public side. In our opinion, this has been a factor of some natural maturation of the general venture market, in addition to the aging of many of the subscription-based software businesses that have received venture funding over the last decade or so.

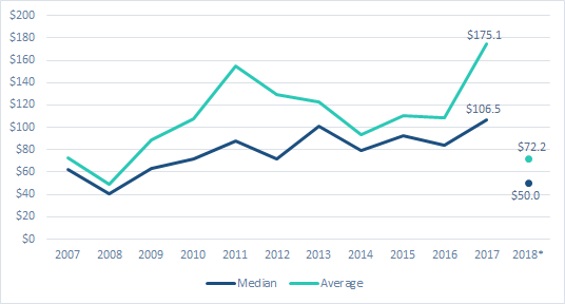

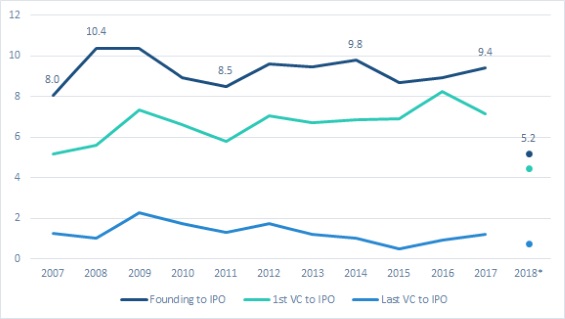

At $106 million, the median amount of VC raised prior to IPO in 2017 came in roughly 2.7x higher than what we saw 10 years ago. Further, the median time from founding to IPO in today’s market sits at 9.4 years, and while this figure has actually trended slightly lower recently, it still comes in 3 years above the median time to exit via other exit routes, primarily strategic acquisitions and private equity buyouts. As a result, venture-backed businesses utilizing the IPO exit ramp today tend to be significantly larger, as evident by the highest proportion of companies on record to debut at a $1 billion+ market cap in 2017.

Median & Average VC Raised Prior to IPO

Source: PitchBook

Median time between VC rounds & IPO (years)

Source: PitchBook

Given the backlog of aging unicorns yet to move forward with liquidity events, along with the shrinkage in the potential acquirer pool that tends to occur as company valuations rise, we think many VC-backed businesses will actually move to test the waters in the public markets more so than we’ve seen in recent years. Further, while many of these companies might not have traditional fundamentals, nor earnings that match some of their public comparables, we do think that many have been able to utilize record amounts raised in the private markets to establish positive cashflow, low customer churn and high renewal rate businesses.

As a result, unit economics have improved and gross margins have increased and we think there is a subset of the market that can appreciate these key performance indicators as companies look to float publicly. Further, we think it is important to right-size the measure of success for such entities. While publicly listed shares will certainly experience volatility, the most important measure for the VCs, and subsequently, the LPs that have had their capital locked up for years is the ability for their portfolio companies to adequately price and meet their capital raise target.

In previous research, we’ve highlighted our expectation to see ample use of alternative liquidity routes by venture investors. We’ve noted three primary paths including an uptick in private equity buyouts of venture-backed businesses, an increase in SPACs used to float privately held companies, along with continued activity in the direct secondary markets. Thus far through the year, we see no reason to adjust our expectations for these events to play out. Through the first quarter of 2018, we’ve already seen a few notable SPAC filings come to market, with the most notable being the reported reverse merger of unicorn FanDuel via Platinum Eagle Acquisition Corp.

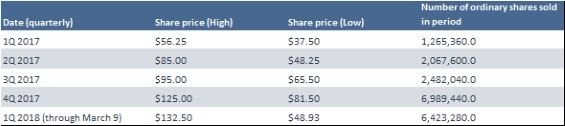

Additionally, we believe shares tendered in private secondary transactions may actually serve as a net positive for companies looking to list publicly as potential investors can gleam ample price discovery through such deals—effectively helping bankers better price and value prospective listings. We think the Spotify direct listing will be a great testament to this notion.

Spotify Private Secondary Transactions

* This figure excludes the share transfers in relation to the Tencent transaction. Source: Spotify F-1

Quarter-End Insights

Stock Market Outlook: Stocks Look Slightly Overvalued Today 4- and 5-star stocks are harder to come by in today's market, but a few values are still out there.

Credit Market Insights: A Decidedly Negative Quarter for Fixed-Income Markets Rising rates and widening credit spreads took their tool in the first quarter of 2018.

Basic Materials: Still Overvalued Despite Protective Tariffs Our bearish view on the mining and metals sector means the basic materials coverage universe trades at a market-cap-weighted 30% premium to our fair value estimates.

Communication Services: The Most Undervalued Sector We Cover We see value in several firms as consumers migrate away from traditional TV bundles and Europe invests in fiber and 4G.

Consumer Cyclical: Confidence, Demographics Support Consumption Gains E-commerce market share gains present challenges for some, but trends continue to support healthy profitability for many companies.

Consumer Defensive: Looking to M&A, Online Sales for Growth We see a few values for long-term investors amid intense competition.

Energy: Looming U.S. Shale Supply Should Temper Optimism Huge output decline boosts near-term fundamentals, but lofty prices likely to trigger dangerous shale growth later.

Financial Services: Regulations and Interest Rates Remain in the Spotlight for 2018 We see financial services stocks across the globe as fairly valued today.

Healthcare: Values Among Drug, Biotech, and Supply Chain Firms Innovation, consolidation, and a mixed regulatory picture for healthcare stocks in the first- quarter.

Industrials: Healthy Demand, But Few Values Among a mostly fairly valued industrials sector, some good values remain.

Real Estate: Rising Rates Won't Derail Strong Fundamentals REITs have focused on strengthening their portfolios, deleveraging, and capital recycling in the face of higher bond yields and new construction.

Technology: Shift to Cloud Computing Most Important Story The sector looks modestly overvalued as a whole, but there are some attractive firms in enterprise software and IT services.

Utilities: Under Pressure in Early 2018 Utilities sell-off presents opportunities for long-term investors.

Private Equity Outlook: Carveouts on the Rise as Fundraising Slows As dealmakers look to innovate their origination process, we anticipate a continued rise in take-privates and corporate divestitures.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)