Private Equity Outlook: Carveouts on the Rise as Fundraising Slows

As dealmakers look to innovate their origination process, we anticipate a continued rise in take-privates and corporate divestitures.

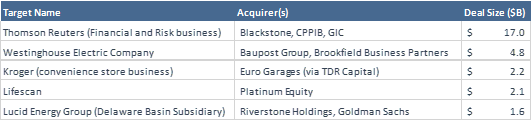

- Dealmakers are increasingly turning to public markets for deal sourcing. In addition to take-private transactions, PE firms are also pursuing sizable carveouts and corporate divestitures. Of the 13 announced deals of $1 billion or more through March 20, nine were either take-privates or some sort of carveout/divestiture.

- Institutional investors are making a concerted effort to disintermediate PE funds and execute deals directly. PE fundraising saw a sharp slowdown early in 2018 following several years of strong activity.

Amid a prolonged period of elevated pricing, PE dealmakers are exploring innovative ways to source deals and partner with other investors. One of the more interesting announced deals that highlights this new dynamic is Blackstone’s announced $17 billion buyout of Thomson Reuters’ financial and risk business. Public-to-private deals have increased for four consecutive years, and we think that corporate carveouts and divestitures will be the next trend in deal sourcing.

Transactions of this nature are happening across the PE ecosystem, and the size of many recent deals is noteworthy; five of the 13 deals $1 billion or more announced through March 20 were divestitures or carveouts. Notable examples include Kroger shedding its convenience store business and Toshiba’s sale of Westinghouse Electric Company, its nuclear power unit.

Major Investments by PE Firms Carveouts/Divestitures in 1Q 2018

An uptick in carveouts and divestitures is to be expected following several years of record-level deal-making by strategic acquirers, many of which are now looking to slimdown from the buying binge. According to a recent EY report, 87% of companies plan to initiate their next divestment within the next two years, compared to just 43% in 2017. Since these situations often require significant post-acquisition effort, we think they are prime targets for PE firms to find discounts and showcase operational expertise.

Another trend highlighted by the aforementioned Thomson Reuters deal is that nontraditional PE investors, including large pension plans and sovereign wealth funds, are becoming prominent players as they compete for deals both alongside and against PE firms. Through this “club deal,” Blackstone is partnering with two of the most prolific nontraditional PE investors: the Canada Pension Plan Investment Board and GIC, Singapore’s Sovereign Wealth Fund. We expect sophisticated LPs, many of which are building in-house teams to execute direct deals, to increasingly partner with reputable PE firms on deals like this in the coming quarters.

In February, a group of investors committed $700 million to a new venture called Capital Constellation, which will provide anchor investments to new managers while seeking to gain expertise and benefitting from a revenue-sharing model. Other investors are being even more targeted: Caisse de depot et placement du Quebec, which already has three PE offices around the globe, announced in March it was creating its own in-house investing team.

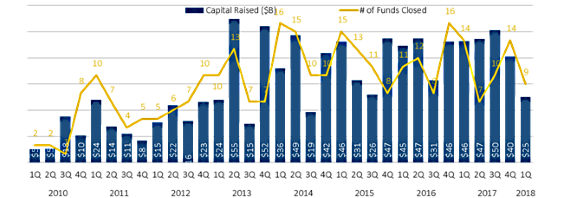

Even though some LPs are venturing out on their own, demand for traditional PE funds has remained strong in recent years; however, it appears that the frenzy may be waning somewhat early in 2018. Through mid-March, US PE funds had closed on $35 billion across 48 funds, both of which are less than 20% of the full-year totals from 2017. Most notable is the downturn in activity for funds in excess of $1 billion, with only nine such vehicles closed so far in 2018. We largely attribute this slowdown to mean reversion; North American PE firms raised 29 funds of $5bn+ funds over the five years from 2010-2015, but closed 24 funds of that size in just two years from 2016-2017.

Fundraising for Funds of $1bn+

Click here for larger chart

Looking ahead to the rest of 2018, we expect to see an uptick in fundraising as LPs continue to indicate a strong appetite for PE. While we think it is likely that billion-plus fundraises will fall short of the totals from recent years, activity should accelerate as several prominent managers have held initial closes on sizable vehicles that should close in the coming months.

Quarter-End Insights

Stock Market Outlook: Stocks Look Slightly Overvalued Today 4- and 5-star stocks are harder to come by in today's market, but a few values are still out there.

Credit Market Insights: A Decidedly Negative Quarter for Fixed-Income Markets Rising rates and widening credit spreads took their tool in the first quarter of 2018.

Basic Materials: Still Overvalued Despite Protective Tariffs Our bearish view on the mining and metals sector means the basic materials coverage universe trades at a market-cap-weighted 30% premium to our fair value estimates.

Communication Services: The Most Undervalued Sector We Cover We see value in several firms as consumers migrate away from traditional TV bundles and Europe invests in fiber and 4G.

Consumer Cyclical: Confidence, Demographics Support Consumption Gains E-commerce market share gains present challenges for some, but trends continue to support healthy profitability for many companies.

Consumer Defensive: Looking to M&A, Online Sales for Growth We see a few values for long-term investors amid intense competition.

Energy: Looming U.S. Shale Supply Should Temper Optimism Huge output decline boosts near-term fundamentals, but lofty prices likely to trigger dangerous shale growth later.

Financial Services: Regulations and Interest Rates Remain in the Spotlight for 2018 We see financial services stocks across the globe as fairly valued today.

Healthcare: Values Among Drug, Biotech, and Supply Chain Firms Innovation, consolidation, and a mixed regulatory picture for healthcare stocks in the first- quarter.

Industrials: Healthy Demand, But Few Values Among a mostly fairly valued industrials sector, some good values remain.

Real Estate: Rising Rates Won't Derail Strong Fundamentals REITs have focused on strengthening their portfolios, deleveraging, and capital recycling in the face of higher bond yields and new construction.

Technology: Shift to Cloud Computing Most Important Story The sector looks modestly overvalued as a whole, but there are some attractive firms in enterprise software and IT services.

Utilities: Under Pressure in Early 2018 Utilities sell-off presents opportunities for long-term investors.

Venture Capital Outlook: Despite Slow Volume, Liquidity Prospects Remain We expect ample opportunity in the VC-backed IPO market as alternative liquidity routes gain popularity.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)