Sorting the Rebels From the Conformists

Tracking error helps you set expectations.

This article originally appeared in the February issue of Morningstar FundInvestor.

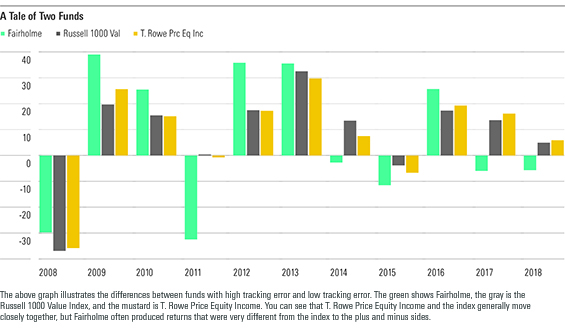

Does your fund have a surprise in store? Tracking error might give you the answer. Tracking error is a favorite measure of the investment industry. It measures the volatility of a fund that is not explained by the fund's index. In other words, it measures how much a fund's returns have varied from the index's.

Tracking error has some similarities to volatility and risk. Volatility measures such as standard deviation tell you how much a fund goes up and down. Risk is how much you lose or can lose by most investors' definitions. Tracking error wouldn't count as risk because a fund that tracks the S&P 500 perfectly would have zero tracking error even though it could lose or gain a chunk of its value quickly.

Nearly all equity fund managers watch their tracking error and active share, and fund company risk monitors compile reports on these trends for managers and their bosses. Some fund companies go so far as to set a tracking error (or sometimes active-share budget) for each fund. The budget can be based on the strategy and goals of a fund, the manager's skill level, or the fees that will have to be overcome to beat the benchmark.

Tracking error is worth a closer look because it can provide guidance on how a fund will behave in the future as well as how to use the fund in a portfolio. Because it is backward-looking, it still has some of the same limitations as standard deviation or past performance. If a fund makes crucial changes to its portfolio, it can become more like or less like its index than the tracking error would lead you to believe.

Let's review the funds in the Morningstar 500 with the largest three-year tracking errors as of the end of 2017.

From a planning perspective, the tracking error is letting you know that you really wouldn't want a fund like Fairholme to play the role of providing value exposure to your portfolio. Rather, it suggests such funds are better used in small proportions in your overall portfolio.

Vanguard Precious Metals and Mining VGPMX and

Fairholme Focused Income FOCIX has a huge 11.9 tracking error, which is off the charts for a high-yield fund. Most high-yield funds avoid having more than say 2% or so exposure to any one issuer, but Fairholme Focused Income embraces issue risk.

Unlike, say, Fairholme, this Hotchkis fund should be easier to use in a portfolio. If you have a growth-tilted portfolio without much on the deep-value side, this fund is a nice counterweight. However, its volatility suggests you wouldn't want it to be a core position.

The Flip Side So, what does it mean if an actively managed fund has low tracking error? It's likely that such a fund is widely diversified by security and sectors. And, yes, it figures to give you exposure that is pretty similar to the index. Thus, you would likely want to own these funds alongside a similar index fund.

Does that mean these are closet indexers to be shunned? No, but certainly you should compare them to the lowest-cost index funds available to you before you buy. The first place to look is the price. You want something to have low expenses if it is making only small bets to overcome the index.

You also want a sound strategy and good managers so that they again have a chance to beat the index. If it doesn't meet those tests, then skip it. But these less ambitious low-tracking-error funds tend to have some common attributes with index funds. They are low-cost and dependable sources of exposure that can often work well as core holdings.

Bronze-rated

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)