The Wide Moat Focus Index Adds 11 New Holdings

The Morningstar Wide Moat Focus Index made room for some undervalued consumer defensive stocks in March.

Every quarter, we reconstitute one subportfolio of the Morningstar Wide Moat Focus Index. When we do this, we re-evaluate the index's holdings and add and remove stocks based on a preset methodology. This helps keep the index true to its aim of providing exposure to competitively advantaged (wide-moat) stocks selling at the lowest current market price/fair value ratios.

The index consists of two subportfolios with 40 stocks each. The subportfolios are reconstituted semiannually in alternating quarters, on a "staggered" schedule. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves right-sizing positions.

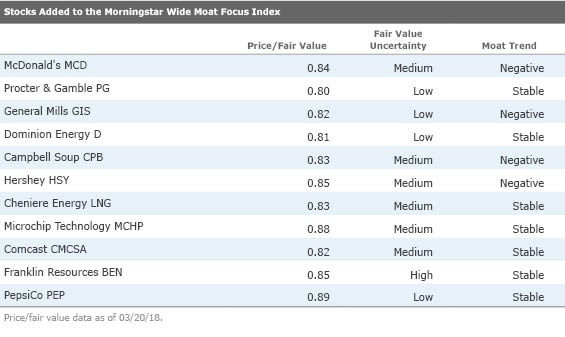

The Adds After the March reconstitution, half of the portfolio swapped out 11 positions. The net result is that the index now holds 52 positions.

One discernible theme is that wide-moat consumer defensives look cheap. Companies like

As director of consumer sector equity research Erin Lash wrote, although consumer defensive firms have been laser-focused on driving efficiencies, these efforts to extract costs have failed to offset languishing top-line trends.

"This has been evidenced in soft volumes (compared with historical levels) combined with price/mix that has generally still been under pressure."

Lash also points out that the growth of the hard discounters in Europe, Australia, and increasingly in the U.S., and the emergence of the e-commerce channel, are lowering barriers to entry in the consumer defensive space and intensifying price competition. Meanwhile, consumers are looking for alternatives to the big brands, either seeking better value from unbranded alternatives, or trading up to more niche, artisan products such as craft beer, she said.

These competitive pressures have helped create opportunities for long-term investors who want to build positions in these competitively advantaged names.

Likewise, utilities such as

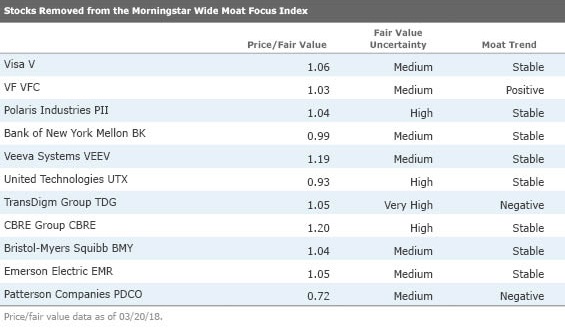

The Drops On the flip side, 11 stocks were removed because their price/fair values rose beyond our buy range.

There weren't many broad themes among the companies that were removed owing to high price/fair value ratios--mostly just strong individual performance. For instance,

"Revenue and earnings reached all-time highs in 2017 as the global economy continued to grow," Schwer said.

Healthcare sector director Damien Conover said this positive data "[supports] our expectation Bristol will gain close to a quarter of the $12 billion NSCLC market. We don’t expect any major changes to our fair value estimate following the data, but the continued strength of Bristol’s positioning in immuno oncology helps reinforce the company’s wide moat."

We removed

"We believe Patterson faces significant pressure from alternative sourcing options for dental consumable products (fillings, gauze, latex gloves, disinfectants, swabs)," said senior equity analyst Vishnu Lekraj. "From what we can gather, there has been increased competition from online-based wholesale players that can source consumables from the cheapest suppliers nationwide."

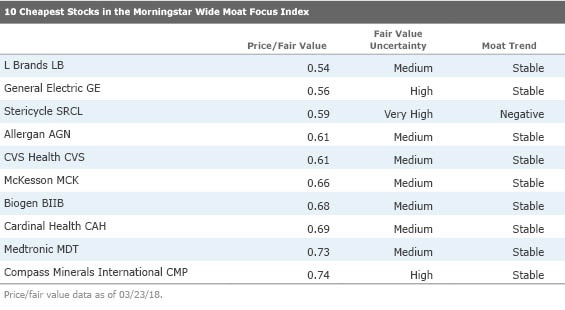

High-Quality Stocks in the Bargain Bin The table below lists the 10 cheapest stocks in the index, ranked by price/fair value. The median stock in the Wide Moat Focus Index is trading at a weighted average price fair/value of 0.81. By comparison, the broad Morningstar US Market Index is close to fairly valued, trading at a weighted average price/fair value of 0.95 .

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)