Zombie Index Funds Are Delivering Frightening Tax Bills

Investors have been fleeing some index funds in droves, resulting in large capital gains distributions.

This article is part of Morningstar's Guide to Passive Investing special report.

A version of this article appeared in the March 2018 issue of Morningstar ETFInvestor.

Index funds' low turnover generally makes them more tax-efficient versus actively managed funds, which tend to have higher turnover. But not all index funds are equal. Indeed, many have been distributing regular and sizable capital gains in recent years. These funds can teach us important lessons about the forces that drive funds' tax efficiency. Their recent track record raises questions about potential tax issues faced by other funds--Vanguard exchange-traded funds in particular.

When Index Funds Fall Short I've previously outlined the two sources of ETFs' tax efficiency: strategy and structure. The former is not unique to ETFs. There are hundreds of index mutual funds that track low-turnover market-cap-weighted benchmarks. The slower churn within these funds' portfolios means they're less likely to sell securities at a gain and distribute those gains to fund shareholders. This proposition is generally solid, assuming there are no other forces driving turnover in the portfolio.

What else might cause turnover in a fairly mundane index portfolio? Redemptions can be a factor. When investors want out, a manager might have to raise cash to meet redemption requests. In the case of managing an index portfolio, tracking the fund's benchmark is job one. So, portfolio managers have limited flexibility when it comes to selecting which securities to sell. They can't cherry-pick shares that have embedded losses to meet redemptions in order to avoid unlocking gains. They can, however, look to liquidate those tax lots in the portfolio that have the highest cost basis. This can help minimize any capital gains realized in the process. Also, redemptions can be netted against cash flows coming into the fund. In the event there is more cash coming into a fund than going out, this can help portfolio managers avoid selling securities and unlocking gains. But if redemptions are large, persistent, and overwhelm inflows, that's another story altogether.

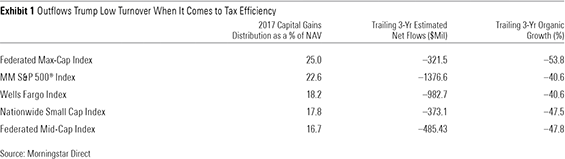

Exhibit 1 features five examples of just how tax-inefficient index funds can be, assuming the circumstances are just right. These five represent the index mutual funds tied to cap-weighted benchmarks with the largest capital gains distributions as a percentage of their net asset value in 2017. While many of the largest index mutual funds tracking similar bogies didn't distribute a penny of capital gains last year (nor have some of them done so in many years), these funds were paying out dollars' worth of gains. As is apparent in the data, outflows can wreak havoc on index funds' tax efficiency.

Outflows alone aren't enough, however. The magnitude and timing of these funds' outflows have been particularly problematic. During the past three years, each of these funds' asset bases has been roughly halved by a shareholder exodus. In the face of outflows of this magnitude, there is little if anything portfolio managers can do to soften the blow as they realize gains to send cash back to existing shareholders. Their best defenses in this scenario are to first use any realized losses they may have in pocket to offset gains. Once that well has run dry, they can--as mentioned earlier--sell those tax lots from their portfolio that have the highest cost basis and thus the lowest embedded gains. As is evidenced in the size of the distributions these funds issued in 2017, this is small solace to taxable investors.

Hemorrhaging cash is one thing. Hemorrhaging cash in the middle of a bull market is another. The timing of the withdrawals from these funds has made the tax damage even worse. Years into a market rally, funds have few realized losses to shield them, and the securities in their portfolios have generally ticked up in tandem with global markets. Thus, net outflows from these portfolios will almost inevitably result in gains.

Characteristics of Failing Index Funds Why are these funds suffering massive withdrawals during one of the most favorable market environments in memory? Many of them are relics of their sponsors' desire to round out offerings delivered in retirement channels. Historically, when an S&P 500-tracking index fund became an indispensable component of a 401(k) menu that featured a helping of proprietary funds, many sponsors filled that spot on the menu with their own homegrown "me-too" index funds. As market shares have shifted in the 401(k) space, much of the money invested in them has been stranded. These funds' shareholders are left with what are effectively orphaned funds, which typically sport unreasonably high fees. With this in mind, it's not surprising that many of these funds' shareholders have moved on.

What's Vanguard Got to Do With It? Structure is the second source of ETFs' tax efficiency. Unlike mutual funds, ETFs can purge securities from their portfolios on an in-kind basis, transferring them to an authorized participant, thus avoiding unlocking any embedded gains. So, in theory, if an ETF were to experience the magnitude of withdrawals seen recently by some of the aforementioned zombie index funds, it would be able to steer clear of generating gains as it jettisoned its holdings. But not all ETFs are created equal. Most notably, Vanguard's ETFs are often a separate share class of its mutual funds. This structure has some distinct advantages but presents a unique challenge to the tax efficiency of the ETF share class.

Pros and Cons Vanguard's ETF share class structure has some clear advantages. In those instances where the firm bolted an ETF onto an existing mutual fund, the ETF immediately enjoyed the benefits of the fund's scale. The most notable of these benefits is cost, manifesting in lower fees and lower trading expenses. Also, in this setup, shareholders of the mutual fund share classes gain a potential avenue to improve the fund's tax profile in the ETF share class' ability to redeem securities in kind. Further, shareholders of the ETF stand to benefit from the tax shield provided by any losses realized across the mutual fund share classes.

From the point of view of tax efficiency, Vanguard's ETF share class structure also has a potential drawback. The ETF share classes of the firm's funds are on the hook for a pro rata share of any taxable gains realized across the funds' share classes. Unlike the ETF share class, the mutual fund share classes cannot purge securities in kind and must sell them to meet redemptions. Thus, shareholders in the ETF share class face the potential of footing a tax bill created by the behavior of those in the mutual fund share classes. This is a distinct disadvantage of the Vanguard ETF share class structure.

What Are the Odds? While it is impossible to rule out the risk that Vanguard ETF shareholders will be adversely affected by the actions of those in other share classes of the company's funds, it is also important not to overstate it. The confluence of factors that would result in Vanguard ETF investors receiving capital gains distributions directly attributable to the twitchiness of those in the mutual fund share classes would need to closely mimic the one I described earlier. Specifically, Vanguard funds would have to experience large outflows in rising markets. The gains' magnitude would be largely driven by the timing and size of historical inflows (which would determine securities' cost basis) and the timing and size of outflows. It is also important to take into account the distribution of assets across the various share classes. In those cases where the ETF share class represents a small portion of the fund's overall assets, the risk of incurring gains may be somewhat greater given that the fund has a narrower channel through which to rid the portfolio of low-cost-basis securities.

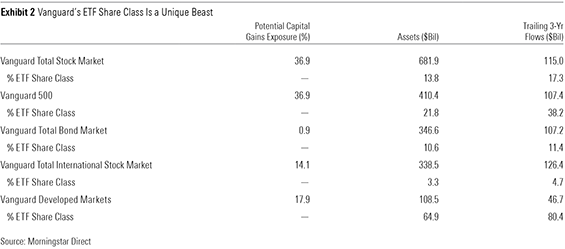

In Exhibit 2, I've included data showing the potential capital gains exposure (expressed as a percentage of fund assets), net assets, and trailing three-year net inflows as of the end of February for Vanguard's five largest index funds with ETF share classes. I have also calculated the percentage of assets and three-year flows accounted for by the ETF share class. As you can see, nearly a decade into the bull market, the firm's stock index funds are sitting on substantial unrealized gains. Unlike the zombie index funds we discussed earlier, Vanguard's funds have generally been enjoying large net inflows for years. This is the most effective line of defense against unlocking gains.

I'd be hard-pressed to say that Vanguard will see the rush to the exits that some of its floundering peers have experienced anytime soon. That said, the market could take a turn for the worse and flows could flatten or turn negative. In that event, whether any gains are realized will depend on the velocity of the market and money leaving the funds. Vanguard shareholders have historically been perseverant, adding to their investments come rain or come shine. That said, some of the growth the firm has experienced in recent years could have come in part from some less-resilient investors. The next drawdown could reveal changes in the character of the firm's clientele.

Investors in the ETF share classes of Vanguard funds face a unique risk as to the tax efficiency of their funds. I think that the likelihood of this risk manifesting is low: It's highly unlikely that Vanguard will ever see its shareholders abandon the firm en masse in a bull market. If the risk does indeed materialize, I would expect its impact to be minimal. The firm's ETF share classes have been growing as a portion of its funds' overall size and still stand to benefit from any realized losses created within the mutual fund share classes. The ETF share class is naturally more appealing to investors who may have shorter time horizons, such as those using ETFs in lieu of futures for purposes of equitizing cash. This allows the firm to segment its client base to some degree, funneling those likely to come and go over shorter time frames into the ETF share class and trying to preserve the mutual fund share classes as the domain of the buy-and-hold crowd. This further insulates ETF shareholders from prospective capital gains distributions stemming from redemptions in the mutual fund shares.

While I'll never say never, I will say that investors shouldn't lose sleep over their Vanguard ETF becoming one of the walking dead.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)