ETFs: Tax-Efficient but Not Tax-Immune

ETFs have strategic and structural advantages that make them more tax-efficient than most mutual funds.

“Because I’m the taxman, yeah, I’m the taxman.”

—George Harrison

One of ETFs' most primary advantages is their tax efficiency—especially as measured relative to actively managed mutual funds. ETFs’ tax efficiency has two sources. The first stems from strategy, the second from structure. The first and most important factor explaining ETFs’ tax efficiency is the fact that index-tracking funds (99% of ETF assets are in index-tracking funds) generally have far lower turnover relative to actively managed ones. The natural rate of turnover for a broad, market-cap-weighted U.S. stock index fund is 3%–5% per year.

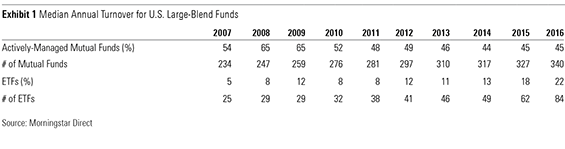

Strategy In the accompanying table, I've calculated the median annual turnover for actively managed mutual funds and ETFs in the U.S. large-blend Morningstar Category during the past 10 years. It is immediately evident that index-tracking ETFs turn their portfolios over at a fraction of the rate their actively managed mutual fund peers do. This is only natural, given that most of the ETFs in this sample simply own the market. Any changes in the composition of these funds' portfolios will be driven by index changes, which in turn are a result of normal index rebalancing, reconstitution, and corporate actions (such as mergers and acquisitions). Less buying and selling results in fewer taxable events—it's really that straightforward.

It’s important to emphasize that this source of tax efficiency is strategy-specific and has nothing to do with the ETF structure. Index mutual funds in the large-blend category have experienced similarly low levels of turnover in the past decade. This should come as little surprise given that many of them track the same indexes that underlie their ETF peers.

Passive, low-turnover strategies are the linchpin of many—but not all—ETFs’ tax efficiency.

Structure The second source of ETFs' tax efficiency is the in-kind creation and redemption mechanism by which ETF shares are brought into and removed from the market. The differences between how ETF shares and mutual fund shares are created and destroyed have important implications for investors in each wrapper.

The creation and redemption process in a traditional mutual fund is fairly straightforward. When investors want to buy a fund, they fork over their cash to the fund company in exchange for shares in that mutual fund. The portfolio manager then puts that money to work, buying assets on behalf of the fund. When the investors want their money back, they sell their shares. When investors sell, the fund may have to liquidate assets in order to raise cash to hand back to the investor. This regular buying and selling, which is prompted in part by investors regularly entering and leaving the fund, comes at a cost.

That cost has a number of different components:

- There is the frictional cost of portfolio turnover, which comprises things like brokerage commissions, bid-ask spreads, and market impact.

- There is the opportunity cost of holding cash to meet regular redemptions. Many managers will keep a cash stake in the portfolio so they won't have to regularly sell securities to raise cash in order to facilitate redemptions. This can weigh on performance during bull markets, as many funds might not be fully invested.

- Another very meaningful part of this cost equation (and the one that is germane to this discussion) is taxable capital gains distributions. As funds liquidate low-cost-basis securities to meet redemptions or to free up cash to invest in new securities they will often—particularly in the advanced stages of a bull market, as is the case today—realize sizable taxable capital gains, which are passed on to shareholders.

In the “cash-in, cash-out” context of the mutual fund wrapper, these costs—which are created by investors coming and going from the fund—are shared, or “socialized,” across long-term shareholders.

The creation and redemption mechanism for ETFs is a completely different animal. The ETF market is split in two: There is a primary market for ETF shares and a secondary one. Most investors deal exclusively in the secondary market, trading ETF shares back and forth between one another on the stock exchange. But when supply and demand for ETF shares gets out of whack, actors from the primary market mobilize. For example, if investors want more shares of an ETF than there are available in the market (that is, demand outstrips supply), that fund will trade at a premium to its net asset value. This sends a signal to authorized participants—a special breed of market makers—to create new ETF shares. They do so by gathering a basket of securities, say all the stocks in the S&P 500, and handing those securities over to the ETF provider in exchange for new ETF shares. The authorized participant then sells these shares on the secondary market, bringing supply and demand back in line and collapsing the premium. This same process works in reverse when supply outstrips demand. This “in-kind” creation and redemption process is what keeps the price of ETF shares so close to the value of the basket of assets in their portfolios.

This process also lends important benefits from a cost point of view. First, because the buying and selling of securities is essentially outsourced to the market-making community (they ultimately recoup those costs and then some as they collect bid-ask spreads), the costs of adding and deleting securities from the portfolio are not borne by long-term shareholders; they are incurred by buyers and sellers of ETF shares in the secondary market. It also means that that there is no cash drag: The fund will be fully invested at all times. And last, but certainly not least, the in-kind creation and redemption process allows ETF portfolio managers to purge low-cost-basis positions from their portfolios without unlocking capital gains. This makes ETFs, in general, a far more tax-efficient wrapper than mutual funds.

There is ample evidence of this structural source of tax efficiency enjoyed by ETFs. For example, there are many ETFs linked to more-complex benchmarks (that is, strategic-beta ETFs) that regularly have annual portfolio turnover around 100%. Many of these funds have yet to distribute a taxable capital gain to shareholders, thanks in part to this in-kind creation and redemption process. For instance, First Trust Large Value Line 100 ETF FVL has had average turnover of about 375% per year during the past five years but has not distributed a single capital gain in that span.

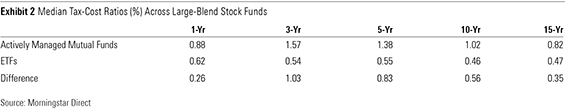

Putting It All Together I've included a table that shows the median tax-cost ratios for actively managed mutual funds and ETFs in the U.S. large-blend category. The tax-cost ratio is an annualized estimate of the tax-related headwinds facing investors and accounts for both regular income distributions as well as taxable capital gains. It can be interpreted in much the same way as an expense ratio. Clearly, that headwind is stronger for investors in actively managed mutual funds.

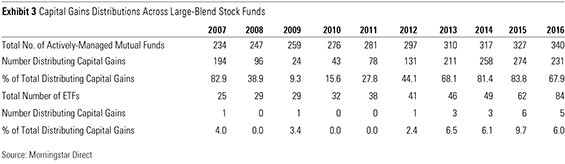

The tax burden for actively managed mutual funds is greater chiefly because they have tended to regularly distribute capital gains to their shareholders. Here I have compiled a table showing the portion of actively managed mutual funds (I have excluded index mutual funds) and ETFs in the large-blend category that distributed capital gains during the past 10 years. Obviously, distributions are more common amongst actively managed mutual funds than ETFs.

Tax-Efficient, Not Tax-Exempt Tax efficiency should not be conflated with tax immunity. Investors in ETFs will still pay taxes on regular distributions of income, and they will be on the hook for capital gains taxes when they sell an ETF for more than they paid for it. Also, ETFs will distribute capital gains, though they tend to be less frequent and of lesser magnitude than those generated by their actively managed counterparts. So while ETFs are relatively more tax-efficient, thanks mostly to their underlying strategies and with some help from their unique structure, they are not immune to taxation.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)