Homeowners: Don't Make This Common Insurance Mistake

Making sure your insurance coverage adequately reflects home renovations could save you money if you file a claim.

Have you made improvements to your home in the past few years? Or are you planning to make some upgrades soon? You're certainly not alone. According to Harvard University's Leading Indicator of Remodeling Activity, home remodeling spending in the United States totaled roughly $315 billion in 2017 and is projected to rise nearly 8% in 2018.

If you've recently undertaken a home remodeling project or soon will, be sure to tell your homeowners insurance company about the updates to determine whether you need to purchase more insurance reflecting your home's increased value.

"Why would I want to pay higher premiums?" you ask. It's a good question. But here's what can happen if you don't: Say your newly upgraded kitchen catches fire. You file a claim on your homeowners insurance, which you never updated to reflect your home renovations. The damage estimate to your home is far less than the total amount your home was insured for, so you're covered, right? Actually, the insurance company might only pay for a portion of the damages rather than footing the whole bill. Here's why.

What Is 'Replacement Cost'? Many people's first experience with homeowners insurance happens when they take out a mortgage loan. Your mortgage lender requires that you have a homeowners insurance policy; in most cases, that policy requires that you cover a minimum of 80% of your home's replacement value--in other words, what it would cost to completely rebuild your home today, with materials, labor, etc., in current prices.

It's entirely possible that a home's replacement cost can be out of sync with its market value, or what your house would sell for in the real estate market. There are a few reasons for this, but a big one is that your home's market value takes into account the land value, while its replacement cost does not.

Imagine that you live in a rural area and you own a four-bedroom home with a resale value of $200,000, and a replacement cost of similar value. Now imagine that you were tired of living out in the country, and you wanted to build the same house in a trendy downtown neighborhood. It still may cost you $200,000 in labor and materials to build it, but a four-bedroom house downtown may sell for many times what it would in a rural setting.

Similarly, a home bought at the peak of the so-called housing bubble in 2006 might have sold for much less during the financial crisis that followed, but the cost to rebuild it would probably have stayed fairly steady.

What Happens If You're Underinsured? One helpful feature some homeowners insurance contracts have is inflation guard coverage, which can help cover the cost of building materials and labor as these costs inflate over time. If you haven't made any upgrades to your home since you took out your policy, the insurance guard coverage might be all you need to keep your coverage amount up to date.

But if you've done any construction that increased the value of your home since taking out the policy, your home's new (higher) replacement value won't be captured by the inflation adjustment. Though some agents or insurance companies will send a reminder to update your coverage to reflect home renovations when you receive policy renewal letters, many don't (or many homeowners ignore them). It's a good idea to be proactive and discuss any significant upgrades to your home with your insurance company. Some might not require a change to your home's insurance coverage, but it's better to be on the safe side, because the "penalty" for being underinsured is that the insurance company may not cover the full amount of a claim you file.

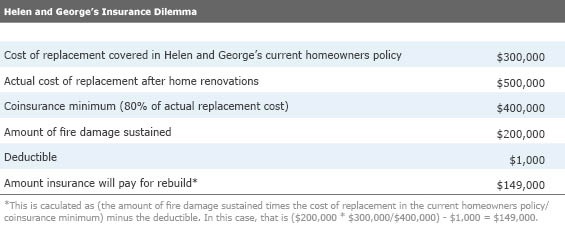

Let's look at a hypothetical example. Helen and George bought a house a few years ago and took out a homeowners policy with inflation guard coverage that insured the home for its replacement cost, which was $300,000.

In the past several years, Helen and George have upgraded their kitchen, built a new front porch, and remodeled all their bathrooms. The policy's replacement cost, even adjusted for inflation, will not reflect the upgrades made to the house; the cost to rebuild the house is now $500,000.

One day the house was damaged by fire. (Helen and George got out safely, don't worry.) The fire caused $200,000 in damage. Helen and George breathe a sigh of relief because they insured their house for more than the amount of the damages. But instead of paying the full bill for the reconstruction, their insurance company sent them a check for $149,000. What gives?

The '80/20 Rule' Most insurance companies require you to insure your home for a minimum of 80% of the replacement cost. (100% coverage is better, but most insurance companies will pay out a full claim if you have 80% of the replacement cost covered.) If you don't, the claims you file will be prorated by the percentage of the replacement cost that you actually have coverage for, minus your deductible.

Remember that the purpose of homeowners insurance is to minimize your risk of financial loss resulting from damage to your home, but you're not effectively managing these risks unless you have adequate coverage. George and Helen's homeowners insurance premiums would likely have increased a bit in order to raise their coverage from $300,000 to their home's higher replacement value. But the difference in premiums wouldn't have been as high as $50,000, which is what they ended up paying out of pocket to cover the damages that insurance didn't pay for.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)