As New Tax Laws Take Effect, Check Your Withholding Amount

If you haven't revisited the number of allowances claimed on your W-4 form lately, now is a good time to do a checkup and make needed adjustments.

Do you remember how many withholding allowances you claimed on the last W-4 you filled out? That's the form you have to complete when you begin a new job, so your company's payroll knows how much federal income tax to withhold from your pay.

The IRS advises that you complete a new W-4 every year, and also when your "personal or financial situation changes"--a big raise, marriage, have a child, etc. If you remember to do this regularly, congratulations; you're a step ahead of most people, I would suspect.

If you haven't revisited this form for a few years, now is a good time. The IRS updated the income-tax withholding tables for 2018 to reflect changes made by the Tax Cuts and Jobs Act at the end of 2017. (The IRS has also updated its withholding calculator to help you compute the ideal tax withholding amount in light of the tax-law changes; more on that below.)

Because of the changes to the tax brackets, checking your withholding amount can help ensure that you're not withholding too little tax, which may result in an unexpected tax bill or penalty at tax time next year. If you don't pay enough tax, either through withholding or estimated tax payments, you may be subject to a penalty for underpayment. According to the IRS, you could owe a penalty if your total payments (from withholding and estimated tax) do not equal at least 90% of your tax liability for the year, or 100% of your prior year tax, whichever is smaller.

Conversely, you may not want to withhold so much that you receive a big refund next April. Tax experts often advise targeting a withholding amount that closely matches your tax liability, which allows you to put your money to better use by paying down debt or saving for retirement throughout the year, rather than lending the government your money interest-free.

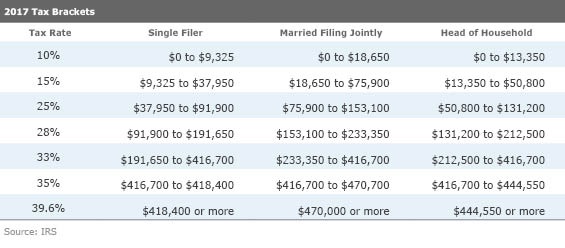

Is Your Tax Bracket Changing? As a first step, check these tables to see if your tax rate is changing. If it is, you will probably want to make sure your withholding amount is still on track. Here are the old tax brackets:

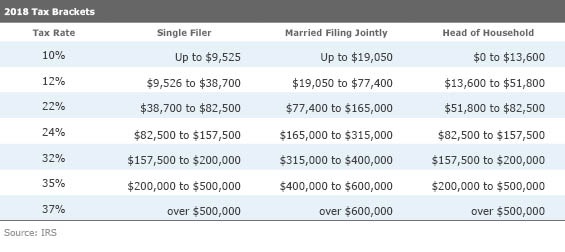

And here are the new ones:

Who Will Be Most Affected? According to the IRS, people with "more complex" tax situations especially should revisit their withholding amounts. Such people include:

- Two-income families

- People with two or more jobs at the same time or who only work for part of the year

- People with children who claim credits such as the Child Tax Credit

- People who itemized deductions in 2017

- People with high incomes and more complex tax returns

If claiming lots of itemized deductions to reduce your taxable income was a big part of your tax strategy in the past, be aware than a lot of these rules are changing. The Tax Cuts and Jobs Act restricts many itemized deductions, and it also limits the deduction that can be taken for state and local property taxes (combined) to $10,000 per family.

The standard deduction, meanwhile, has been increased to $24,000 for married couples filing jointly, $12,000 for individual filers, and $18,000 for head of household filers.

There also have been some significant changes to the Child Tax Credit. Previously phased out at $110,000 for those who are married filing jointly and $75,000 for single filers, the income thresholds have increased dramatically; the credit begins to phase out at an adjusted gross income of $400,000 for married filing jointly, and $200,000 for other taxpayers (beginning in tax year 2018). It is now $2,000 per qualifying child, and there is also a $500 nonrefundable credit for nonchild qualifying dependents.

Do a Withholding Checkup (Don't Delay!) The IRS has updated its withholding calculator to incorporate tax changes. It's a good idea to do a withholding checkup as soon as possible, and, if it's necessary to make some changes, fill out a new Form W-4 and submit it to your employer.

To be clear, this will not affect the tax return you will file next month. But you might as well do it now as you prepare your 2017 tax return, because the calculator requires that you input a lot of the data from your most recent tax return to find the correct withholding amount. (For those concerned about security, the IRS's withholding calculator doesn't require sensitive personally identifiable information like your name, Social Security number, address, or bank account numbers. The IRS also says it does not save or record the information you enter on the calculator.)

Here are some things the IRS suggests you have on hand when you use the calculator:

- An estimated value of your 2018 income. Your completed 2017 Form 1040 will help you estimate your 2018 income.

- The number of children you will claim for the Child Tax Credit and Earned Income Tax Credit

- Your most recent pay stubs

Further, if you find that you do need to make changes to your withholding amount, doing it as early as possible in 2018 will help ensure that the proper amount of taxes is being withheld for longer, which will help rightsize your full-year tax payments.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)