Will Bitcoin Go to Zero?

The bitcoin headlines are still coming in hard and fast, despite a harrowing drop from the December highs of just below $20,000. The sentiment bubble remains intact. But are prices headed even lower?

By Anthony Mirhaydari

This article originally appeared on PitchBook.com.

The bitcoin headlines are still coming in hard and fast, despite a harrowing decline from the December high near $20,000. The sentiment bubble remains intact; even if the price bubble has been somewhat deflated.

Consider that 59% of last year's ICOs have failed or are failing, encouraging some triumphant "I told you so!" from skeptics who now leer at quieted Twitter accounts, downed websites and other digital graveyards of those looking to cash in on the boom.

This led Goldman Sachs analysts to wonder in a widely circulated research note earlier this month, "Is bitcoin a (bursting) bubble?" To be sure, both the bitcoin bulls and the bears have plenty of support to lean on.

There was another recent high-profile theft, with Japanese exchange Coincheck confirming the loss of more than $500 million worth of digital coins. There was the death of a South Korean regulator looking to crack down on cryptocurrencies. And crypto prices in general seem to be correlated with stock prices and are thus vulnerable to a quickening of monetary policy tightening worldwide.

Positives include more governance/network/hard fork-related progress, with "Bitcoin Core" rolling out Segregated Witness (SegWit) in an effort to correct glaring inefficiencies in the transaction network. The launch of Venezuela's "petro," a state-run oil-backed crypto deployed as a last-ditch effort to avoid defaulting on the country's $60 billion debt, echoing Russian efforts to launch the "CryptoRuble." And, earlier this week, the purchase by Goldman-backed Circle, a money transfer app, of crypto exchange Poloniex for about $400 million.

The future of bitcoin At the highest level, Goldman's take is that bitcoin is likely in a bubble, that the underlying blockchain technology holds promise, and that bitcoin (and other "first-generation" cryptocurrencies that are unlikely to survive) enjoyed characteristics that were uniquely conducive to the current speculative mania.

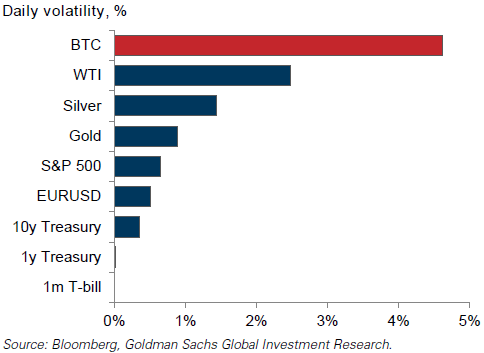

They view bitcoin as comparable to the Mosaic web browser and the Alta Vista search engine, which popularized internet access and search but eventually lost their first-mover advantage to the likes of Netscape and Google. Amazon's recent ability to muscle its way into established areas like streaming television and meal delivery also shows that being first in something is no longer the boon it once was—especially with bitcoin's meteoric price rise late last year revealing structural flaws, including inefficient payment settling, vulnerability of centralized exchanges (anathema to Satoshi Nakamoto's original vision) and the inappropriateness as a means of exchange for day-to-day transactions, given the extreme price volatility.

Volatility rate of bitcoin vs. other assets

Instead, bitcoin morphed into a near-term store of value powered by far-off hopes of widespread adoption and dominance. The technology was vague and amorphous enough that proponents could ascribe near-mystical qualities when the reality today is a hackable, unregulated, shadow banking alternative with a reputation for funding the despicable.

And unlike any other commodity—say, oil or gold or Dutch tulips—supply could not react to higher prices by increasing output. When more miners want more bitcoin, the hash rate will scale difficulty. Thus, the rate at which new bitcoins are "discovered" is kept relatively stable at about 75 per hour.

But the rush by miners makes the bitcoin network massively power-hungry, carbon-intensive and, frankly, unsustainable, with its power consumption expected to match current worldwide levels by early 2020.

Steve Strongin, head of Goldman Sachs Global Investment Research, warns that institutional investors shouldn't just be asking if bitcoin is a bubble or has market structure problems, but also whether today's cryptocurrencies will even exist five or 10 years from now. His answer: "It's possible but not probable," as a better implementation of blockchain technology—or a successor to it—will play a larger role in the economy.

As a result, the cryptocurrencies that don't survive are likely to "trade to zero," a risk that Strongin believes is broadly underappreciated right now.

Any potential bitcoin 2.0 candidate will need to address the following issues, according to Strongin and his peers at Goldman Sachs:

- To become a means of exchange, widespread adoption by everyday retailers and service providers would be necessary

- The fact that modern fiat currencies, the regulated banking system and current payment processing systems function well and are rapidly innovating, with examples including Apple Pay and Venmo

- Overcoming gold's advantages—mainly, reputable and secure custodial services—as a means of storing wealth outside the banking system

- The relative ease of creating "alt coins" based on bitcoin's blockchain platform, which enjoys no intellectual property protections

At the other end of the spectrum, Dan Morehead, CEO of crypto-focused investor Pantera Capital, believes bitcoin's fair value could be approximately $500,000, per the Goldman note, based on his estimates of market share capture from areas of disruption, including international money transfers, credit card transactions, gold and other wealth stores, and fiat currencies.

But even Morehead admits there are areas where current blockchain technology is falling short of its objectives and that 90% of the altcoins and ICOs being issued right now will go to zero. His advice? Aggressively diversify to “craft a portfolio that will have some losing assets, but also a couple of truly transformative winners.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)