Sizing Up a Pair of Emerging-Markets Debt ETFs

The classic battle between market-cap-weighting and equal-weighting unfolds in the bond ETF arena.

Just as with equity exchange-traded funds, the Morningstar Analyst Rating is a useful input into investors’ selection process when choosing among fixed-income ETFs. To demonstrate the rating’s utility, I will compare two emerging-markets bond ETFs: Bronze-rated

The emerging-markets bond Morningstar Category is relatively new territory for index funds. These two funds represent very different approaches to indexing: One weights bonds based on market capitalization, while the other weights them equally. Analyzing the attributes of each approach will help to illustrate how our ratings methodology and process come to life. This example shows the degree to which our assessment of index-tracking funds is driven by the methodologies of their underlying indexes—which drive the process via which they construct their portfolios.

Process Pillar Before getting into the specific makeup of these funds' benchmarks, it is worth asking whether it even makes sense to index emerging-markets bonds, a rather risky and illiquid corner of the bond market. The liquidity of an underlying market is a particularly important factor for index strategies. Transaction costs can erode investors' returns in less-liquid markets. The liquidity of a given market can be roughly approximated by the number of market participants, their scale, and their propensity to transact. Ten years ago, the emerging-markets bond category consisted of 23 funds with total net assets of $7 billion. By the end of 2017, it grew to $60 billion of net assets and more than 90 strategies. Though not as liquid as fixed-income markets in the developed world, today there are sufficient participants and outstanding issuances to make the underlying market liquid enough to index at a reasonable cost.

While EMB and PCY invest in the same universe, their approaches to security selection and portfolio construction are vastly different. EMB tracks the market-cap-weighted JPMorgan EMBI Global Core Index, which measures the performance of U.S.-dollar-denominated emerging-markets debt issued by sovereign and quasi-sovereign entities with at least two and a half years until maturity. This approach offers the advantages of transparency and low transaction costs. Larger bonds tend to be cheaper to trade. The fund’s market-cap-weighted index will naturally favor the largest issues in this universe. As a result, the strategy has been able to track its index reasonably well. From January 2014 through December 2017, the fund produced an annualized return of 6.52%, trailing its benchmark by 0.53% on an annualized basis. The fund’s 0.39% expense ratio explains the majority of its tracking difference.

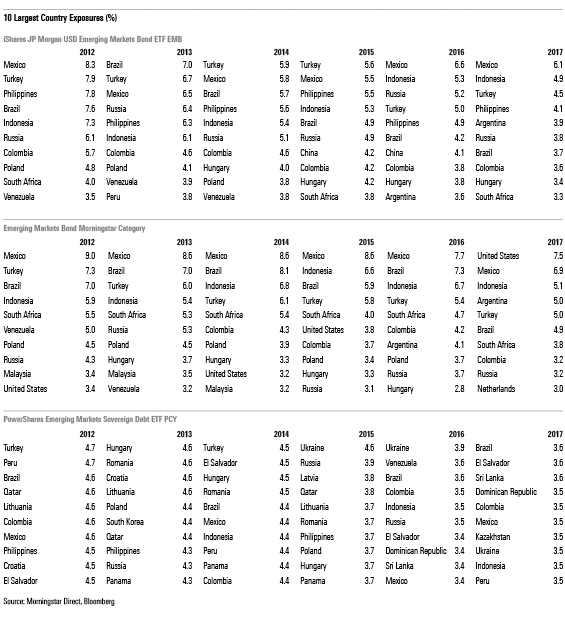

The index’s portfolio is sensibly constructed and, more importantly, representative of the opportunity set available to its category peers, as shown in Exhibit 1. This table shows EMB’s 10 largest country exposures as well as those for the emerging-markets bond category average and PCY. From this perspective, it is clear that EMB has a high degree of overlap with its average category peer—far more so than PCY. “Representativeness” is an important consideration in our Process Pillar rating. Representativeness is positively correlated to an index’s ability to harness the collective wisdom of the market, and EMB’s bogy earns high marks for representativeness. Overall, the fund’s portfolio displays many of the attributes of a good investable index, and we have assigned the fund a Positive Process Pillar rating.

Critics of market-cap-weighted bond benchmarks argue that cap-weighting is suboptimal because it tilts indexes toward the obligations of the most heavily indebted entities, which—they argue—may result in unintended risks. To address this issue, PCY’s DB Emerging Market USD Liquid Balanced Index benchmark equally weights its holdings by country and by issue. While this method addresses some of the criticisms of cap-weighted fixed-income indexes, it comes with its own challenges.

Compared with its cap-weighted peer, PCY’s benchmark ranks poorly on several fronts. This index provides equal-weighted exposure to U.S.-dollar-denominated emerging-markets sovereign and quasi-sovereign bonds with at least three years remaining until maturity across the credit spectrum. The fund targets bonds with the largest yields and equally weights each country and issuers within each country based on a defined set of criteria established by the Deutsche Bank emerging-markets index committee. But investors do not have visibility into the committee’s country selection decisions beforehand, making it difficult to anticipate changes. For example, the number of countries in the fund increased to 31 in 2017 from 23 in 2014. This lack of transparency is especially problematic because when a new country position is added by the committee, it becomes a significant part of the portfolio, 3%–4% of its value, which can meaningfully alter the index’s risk/reward profile.

The committee puts together a portfolio that reaches to the far corners of the emerging-markets universe. This increases credit risk and transaction costs. For example, the fund held debts from Slovenia, Qatar, and Latvia in 2017. These countries’ obligations are less frequently traded than debts from other large emerging markets such as Indonesia and Mexico, making them costlier to transact.

The fact that the selection criteria for PCY’s index are relatively opaque, its country allocations are unrepresentative of its peers’ opportunity set, and it faces high transaction costs, limit this fund’s Process Pillar rating to Neutral.

Exhibit 1

Performance Pillar Our Performance Pillar rating hinges on funds' absolute and risk-adjusted returns relative to category peers. As of the end of 2017, EMB and PCY had trailing five-year annualized returns of 3.60% and 3.69%, respectively. These numbers put both of them squarely in the middle of their category. Their Sharpe ratios for the same period were on par with the category average. Given their middling absolute and risk-adjusted performance, we have assigned both funds Neutral Performance Pillar ratings as of our most recent review.

Price Pillar Simply put, when it comes to fees, less is more. Both funds score well here. EMB charges 0.39% and PCY's fee is 0.50%. Both funds' fees are lower than the toll taken by 95% of their category peers. The median fee for the category is approximately 1.00%. These funds' relatively slim prices give them a leg up.

Conclusion EMB's cost advantage and sensibly constructed portfolio underpin its Bronze rating. PCY's relatively unrepresentative benchmark is the linchpin of our decision to assign the fund a Neutral rating. This example underscores the centrality of our assessment of funds' processes in assigning our overall rating. It is vital that investors understand the nuances of the methodologies of the indexes that underlie ETFs and traditional index funds because seemingly similar index funds are never created equal.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)