Examining Vanguard's Active Factor ETFs

These new funds aren't groundbreaking, but they offer some incremental advantages over their peers.

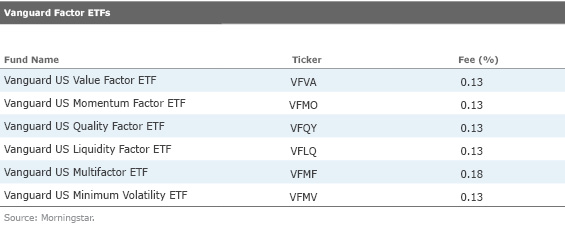

Vanguard recently launched a suite of low-cost, actively managed factor exchange-traded funds, making a late entry in a crowded field. The firm’s Quantitative Equity Group, which manages the new funds, has managed similar factor ETFs listed in Europe since December 2015. Most competing factor ETFs are index-based, a group of funds we refer to as "strategic beta," and are often marketed as “smart beta.” Vanguard has notably shied away from such ETFs, arguing that active implementation of factor strategies can be more cost-efficient and that investors should think of these as active strategies.

These new factor ETFs are not active in the traditional sense. They are systematic, rules-based strategies, so there are no qualitative judgments about the investment merit of each stock. But the managers have discretion to rebalance the portfolios (or not) when they see fit to balance the costs of trading against the benefits.

Single Factor Funds Here's how the firm's value, momentum, quality, and liquidity strategies work.

Each fund starts with the stocks in the Russell 3000 Index. It then filters out some of the least-liquid stocks from that universe. The managers divide the universe into three size buckets: large-cap, which includes the largest 200 stocks; mid-cap, which includes the next-largest 800 stocks; and small-cap, which covers everything else. Each fund ranks all stocks within each bucket on the strength of their exposure to the factor of interest and targets those representing the best scoring third by market value. The funds weight their holdings by the strength of their factor characteristics, so they tend to cover less than one third of the market.

These funds are distinctive because they apply their strategies across the entire market-cap spectrum. Most factor strategies have historically worked the best among the smallest stocks, as mispricing can be more pronounced here, so these funds should offer better upside potential than those that stick to large- and mid-caps.

While the full market-cap approach makes sense for the value, momentum, and quality funds, it seems a bit strange that Vanguard elected to use that framework for the liquidity fund, which targets less heavily traded (less liquid) stocks. Low liquidity is highly correlated with small market capitalizations, so constraining the fund to own large- and mid-cap stocks dilutes its exposure to the least-liquid stocks, as does the initial liquidity screen Vanguard employs. However, this is necessary to improve the fund’s capacity and reduce transaction costs. And Vanguard believes that the liquidity factor, just like the others, pays off across the entire market-cap spectrum.

Multifactor Fund While the individual factors that Vanguard targets have each paid off over the long term, they all go through stretches of underperformance. Vanguard's multifactor strategy diversifies across the value, momentum, and quality factors, which can reduce the risk of underperformance because these factors tend to pay off at different times. It excludes liquidity partially because it would increase transaction costs when combined with a higher turnover factor, like momentum.

This fund starts with the same universe as the individual factor funds, but it throws out the most volatile 20% of stocks (by count) in each of the three size buckets to eliminate stocks that will likely have less stable factor exposures. It then sorts the remaining stocks in each bucket using a simple average of their value, momentum, and quality scores, and targets those representing the best scoring third by market value. Finally, it weights its holdings by the strength of their factor characteristics.

This integrated approach means that the fund won’t necessarily own the cheapest stocks, or the stocks with the best momentum, but rather those with the best overall combination of characteristics. This should lead to slightly more potent factor exposure at the portfolio level than an investor could achieve by combining Vanguard’s individual factor funds because there isn’t much overlap among their holdings, which can dilute the combined portfolio’s factor exposures.

Minimum Volatility In contrast to the other factor ETFs, which aim to deliver market-beating returns, Vanguard's minimum-volatility fund is designed to cut risk. Investors shouldn't expect it to offer higher returns than the market over the long run. It uses a holistic optimization framework to minimize volatility that considers both individual stock volatility, as well as correlations across stocks. This is the same model that underlies the Vanguard Global Minimum Volatility Fund, with a Morningstar Analyst Rating of Silver. It operates under a set of constraints to improve diversification, including limiting sector tilts relative to the market (this is the only fund in the suite to do that) and exposure to individual stocks.

This strategy is most similar to

The Big Picture Vanguard's new actively managed factor ETFs aren't groundbreaking. With the exception of the liquidity fund, they are similar to index-based strategies already in the market. Their active implementation probably won't have a big impact on performance (with the exception of the liquidity fund), but it should reduce transaction costs, which can help on the margin, particularly as the funds grow.

The funds’ focus on the entire market-cap spectrum will likely move the needle more, as will their weighting approach, which gives them potent exposure to their targeted factors. This concentrated factor exposure will likely create high tracking error to the market and could cause the funds to lag their peers when their respective factors are out of favor. And because the funds don’t control their sector exposures (with the exception of the minimum volatility fund), they can introduce persistent sector biases, which can also be a source of risk.

However, these funds have a good chance to succeed. They all offer concentrated exposure to well-documented factors that should continue to pay off over the long term. Unlike most of their peers, they own stocks of all sizes, which not only improves diversification, but should also help performance because the payoff to factor investing tends to be larger among smaller stocks. Flexible implementation and low fees add to their appeal.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)