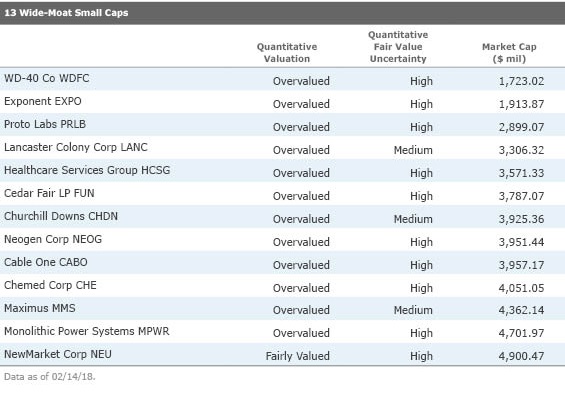

13 Small-Cap Stocks With Wide Quantitative Moats

Our new quantitative rating identifies these small companies as having sustainable long-term competitive advantages.

When we analyze companies at Morningstar to estimate the equity's intrinsic value, the most important step involves identifying economic moats, or structural barriers that protect companies from competition.

What makes a moat? Our analysts look for companies whose returns on invested capital are likely to exceed its weighted average cost of capital in the future. We also look for firms that appear to have at least one of the five sources of sustainable competitive advantage (intangible assets, cost advantage, switching costs, network effect, or efficient scale).

It's more difficult to find smaller-cap firms that exhibit moat-worthy characteristics. Strong and enduring competitive advantages are promising for any company, but they are particularly attractive for smaller companies with long growth runways, as they have the ability to compound shareholders' capital at high rates of return over long periods of time.

In November, we wrote about seven small-cap companies to which our analysts have assigned wide economic moats, meaning that we think they have advantages that will allow them fend off competitors and remain profitable for at least 20 years. We are again looking at wide-moat small caps, but this time we are incorporating a new implement in our toolkit: the quantitative moat rating, which is a component of our quantitative equity rating.

Though Morningstar has one of the largest independent equity research teams in the world, with 120 analysts covering approximately 1,000 equities in the U.S., we're not able to cover every stock that our users own or want to research. Our quantitative equity rating allows us to greatly expand our reach.

The Quantitative Economic Moat Rating is analogous to Morningstar's Economic Moat Rating in that both are meant to describe the strength of a firm's competitive position. But the quantitative moat rating is generated by a statistical model that is based on Morningstar's analyst-driven equity ratings; it is designed to predict the economic moat rating a Morningstar analyst would assign to the stock.

Below we list 13 stocks with wide quantitative moat ratings. (Analyst Reports are not available for companies under quantitative coverage.)

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)