Managed-Futures Funds Vulnerable to Market Turbulence

Last month was a standout for the category, but their current general positioning means they could be hit hard by a market correction.

The current general positioning of managed-futures funds is vulnerable to a market correction, and here is why.

Sustained directional upside or downside market movements determine managed-futures funds’ positioning. Most of these systematic trend followers use multiple models that combine different look-back periods, creating "time diversification." In other words, managed-futures funds’ short-term models enter the market first as a trend develops, and medium-term and long-term models follow. This helps managers to gradually enter and exit the markets, take profits, and ride trends successfully. Model agreement across the various time periods is also an important input for managed-futures funds’ asset allocation, subject to a fund’s risk target.

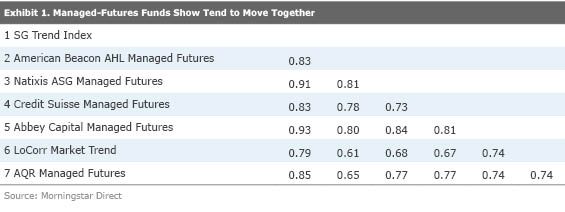

This simple process of following trends generally leads to high correlation among these funds because they operate in similar futures and forwards markets (the number of markets traded can vary). Exhibit 1 shows the relatively high three-year correlations that prominent managed-futures funds have with one another. Note that correlation does not necessarily say anything about the magnitude of the comovements. Therefore, funds with high correlation may generate very different long-term performance depending on the initial design and implementation of the strategy.

Most managed-futures funds had a standout month in January 2018; it was the best month in the past three years. The funds’ common positionings in the four major asset classes that they trade drove this exceptional performance. In general, managed-futures funds had the following positions in common at the end of 2017:

- Long Equities (following the persistent equity rally)

- Short Fixed Income (following the downtrend in rates markets)

- Long Commodities (particularly up-trending crude oil)

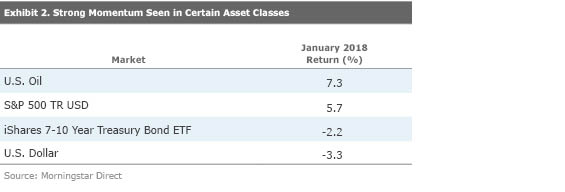

- Short USD (participating in the weakness of USD against major currencies like EUR)

According to recent quarterly communication from these funds, most of them allocated 30%-50% of their risk to equities (mostly long positions), and they have substantially increased their long exposure to energy markets such as crude oil. (Of course, while these funds may have similar overall directional asset class exposure, their portfolios will differ in specific markets sometimes with offsetting positions in different regions.)

The January 2018 returns for indexes representing these asset classes, as shown in Exhibit 2, illustrate the strong momentum that drove these positions.

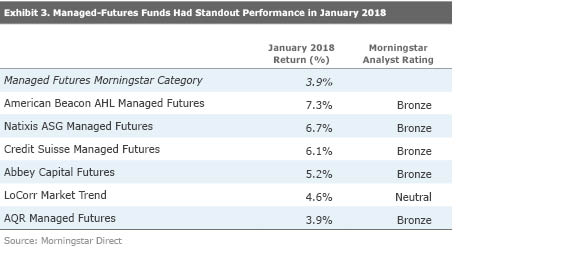

These clearly trending markets led to outsize gains by managed-futures funds in the month of January. Exhibit 3 shows performance for managed-futures funds covered by Morningstar analysts. The average managed-futures Morningstar Category return for January was 3.9%, the best monthly performance since January 2015.

While these results are undoubtedly attractive, it’s important to note that the asset-class positioning generating these results will not likely act as effective hedges or diversifying positions in the context of an investor’s total portfolio--common uses of these strategies, which are largely touted for diversification benefits and potential downside protection. In fact, managed-futures strategies can be highly vulnerable to a rapidly developing risk-off scenario, in which riskier assets such as equities sell off while bonds and the U.S. dollar rally.

That’s not to say that these funds can’t still offer diversification and downside protection. Managed-futures funds dynamically allocate their assets to the four major asset classes as they buy more into a rising market and sell more of a falling market in a systematic way. They do not try to predict what is likely to go up or down but instead respond in a disciplined manner to directional changes in specific futures and forward markets in equity, fixed income, currencies, and commodity asset classes. While these funds’ recent general positioning does not negate their long-term diversification benefits, current market trends have manifested themselves in a risk-on stance, which is vulnerable to an equity market turbulence.

/s3.amazonaws.com/arc-authors/morningstar/5ff7a7e7-10d3-4880-b243-dff72384e635.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5ff7a7e7-10d3-4880-b243-dff72384e635.jpg)