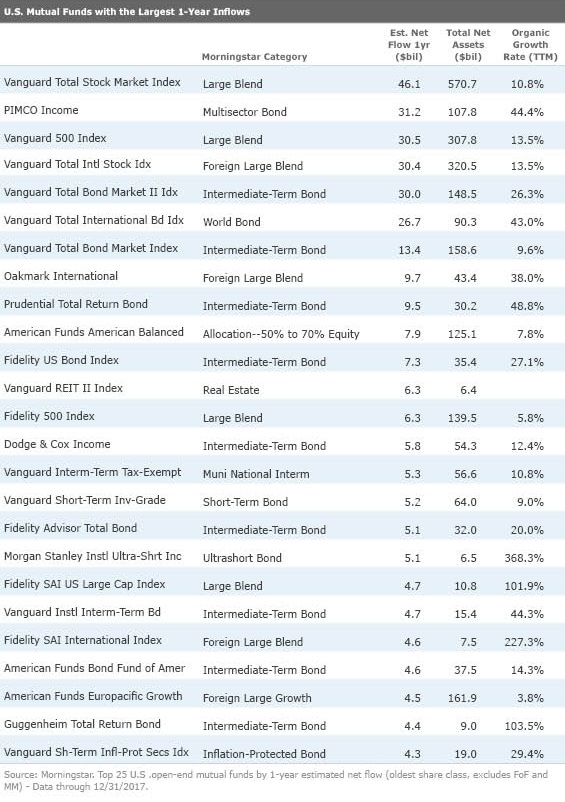

The Top 25 Funds Investors Bought in 2017

Investors continue to flock to index funds in droves, but they've kept the faith in some actively managed bond funds and a few strong-performing active international-stock strategies.

Continuing a multiyear trend, the lion's share of investor assets went into passively managed mutual funds in 2017.

"It's been a year of record flows into passive products overall, almost $700 billion," said Alina Lamy, senior analyst in Morningstar's quantitative research group.

But there were some actively managed areas that still attracted investor dollars: notably, actively managed bond funds and international-stock funds.

Using Morningstar Direct software, we took a look at the 25 funds that had seen the biggest inflows in absolute dollar terms during 2017. Although we screened for the largest inflows in dollar terms, we also included a trailing 12-month organic growth rate data point, which allows us to put the flows in better perspective. For instance, two share classes of the mammoth Vanguard 500 Index fund (VFINX and VINIX) are on the list of top inflows and outflows over the one-year period; the story here is not really one of investor conviction; it's more about fund distribution and sales channels.

Index Funds Rake In Money It's no secret that investors have increasingly opted for index funds, which, among their many advantages, offer broad diversification, low fees, tax efficiency, and simplicity. Six out of 10 funds with the highest estimated net inflows were index funds, and all six of them were Vanguard funds.

Increased investment in target-date funds partially explains the heavy inflows into a few of the more widely purchased Vanguard funds. Vanguard's target-date funds use Gold-rated

Similarly, that target-date series also uses various share classes of Gold-rated

The two share classes of Vanguard target-date funds (institutional and the investor) combined gathered more than $56 billion in new assets combined over the 12-month Vanguard Total Stock Market Index--or even most of it, for that matter. Likewise, Gold-rated

Taxable Bond Flows a Mix of Active and Passive Fund flows were positive for taxable bond funds, and they were divided almost equally between active and passive, Lamy said.

At number two on the list of top-flowing funds is actively managed

It certainly hasn't escaped investors' notice, either. In fact, "white-hot inflows" help explain why the fund's Morningstar Analyst Rating of Silver isn't higher, says senior analyst Eric Jacobson.

"PIMCO recovered really well with PIMCO Income, which was a really good performer after their severe outflows from Total Return," Lamy said. (PIMCO Total Return had around $5.3 billion in outflows in 2017.)

Number nine on the list,

Some other intermediate-term bond funds that were popular with investors included Gold-rated

Passive funds such as Silver-rated

Some Active International Strategies Still in Demand Investors haven't thrown in the towel on actively managed strategies altogether, though. In particular, some international-stock funds were among the top asset-gatherers.

One that has attracted investors' notice is Gold-rated

Gold-rated

Download the complete Asset Flows Commentary here.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)